Excerpts from analysts' reports

Maybank Kim Eng and clients assured after conference call with Sino Grandness

Analyst: Wei Bin

Huang Yupeng, chairman and CEO of Sino Grandness, has not pledged his shares for any loan. NextInsight file photo.In the light of the recent shortseller’s attack on China Minzhong, Sino Grandness’ management has been very responsive and open in dealing with investors’ concerns and readily agreed to hold a conference call with our clients yesterday despite the extremely short notice given to them.

Huang Yupeng, chairman and CEO of Sino Grandness, has not pledged his shares for any loan. NextInsight file photo.In the light of the recent shortseller’s attack on China Minzhong, Sino Grandness’ management has been very responsive and open in dealing with investors’ concerns and readily agreed to hold a conference call with our clients yesterday despite the extremely short notice given to them.

In all, the concall was organised within 90 minutes and 20 clients participated. We think the information shared by management was helpful and informative, and should go a long way to calming investor concerns. We maintain our BUY call and target price of SGD1.89 on Sino Grandness.

Voyage Research (fka SIAS Research) pegs Uni-Asia's intrinsic value at 29 cents

Analyst: Liu Jinshu

CFO Lim Kai Ching and Chief Operating Officer Michio Tanamoto.

CFO Lim Kai Ching and Chief Operating Officer Michio Tanamoto.

Photo: Company Uni-Asia Holdings Limited (Uni-Asia) reported 2Q 2013 net profit of US$0.3m on revenue of US$16.3m. 1H net profit and revenue came in at 43% and 41% of our full year forecasts.

We maintain our forecasts as a number of anticipated profit catalysts are expected to be realized in 2013. Maintain Increase Exposure.

Maybank Kim Eng and clients assured after conference call with Sino Grandness

Analyst: Wei Bin

Huang Yupeng, chairman and CEO of Sino Grandness, has not pledged his shares for any loan. NextInsight file photo.In the light of the recent shortseller’s attack on China Minzhong, Sino Grandness’ management has been very responsive and open in dealing with investors’ concerns and readily agreed to hold a conference call with our clients yesterday despite the extremely short notice given to them.

Huang Yupeng, chairman and CEO of Sino Grandness, has not pledged his shares for any loan. NextInsight file photo.In the light of the recent shortseller’s attack on China Minzhong, Sino Grandness’ management has been very responsive and open in dealing with investors’ concerns and readily agreed to hold a conference call with our clients yesterday despite the extremely short notice given to them. In all, the concall was organised within 90 minutes and 20 clients participated. We think the information shared by management was helpful and informative, and should go a long way to calming investor concerns. We maintain our BUY call and target price of SGD1.89 on Sino Grandness.

Will the due diligence by HKSE be stricter in light of recent events? This is not an issue as Sino Grandness is well prepared for it. The listing requirements for Chinese companies have already been tightened significantly in the last few years.

In fact, Garden Fresh has already been audited twice by a Big 4 auditor – once in Oct 2011 and a second time in Jul 2012 – when they raised funds from the convertible bond holders (essentially just Goldman and another large investor).

Loquat juice has proven to be a winning beverage for Sino Grandness. Photo: CompanyThe investors’ auditors were extremely stringent to the extent of interviewing Sino Grandness’ customers and suppliers to cross-verify the company’s claims. Unlike share placements, where the due diligence is usually done on a cursory basis, private equity funds are significantly more stringent with the checks, especially when they are also investing in a private company; in this case, Garden Fresh, a private subsidiary of Sino Grandness.

Loquat juice has proven to be a winning beverage for Sino Grandness. Photo: CompanyThe investors’ auditors were extremely stringent to the extent of interviewing Sino Grandness’ customers and suppliers to cross-verify the company’s claims. Unlike share placements, where the due diligence is usually done on a cursory basis, private equity funds are significantly more stringent with the checks, especially when they are also investing in a private company; in this case, Garden Fresh, a private subsidiary of Sino Grandness.

Recent story: Survey: SINO GRANDNESS Unrivaled In Shenzhen

Loquat juice has proven to be a winning beverage for Sino Grandness. Photo: CompanyThe investors’ auditors were extremely stringent to the extent of interviewing Sino Grandness’ customers and suppliers to cross-verify the company’s claims. Unlike share placements, where the due diligence is usually done on a cursory basis, private equity funds are significantly more stringent with the checks, especially when they are also investing in a private company; in this case, Garden Fresh, a private subsidiary of Sino Grandness.

Loquat juice has proven to be a winning beverage for Sino Grandness. Photo: CompanyThe investors’ auditors were extremely stringent to the extent of interviewing Sino Grandness’ customers and suppliers to cross-verify the company’s claims. Unlike share placements, where the due diligence is usually done on a cursory basis, private equity funds are significantly more stringent with the checks, especially when they are also investing in a private company; in this case, Garden Fresh, a private subsidiary of Sino Grandness. Any shares pledged by major shareholder Huang Yupeng? Some investors expressed concern that Sino Grandness may be the next target of short sellers, hence one key question raised was – did major shareholders pledge any shares to banks in return for personal credit that may end up in the borrowing market for shortsellers.

The company confirmed that shares belonging to Mr Huang Yupeng (chairman of Sino Grandness who owns 40% of the shares outstanding) are held in his own name and are not pledged out. In fact, the company claimed that the bulk of Mr Huang’s personal wealth is tied up in Sino Grandness shares and he would not be doing himself any favour if he knowingly pledged out his shares.

The company confirmed that shares belonging to Mr Huang Yupeng (chairman of Sino Grandness who owns 40% of the shares outstanding) are held in his own name and are not pledged out. In fact, the company claimed that the bulk of Mr Huang’s personal wealth is tied up in Sino Grandness shares and he would not be doing himself any favour if he knowingly pledged out his shares.

Recent story: Survey: SINO GRANDNESS Unrivaled In Shenzhen

Voyage Research (fka SIAS Research) pegs Uni-Asia's intrinsic value at 29 cents

Analyst: Liu Jinshu

CFO Lim Kai Ching and Chief Operating Officer Michio Tanamoto.

CFO Lim Kai Ching and Chief Operating Officer Michio Tanamoto.Photo: Company Uni-Asia Holdings Limited (Uni-Asia) reported 2Q 2013 net profit of US$0.3m on revenue of US$16.3m. 1H net profit and revenue came in at 43% and 41% of our full year forecasts.

We maintain our forecasts as a number of anticipated profit catalysts are expected to be realized in 2013. Maintain Increase Exposure.

Key Catalysts Remain in Place: We expect investment income to recover in 2H 2013 as the commercial property investment in Hong Kong is likely to reap some gains for the company once it is completed.

The company is also on track to complete three small residential projects in Japan within this year and we would expect some gains to be realized out of them.

As such, we are of the view that the company is likely to perform better in 2H 2013 compared to 2Q 2013.

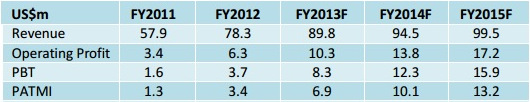

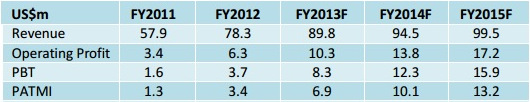

Source: Voyage Research

Source: Voyage Research

Recent stories:

STAMFORD TYRES, UNI-ASIA SHIPPING: Latest Happenings...

The company is also on track to complete three small residential projects in Japan within this year and we would expect some gains to be realized out of them.

As such, we are of the view that the company is likely to perform better in 2H 2013 compared to 2Q 2013.

Source: Voyage Research

Source: Voyage ResearchRecent stories: