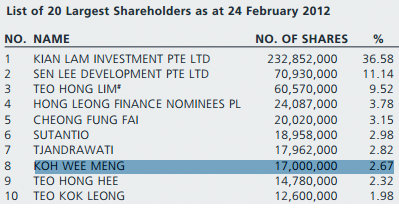

ON THE RIGHT, Koh Wee Meng appears in a screenshot of the top shareholders' list as published in the FY2011 annual report of boutique property developer cum hotel owner, Roxy-Pacific Holdings.

Note that he held 17 million shares, or a 2.67% stake as at 24 Feb 2012.

Koh Wee Meng, in case you didn't know, is the executive chairman and CEO of Fragrance Holdings, a billionaire who made his money through his hotel chain and property investment. (See Bloomberg article: Koh Makes Billion as Fragrance Sheds Love Hotel Image)

In April 2012, as a result of a 1-for-2 bonus issue, his 17 m shares would have become 25.5 million.

Fast forward to end-Dec 2012, and he had 45,797,000 shares to his name, according to a filing with the Singapore Exchange yesterday.

His buying of all those shares, we now know, probably helped the stock price of Roxy-Pacific achieve an amazing 127% gain in 2012.

Roxy-Pacific's stock price performance also reflected the company's positive moves, including its first-ever bonus issue, its first-ever interim dividend payout, its first-ever declaration of a dividend policy -- and its business track record and prospects.

Mr Koh now directly holds a 4.7963% stake in Roxy-Pacific, a fact that has just become public along with the the shareholding of his wife, Lim Wan Looi (an executive director of Fragrance Holdings).

She had recently bought 2 million shares herself.

As a result, the total shareholding of the couple has crossed 5% to 5.0058%, making both of them substantial shareholders of Roxy-Pacific. This fact was duly reported in a filing to the SGX yesterday.

Recent stories:

ROXY-PACIFIC: Not adversely affected by new URA rules on shoebox units

ROXY-PACIFIC: Why its stock is up 94% in year to date