PARKROYAL on Pickering Hotel was constructed by Tiong Seng Holdings. Photo: Internet

PARKROYAL on Pickering Hotel was constructed by Tiong Seng Holdings. Photo: Internet Pek Lian Guan, CEO of Tiong Seng Holdings. NextInsight file photoTIONG SENG HOLDINGS has come a long way since its inception in 1959, more than five decades ago.

Pek Lian Guan, CEO of Tiong Seng Holdings. NextInsight file photoTIONG SENG HOLDINGS has come a long way since its inception in 1959, more than five decades ago. Initially, Tiong Seng’s business was to provide excavation, earth moving and trucking services.

Gradually, its business expanded and is now one of the largest building construction and civil engineering contractors in Singapore with an A1 grade. This grade allows the company to bid for public sector construction projects with unlimited contract value.

Besides the construction business, Tiong Seng has another significant division - property development - focusing on developing residential and commercial projects in various second- and third-tier cities in the PRC.

Some interesting points

1. Order book of S$1.47b, one of the largest, if not the largest, among listed peers

As of 25 Mar 2013, Tiong Seng had an order book of S$1.47b. The bulk of the order book will be recognized in 12-30 months which should ensure earnings visibility over the next couple of years.

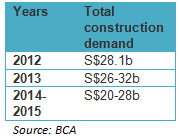

The Building Construction Authority (“BCA”) estimates the total construction demand in 2013 will range from S$26-32b. (2012: S$28.1b).

The Building Construction Authority (“BCA”) estimates the total construction demand in 2013 will range from S$26-32b. (2012: S$28.1b).

As Tiong Seng is one of the largest players, if not the largest among its listed peers in Singapore, the stable / bullish BCA outlook bodes well for Tiong Seng.

Source: Annual report 2012

Source: Annual report 2012

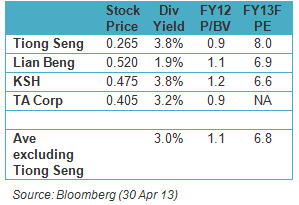

3. Valuations are not extremely cheap

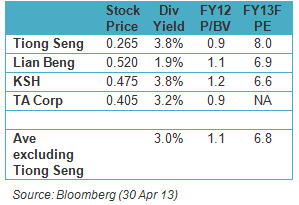

Tiong Seng’s valuations of 8x FY13F PE and 0.9x FY12 P/BV are not exactly cheap but quite reasonable in view of the above mentioned points and relative to their peers.

3. Valuations are not extremely cheap

Tiong Seng’s valuations of 8x FY13F PE and 0.9x FY12 P/BV are not exactly cheap but quite reasonable in view of the above mentioned points and relative to their peers.

4. Rather illiquid stock with average 30D volume at 1.16m shares

Tiong Seng’s free float is only about 20.8% as the top 20 shareholders own 79.2% of Tiong Seng.

As a result, Tiong Seng is rather illiquid with average 30D volume amounting to about 1.16m shares only. In my opinion, an illiquid stock is a double-edged sword. If there is sudden positive news, it may be easy for the share price to move higher as the supply of shares in the market is not large. However, the converse is also true. (i.e. if there is negative news and the share price plunges, investors may find it difficult to unload their positions).

5. Not extensively covered by analysts

The Building Construction Authority (“BCA”) estimates the total construction demand in 2013 will range from S$26-32b. (2012: S$28.1b).

The Building Construction Authority (“BCA”) estimates the total construction demand in 2013 will range from S$26-32b. (2012: S$28.1b). As Tiong Seng is one of the largest players, if not the largest among its listed peers in Singapore, the stable / bullish BCA outlook bodes well for Tiong Seng.

2. Property development sales to be the kicker

Revenue from sales of development properties was about S$3.3m in FY12 (see table below).

According to the company's 4QFY12 results, the revenue of S$3.3m was contributed from sale of 1 unit totaling 84 sqm in Wenchang Broadway in Yangzhou and 4 units totaling 681 sqm in Tianmen Jinwan Building in Tianjin.

According to the company's 4QFY12 results, the revenue of S$3.3m was contributed from sale of 1 unit totaling 84 sqm in Wenchang Broadway in Yangzhou and 4 units totaling 681 sqm in Tianmen Jinwan Building in Tianjin.

According to the company's 4QFY12 results, the revenue of S$3.3m was contributed from sale of 1 unit totaling 84 sqm in Wenchang Broadway in Yangzhou and 4 units totaling 681 sqm in Tianmen Jinwan Building in Tianjin.

According to the company's 4QFY12 results, the revenue of S$3.3m was contributed from sale of 1 unit totaling 84 sqm in Wenchang Broadway in Yangzhou and 4 units totaling 681 sqm in Tianmen Jinwan Building in Tianjin.As at 31 December 2012, Tiong Seng has sold the remaining 1 unit, totaling 141 sqm of Tianmen Jinwan Building, 275 units, totaling 32,507 sqm, of Sunny International Project and 4 units, totaling 239 sqm of Wenchang Broadway in Yangzhou.

These were not recognized in its FY2012 revenue in accordance with its revenue recognition policy. It is likely that FY13F revenue from the sale of development properties should exceed that of FY12.

3. Potential cost savings from future loan refinancing

These were not recognized in its FY2012 revenue in accordance with its revenue recognition policy. It is likely that FY13F revenue from the sale of development properties should exceed that of FY12.

3. Potential cost savings from future loan refinancing

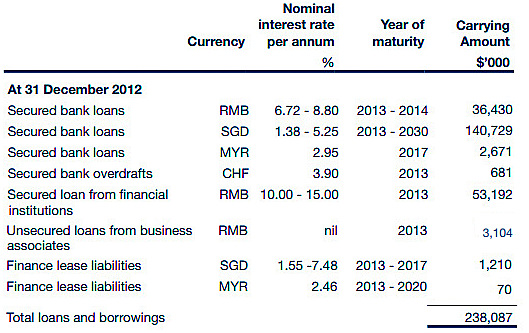

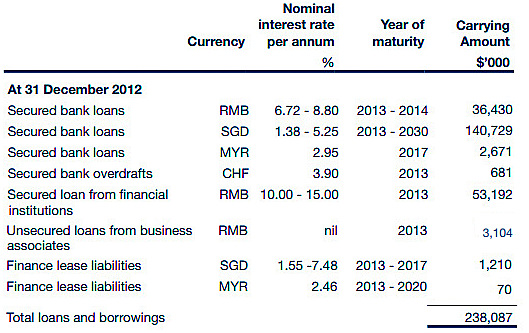

Tiong Seng has a secured RMB loan from financial institution of SGD equivalent 53.2m which expires on 5 Aug 2014. (The initial maturity date was in 2013 but Tiong Seng renewed the loan after year-end.)

With the high interest 10-15% p.a. that it is paying for the RMB loan, there seems to be scope for potential interest savings upon renewal, or refinancing, of the loan.

With the high interest 10-15% p.a. that it is paying for the RMB loan, there seems to be scope for potential interest savings upon renewal, or refinancing, of the loan.

Source: Annual report 2012

Source: Annual report 20124. Steady dividend of $0.01 since listing; XD on 6 May

Since listing on 16 Apr 2010, Tiong Seng has been giving S$0.01 dividend per share each year. Based on Tues closing price of $0.265, this works out to be 3.8%, one of the highest among listed peers.

5. Maiden steps into Myanmar

On 22 Apr 2013, Tiong Seng announced that it has signed an MOU with Shwe Taung Development Co., Ltd, a leading corporation in Myanmar with exposure to diverse industries such as real estate, construction, engineering etc, to explore entering into a joint venture to set up a pre-cast plant in Myanmar.

According to the Myanmar Ministry of Construction, Myanmar plans to build more than a million houses over the next two decades. This is likely to bode well to Tiong Seng’s potential joint venture in the long term as residential construction accounts for about 51% or US$1.5b of Myanmar’s total construction output.

According to the Myanmar Ministry of Construction, Myanmar plans to build more than a million houses over the next two decades. This is likely to bode well to Tiong Seng’s potential joint venture in the long term as residential construction accounts for about 51% or US$1.5b of Myanmar’s total construction output.

Noteworthy points

1. Lumpy results

This is widely seen in construction companies. Quarterly results are difficult to forecast with accuracy as revenue can swing quite significantly in accordance with their revenue recognition policies. Nevertheless, Tiong Seng's FY13F is likely to be a stronger year vs FY12 due in part to the sales contribution from the development properties in China.

2. Construction business – tough business to be excited about

The construction business is not exactly the most sexy story to be excited about due to lumpy results, low margins, stiff competition and escalating costs etc.

Notwithstanding this, it is noteworthy that Tiong Seng has executed several high-tech initiatives which reduce its reliance on labour relative to its peers.

For example, Tiong Seng possesses the ability to design, produce and install pre-cast components. This is unlike most other contractors who buy straight from pre-cast producers.

According to management, such measures result in about 20% cost saving in manpower requirements. As Singapore’s foreign worker levy is expected to increase from $350 to $450 in July this year, it is likely that Tiong Seng’s competitive advantage will be more apparent this year.

Notwithstanding this, it is noteworthy that Tiong Seng has executed several high-tech initiatives which reduce its reliance on labour relative to its peers.

For example, Tiong Seng possesses the ability to design, produce and install pre-cast components. This is unlike most other contractors who buy straight from pre-cast producers.

According to management, such measures result in about 20% cost saving in manpower requirements. As Singapore’s foreign worker levy is expected to increase from $350 to $450 in July this year, it is likely that Tiong Seng’s competitive advantage will be more apparent this year.

3. Valuations are not extremely cheap

3. Valuations are not extremely cheap4. Rather illiquid stock with average 30D volume at 1.16m shares

Tiong Seng’s free float is only about 20.8% as the top 20 shareholders own 79.2% of Tiong Seng.

As a result, Tiong Seng is rather illiquid with average 30D volume amounting to about 1.16m shares only. In my opinion, an illiquid stock is a double-edged sword. If there is sudden positive news, it may be easy for the share price to move higher as the supply of shares in the market is not large. However, the converse is also true. (i.e. if there is negative news and the share price plunges, investors may find it difficult to unload their positions).

5. Not extensively covered by analysts

DBS Research seems to be the only research house covering Tiong Seng with a target price of $0.330. With such scant coverage, it is likely that the investment community is still not familiar with its business and prospects.

Therefore, it may take some time for Mr Market to understand it. Conversely, investors who understand and believe Tiong Seng prospects now can purchase it with a considerable margin of safety. On the investor relations front, Tiong Seng has recently appointed Financial PR as its investor relation firm to connect with the investment community.

Conclusion – Execution is key for potential re-rating

Therefore, it may take some time for Mr Market to understand it. Conversely, investors who understand and believe Tiong Seng prospects now can purchase it with a considerable margin of safety. On the investor relations front, Tiong Seng has recently appointed Financial PR as its investor relation firm to connect with the investment community.

Conclusion – Execution is key for potential re-rating

Investors would be watching Tiong Seng results in the coming quarters, coupled with any new contract wins to replenish its order book. In a nutshell, execution is key for a potential re-rating of the stock.

This article was recently published on Ernest Lim's blog http://www.ernestlim15.blogspot.com/ and is reproduced with permission.

Readers who are interested should check out Tiong Seng’s website & http://investors.tiongseng.com.sg/downloads.cfm for more information and analyst reports. You can also email Ernest atThis email address is being protected from spambots. You need JavaScript enabled to view it. for the analyst reports.

Recent NextInsight article: TIONG SENG HOLDINGS: Riding construction boom with advanced technologies

This article was recently published on Ernest Lim's blog http://www.ernestlim15.blogspot.com/ and is reproduced with permission.

Readers who are interested should check out Tiong Seng’s website & http://investors.tiongseng.com.sg/downloads.cfm for more information and analyst reports. You can also email Ernest at

Recent NextInsight article: TIONG SENG HOLDINGS: Riding construction boom with advanced technologies

* This seem to be pretty sizable as compare to the $3.3 million for FY 2012.