Excerpts from analyst reports

Lim & Tan Securities maintains 'buy' call on Hi-P International on new iPhone business

Yao Hsiao Tung, executive chairman of Hi-P. NextInsight file photoBloomberg reported that Apple is giving orders for its new lower-priced mass market iPhone to Pegatron Corp as part of a strategy to reduce risk and diversify its supply chain.

Yao Hsiao Tung, executive chairman of Hi-P. NextInsight file photoBloomberg reported that Apple is giving orders for its new lower-priced mass market iPhone to Pegatron Corp as part of a strategy to reduce risk and diversify its supply chain.

Lim & Tan Securities maintains 'buy' call on Hi-P International on new iPhone business

Yao Hsiao Tung, executive chairman of Hi-P. NextInsight file photoBloomberg reported that Apple is giving orders for its new lower-priced mass market iPhone to Pegatron Corp as part of a strategy to reduce risk and diversify its supply chain.

Yao Hsiao Tung, executive chairman of Hi-P. NextInsight file photoBloomberg reported that Apple is giving orders for its new lower-priced mass market iPhone to Pegatron Corp as part of a strategy to reduce risk and diversify its supply chain. We understand that Hi-P is a supplier to Pegatron Corp for Apple’s iPhones and iPads and the latest contract win for Pegatron Corp for the low cost iPhone will benefit Hi-P.

More importantly, the new iPhone will have a plastic casing which is Hi-P’s forte as the company started off as a plastic injection moulding company and only started the metal component business 2 years ago.

Together with new orders from Apple as well as the ramp up in Blackberry, Motorola and Amazon, we are expecting a 177% rise in profits for Hi-P this year to $50mln, translating to an undemanding forward PE of 13x.

Hi-P’s share price is currently trying to break above the critical 84 cents resistance level.

With the company’s persistent share buy back program currently ongoing as well as improving fundamentals, we believe the odds of it breaking above this level is good and maintain our BUY recommendation.Recent story: HI-P INTERNATIONAL: Upgrades by CIMB & OSK on 1Q2013 net profit jump

CIMB says Swiber is 'cheap' at 72 cents; target is 91 cents

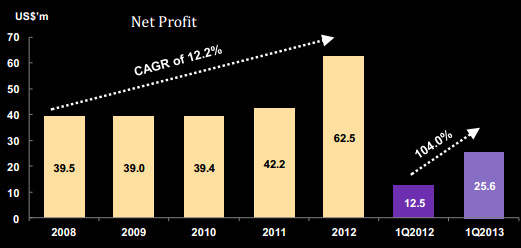

Net profit doubled to US$25.6 million in 1Q on a 59.3% increase in revenue to US$309.7 million

Net profit doubled to US$25.6 million in 1Q on a 59.3% increase in revenue to US$309.7 millionAnalyst: Lim Siew Khee

What Happened

Upstream reported that Swiber is preparing to invest as much as US$500m to build a deep-water offshore construction vessel. The company has floated a newbuild tender for a 4,000-tonne crane vessel with S-lay, reel lay and flex-lay systems. According to Upstream, at least eight yards have been shortlisted for the tender with a contract value of US$400m-500m.

What We Think

Management is non-committal on the news but stated that deep-water is an eventuality. The company is only at the preliminary stage of evaluating the newbuild project. If it goes ahead, we believe that Swiber is likely to choose Chinese yards that provide favourable financing with low upfront payment. Assuming tail-heavy payment terms, a cash call is likely in 2015/2016, nearer to delivery, in our view.

Swiber has a fleet of about 62 vessels currently (12 units under sale and leaseback, 27 units via JVs and 23 units 100% owned). The new deepwater addition will be similar to Ezra’s iced-class subsea construction vessel, Lewek Constellation (about US$420m). We make no changes to our EPS forecasts as the news is not confirmed and the project, if it goes ahead, can only start contributing in FY16/17.

Swiber has a fleet of about 62 vessels currently (12 units under sale and leaseback, 27 units via JVs and 23 units 100% owned). The new deepwater addition will be similar to Ezra’s iced-class subsea construction vessel, Lewek Constellation (about US$420m). We make no changes to our EPS forecasts as the news is not confirmed and the project, if it goes ahead, can only start contributing in FY16/17.

What You Should Do

The stock is cheap at 7.4x CY14 P/E and 0.7x P/BV vs. Singapore OSV’s average of about 1.1x P/BV and 9x CY14 P/E.

Recent story: SWIBER: Is 8% drop in stock price justified?

Recent story: SWIBER: Is 8% drop in stock price justified?