Main reference: Story in Sinafinance

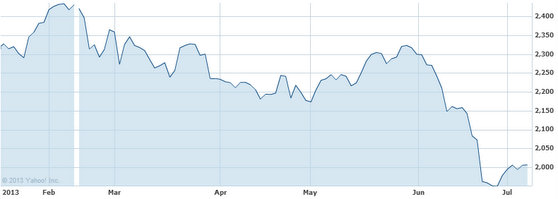

CHINA SHARES are down nearly 10% this year.

Naturally, nerves are fraught.

Here are eight expert takes on where things might be headed.

PR firm BlueFocus, seen here celebrating with a key client, is a ChiNext listco. The four-year-old ChiNext, also known as 'China's Nasdaq', is favored by some market watchers. Photo: BlueFocusMarket researcher Gushang Caifu said the recent slow climb in share prices should begin to spread to a broader spectrum of industries and not just cyclical plays.

PR firm BlueFocus, seen here celebrating with a key client, is a ChiNext listco. The four-year-old ChiNext, also known as 'China's Nasdaq', is favored by some market watchers. Photo: BlueFocusMarket researcher Gushang Caifu said the recent slow climb in share prices should begin to spread to a broader spectrum of industries and not just cyclical plays.

It was especially bullish on a wide range of underappreciated individual counters on China’s SME board but cautioned that a series of recent upswings in the ChiNext – a.k.a. “China’s Nasdaq” – has left the four-year-old board overdue for a correction.

Overall, it was most sanguine on building materials stocks given ongoing urbanization.

Chongqing East Capital Investment said the recent uptrend suggests the 60-day moving average may challenge the 2,100 level.

Currently the benchmark Shanghai Composite Index is at 2,045.

It also believes the ChiNext board could still hit a few more historical highs before falling back to earth.

But the key would be whether to ride out the inevitable “ship jumpers” that will be looking to make quick gains once near-term peaks are reached, as there hasn’t been a sustained upswing in months and the market may not yet be ready to endure it for long.

DMTZ Consultants said that the recent improvements in daily trading turnover were an encouraging sign.

But it cautioned that unless credit tightening measures were eased, then a true breakout bull run would likely not occur anytime soon.

Recent China shares performance. Source: Yahoo Finance

Recent China shares performance. Source: Yahoo Finance

Ningbo Haishun Securities says the Shanghai Composite Index, at least for now, is in a sensitive range.

The brokerage said that anything over 2,030 points is subject to downside pressure.

It added that property and financial stocks in particular would likely be the biggest selloffs if a major corrective drop in the A-share markets were to happen over the near term.

Jinzheng Consultants said given a lack of visibility, it would recommend investors only put half their investible funds into stocks at this point.

Also, shareholders should be more vigilant than usual now that the market was in the middle of interim earnings season.

Beixin Info was on the bearish side, saying that recent gains were likely to be erased as the benchmark was already seeing downside pressure despite a largely anemic summer performance.

It recommended investors not to bet on a bullish second half of the year, but said that some of the less understood and underpriced counters on China’s SME are worthy of consideration.

Minmetals Securities said that amid the current market uncertainty and unsteady economic recovery both at home and abroad, it recommended investors not be too particular about sectors or perceived value.

They should instead stick to bargain-basement-priced counters, especially those that have fallen by significant percentages of late.

Finally, Secon Investment said that the recent influx of capital is a reason to smile, and the higher trading turnover and rising share prices were causing some investors to feel a bit more confident about taking a strategy of just holding and watching.

See also:

'CHINA'S BUFFETT' Has Active July