Translated by Andrew Vanburen from a Chinese-language piece by An Zhongwen in the Shanghai Securities Journal

THE SOUND PERFORMANCE of the benchmark Shanghai Composite is serving as “positive reinforcement,” and funds will likely continue pouring in at an even more feverish rate to the PRC bourses.

However, investors are still steering clear of property until there is more pricing and policy visibility.

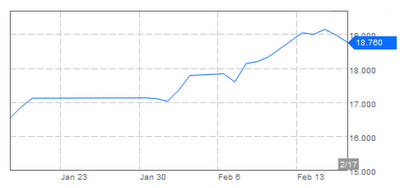

Earlier this week we witnessed both the Shanghai Composite Index and its Shenzhen counterpart touch new nadirs within the current ascent before profit-takers came in and took over the store for a spell, limiting gains for the day.

It is clear that a lot of the oscillating these days is due to the frequent buy-dump behavior of fund injections for short-term profits, a not uncommon phenomenon in an up-trending market.

However, I believe that because the benchmark Index has already tested the near-term nadirs in the current cyclicality, there is even more appetite for adventurism in the generally upbeat climate these days, and funds playing musical chairs – chasing the best seat du jour – should continue to provide upside support to the market for the foreseeable future.

And to make matters even more frenetic, a fair sampling of fund managers do not rule out the possibility of the entrance of a significant chunk of new fund capital into the market during the second quarter.

“There is a good chance that we could soon once again have the word ‘REIT’ (real estate investment trusts) on the tip of our tongues when talking about the current bull run, and assigning credit or blame for the upsurge, a fund manager at a major firm said.

For extended bull runs have the unfortunate effect of allowing everyone to lower their collective guard against investment vehicles proven overly risky in the past.

He added that private quasi-legal fund buildups have been panting at the starting gate of late, anxious to jump into the race before it’s too late, and they are clamoring to begin their gallop as most investors believe the starter’s pistol has already sounded.

When these sources of investment capital begin flowing into the market in earnest, then we can start whispering about the potential for a near-term bubble forming and speculation being the catchword of the day.

The upside to this looming phenomenon is that seasoned investors and well as institutional players will be better able to find value in the market and steer clear of the surging and volatile counters or sectors that are recipients of fickle, large-scale fund capital.

This will hopefully result in more stable channels for long-term, steady returns and provide staying power to the market over the duration.

As most investors are content that recent troughs have been tested and overcome, it is a high probability that asset managers will quickly come back into vogue as optimism in the current upswing becomes increasingly contagious.

“After the week-long Lunar New Year festival, we’ve pretty much seen nothing but rebounds, and I don’t expect the festive feeling to dissipate anytime soon,” the above-mentioned fund manager added.

“And fund activity will likely be a driving force going forward, if history is any guide.”

See also:

Just As In Gambling, Self-Control Equals To Research For Investors

ALEX WONG: Don’t Let Gyrations Make Gamblers Of Us