A shareholder of New Toyo contributed the following article:

GOING BY the posts in Valuebuddies.com forum, investors seemed to have ruled out New Toyo International paying a special dividend from the asset sale proceeds from its associate, Shanghai Asia Holdings.

Therefore, the 3 July announcement by New Toyo of a special interim dividend of 2.28 cents a share, ahead of its half-year results announcement (in mid-Aug), would have come as a surprise to those investors.

I will discuss the prospects of another special dividend later as I would like to now share some salient points about New Toyo, which many readers are probably unfamiliar with.

GOING BY the posts in Valuebuddies.com forum, investors seemed to have ruled out New Toyo International paying a special dividend from the asset sale proceeds from its associate, Shanghai Asia Holdings.

Therefore, the 3 July announcement by New Toyo of a special interim dividend of 2.28 cents a share, ahead of its half-year results announcement (in mid-Aug), would have come as a surprise to those investors.

I will discuss the prospects of another special dividend later as I would like to now share some salient points about New Toyo, which many readers are probably unfamiliar with.

There has been no analyst coverage on New Toyo for many years, and the company's results announcements and annual report do not disclose much about the operations.

It is not surprising that New Toyo has been viewed by many as not being investor-friendly.

It is not surprising that New Toyo has been viewed by many as not being investor-friendly.

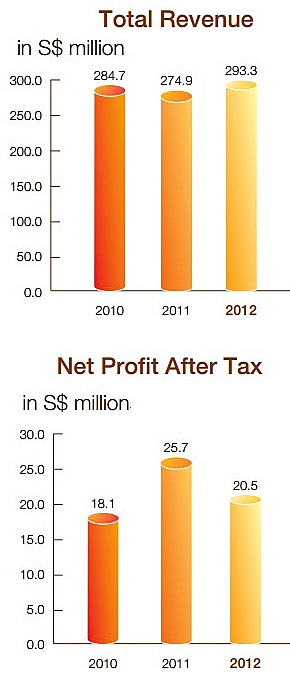

New Toyo International's results.Since its listing in 1997, at a subscription price of 80 cents, New Toyo (recently traded at 32 cents) has made a number of investments that did not provide sustainable profits. Because of this, the company has been viewed as being not savvy despite the subsequent divestment of the sub-par investments.

New Toyo International's results.Since its listing in 1997, at a subscription price of 80 cents, New Toyo (recently traded at 32 cents) has made a number of investments that did not provide sustainable profits. Because of this, the company has been viewed as being not savvy despite the subsequent divestment of the sub-par investments.With rationalisation, New Toyo now has two business segments -- the production of specialty paper and printing of cigarette cartons.

The printing business, undertaken by 53%-owned Tien Wah, is significant, contributing the bulk of New Toyo's profit.

The emergence of Tien Wah as a major printing concern is interesting.

Before 2007, Tien Wah competed with New Toyo for printing jobs.

Tien Wah is an established printer listed on Bursa Malaysia but it had only one factory (in Malaysia). New Toyo had two low-cost factories in Vietnam but they lacked track records.

Tien Wah is an established printer listed on Bursa Malaysia but it had only one factory (in Malaysia). New Toyo had two low-cost factories in Vietnam but they lacked track records.

New Toyo's acquisition of Tien Wah in 2007 and putting Tien Wah in charge of the two factories in Vietnam transformed Tien Wah into a formidable player.

In 2008, Tien Wah bought from the British American Tobacco (BAT) its printing firm in Australia and became the exclusive printer serving four BAT markets for the next seven years.

But just when Tien Wah was about to enjoy steady profit from the exclusive contract, BAT decided to refresh the packaging of its products more frequently.

Frequent changes of design result in fewer cartons being produced in each print run and a high proportion of machine time is wasted in setting up the system before print runs are carried out.

Frequent changes of design result in fewer cartons being produced in each print run and a high proportion of machine time is wasted in setting up the system before print runs are carried out.

As the short-run printing was not anticipated, Tien Wah had to outsource some jobs, at high costs, while awaiting the arrival of new machines it had ordered. Tien Wah's profit was poor in 2009 and 2010, but picked up strongly thereafter.

BAT has also recently required Tien Wah to lower the rate of printing defects to the point of near perfection. Tien Wah is responding well to this requirement, according to its annual report.

It would seem that BAT's stringent requirements have provided Tien Wah the opportunity to demonstrate its capability for higher performance.

New Toyo's other investments in the past may have led many investors to view the acquisition of Tien Wah negatively. But based on Tien Wah's annual reports and results announcements, Tien Wah has done well.

There are concerns that the 7-year business agreement with BAT may not be renewed on expiry in Dec 2015. However, I believe that if Tien Wah maintains its cost advantage and continues to respond to BAT's new, stringent packaging requirements, there are reasons to be optimistic.

Special dividend 2 coming?

Special dividend 2 coming?

New Toyo can be expected to declare the usual interim dividend (0.8 cent a share last year) when it announces its 2013 half-year results in mid-August. The company has consistently paid an interim dividend.

Coming back to the special interim dividend that was declared this month (July) --- there are been speculation as to whether there will be another round of special dividend as the special interim dividend of $10m is a small fraction of asset sales proceeds amounting to $57m..

Coming back to the special interim dividend that was declared this month (July) --- there are been speculation as to whether there will be another round of special dividend as the special interim dividend of $10m is a small fraction of asset sales proceeds amounting to $57m..

New Toyo Group (which includes Tien Wah) would still have $14.3m net cash after paying out the special interim dividend on 22 July.

As Tien Wah's net borrowings amount to $21.8m. New Toyo's own net cash would be $36.1m (ie $21.8 m + $14.3 m).

As Tien Wah's net borrowings amount to $21.8m. New Toyo's own net cash would be $36.1m (ie $21.8 m + $14.3 m).

This is a hefty sum as New Toyo's specialty paper business does not consume much capital.

Tien Wah has strong cash flow (annual profit of $16m plus $11m depreciation/amortisation) and is not reliant on New Toyo for funding despite the net borrowing of $21.8m.

In the light of all this, I am hopeful that another special dividend would be paid in the future by New Toyo.

Tien Wah has strong cash flow (annual profit of $16m plus $11m depreciation/amortisation) and is not reliant on New Toyo for funding despite the net borrowing of $21.8m.

In the light of all this, I am hopeful that another special dividend would be paid in the future by New Toyo.

it is not unreasonable for Amcor to offer at least 6 ~7 times EBITDA if it were to acquire New Toyo (and by extension Tien Wah). This would value New Toyo between 50 to 60 cents.

Just need to be patient :)

it is not unreasonable for Amcor to offer at least 6 ~7 times EBITDA if it were to acquire New Toyo (and by extension Tien Wah). This would value New Toyo between 50 to 60 cents.

Just need to be patient :)

The above statement is an understatement of what had actually happened in 2001/2002's tissue paper business. The EPS loss was more than 20 cents!!!

Let's wait and see !!!

Was he afraid that New Toyo share price would drop sharply after paying out round one of special dividend?

Tien Wah has cut its dividend - New Toyo might follow suit...

Group’s revenue for the second quarter ended 30 June 2013 reduced by 4.2% or RM4.4 million to

RM101.4 million from RM105.8 million in the preceding year corresponding quarter. The current quarter

2013 results were impacted by sluggish demand in certain cigarette related packaging products.

This has shown that tobacco packaging is not as resilient as what people think it to be...

Let me give a simple analogy. The GDP of the country is growing bigger every year but in terms of real growth to each member of the country. We look at GDP per capita. Similarly, in terms of value creation to each equity holder of the company, we look at EPS attributable to equity holders and not group EPS, which is analogous to “GDP of the country”.