Excerpts from analysts' reports

CIMB underweighs REITs and highly-geared companies on prospects of interest rate rise

Analyst: Kenneth Ng, CFA

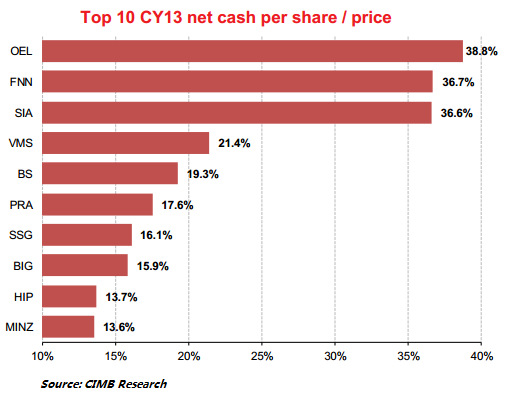

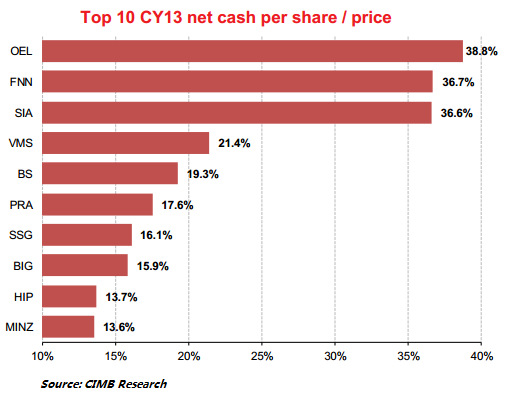

OEL = Overseas Education; VMS = Venture Manufacturing Services; BS = Bukit Sembawang; PRA = Parkson Retail Asia; SSG = Sheng Siong; BIG = Biosensors Group; HIP = Hi-P; MINZ = China Minzhong

OEL = Overseas Education; VMS = Venture Manufacturing Services; BS = Bukit Sembawang; PRA = Parkson Retail Asia; SSG = Sheng Siong; BIG = Biosensors Group; HIP = Hi-P; MINZ = China Minzhong

Should interest rates rise, winners in Singapore would be banks and companies with cash piles. Losers would be companies with high net gearing and REITs.

The fact that REITs have already reacted to rising bond yields does not mean that they will automatically recover to pre-selldown highs.

CIMB underweighs REITs and highly-geared companies on prospects of interest rate rise

Analyst: Kenneth Ng, CFA

OEL = Overseas Education; VMS = Venture Manufacturing Services; BS = Bukit Sembawang; PRA = Parkson Retail Asia; SSG = Sheng Siong; BIG = Biosensors Group; HIP = Hi-P; MINZ = China Minzhong

OEL = Overseas Education; VMS = Venture Manufacturing Services; BS = Bukit Sembawang; PRA = Parkson Retail Asia; SSG = Sheng Siong; BIG = Biosensors Group; HIP = Hi-P; MINZ = China MinzhongShould interest rates rise, winners in Singapore would be banks and companies with cash piles. Losers would be companies with high net gearing and REITs.

The fact that REITs have already reacted to rising bond yields does not mean that they will automatically recover to pre-selldown highs.

In our end-12 Singapore outlook, we took the view that the market did not expect interest rates to rise as yet but the risk remained. If interest rates were to rise, the REIT sector would be most at risk because of its high ownership.

We have been underweight on REIT and telco since end-12 but upgraded them to Neutral in May when Japan started QE.

Our recent strategy aims to find value in banks (DBS), NAV plays (UOL, CAPL, GLP), consumer companies (THBEV, SATS) and stable business models (STE, EZI, VARD) with yields, rather than pure REITs.

What You Should Do. The common question posed is whether investors should get back into some of the REITs.

We reiterate our preference for banks, consumer names and high-yielding, net cash operating companies over REITs and highly-geared companies.

The latter sees a higher concentration among commodity, shipping and second-tier offshore and marine companies.

We reiterate our preference for banks, consumer names and high-yielding, net cash operating companies over REITs and highly-geared companies.

The latter sees a higher concentration among commodity, shipping and second-tier offshore and marine companies.

Potential losers are REITs and highly-geared companies. The most highly-geared companies under our coverage include Olam, NOL, UEM, Swiber, Ezion, Ezra, Wilmar and Noble.

Recent story: UOB KH's strategy for 2H2013: What to buy, sell,

SIAS Research highlights King Wan Corp's bargain power in investing in ships

Analyst: Ng Kian Teck

Ms Chua Eng Eng, 42, is MD of King Wan Corp, whose core business is M&E engineering services. Photo: annual reportWe are revising our FY14/15 numbers upward slightly and this resulted in a higher intrinsic value of S$0.420 per share. Maintain Increase Exposure.

Ms Chua Eng Eng, 42, is MD of King Wan Corp, whose core business is M&E engineering services. Photo: annual reportWe are revising our FY14/15 numbers upward slightly and this resulted in a higher intrinsic value of S$0.420 per share. Maintain Increase Exposure.King Wan increased its stake in Meadows Bright Development Pte Ltd from 35% to 40% recently and now holds an effective stake of 17.5% in the Dairy Farm project.

The project is likely to be launched over the next two months and TOP sometime in 2015/2016. The selling price should be around S$1,300 psf while breakeven cost should be around S$1,000.

The project is likely to be launched over the next two months and TOP sometime in 2015/2016. The selling price should be around S$1,300 psf while breakeven cost should be around S$1,000.

At the same time, the Starlight Suites is about 55-60% sold.

Between Feb to May 2013, King Wan secured six new M&E projects in Singapore worth S$28.4m. They are expected to be completed by 2016.

Between Feb to May 2013, King Wan secured six new M&E projects in Singapore worth S$28.4m. They are expected to be completed by 2016.

Current order book stood at S$166.6m, similar to that of the previous quarter.

Management also highlighted that they have taken the possible hike in labour price into consideration and mitigated it via several measures such as engaging in subcontractors and bidding projects with a slight price buffer.

The listing of KTIS (which holds King Wan’s interest in the two Thai Associates) is expected to be around July 2013 and we reckon that King Wan will probably hold on to the bulk of its shares unless KTIS’ share price spiked up or the former is in need of cash for certain huge expansion/investment.

King Wan is currently exploring investment opportunities, particularly at the dry bulk shipping arena.

Management cited that the unavailability of bank financing and poor market sentiment are keeping vessel prices low, which led to bargaining opportunities for King Wan.

While IRR are low now, upside can be derived from higher future chartering rates and capital appreciation in vessel prices.

King Wan had exhibited great investment foresight in the past with its involvement in Cables International, the two Thai Associates and several property developments. We are optimistic about their recent vessel joint venture.

Recent story: ARA ASSET, KING WAN CORP: What analysts now say

Management cited that the unavailability of bank financing and poor market sentiment are keeping vessel prices low, which led to bargaining opportunities for King Wan.

While IRR are low now, upside can be derived from higher future chartering rates and capital appreciation in vessel prices.

King Wan had exhibited great investment foresight in the past with its involvement in Cables International, the two Thai Associates and several property developments. We are optimistic about their recent vessel joint venture.

Recent story: ARA ASSET, KING WAN CORP: What analysts now say