Above, L-R: Gary Ho (COO, Operation & Supply Chain Management), Yao Hsiao Tung (Chairman & CEO), Samuel Yuen (CFO), and ML Tjoa (COO, R&D and Business Development).

Hi-P'S STOCK PRICE rose 3.5 cents on Fri to 78.5 cents after Hi-P International said some of the programs delayed in 3Q are being delivered in the current 4Q and will continue into 2013. Profit in 4Q2012 is expected to be stronger than 3Q2012.

Hi-P stock gave up 1.5 cents yesterday (Monday) and is down significantly from a high of $1.08 posted about five weeks ago on Sept 21 as the market turned bearish in anticipation of its 3Q result.

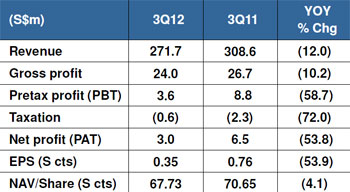

It posted a net profit of S$3.0 million for 3Q2012, reversing a net loss of S$2.1 million for 2Q2012.

3Q2012 revenue increased 7.9% quarter-on-quarter to S$271.7 million.

The global contract manufacturer of components for smart phones, tablet computers and other consumer electronics had been affected by delays in project start up of existing and new customers.

But the management expects 4Q2012 to be better than 3Q2012 as the delayed projects kick-in but says that FY2012 results will lag FY2011.

NextInsight file photo

Despite uncertainty in global economic growth, sales of tablets and smart phones are holding up as consumers turn to these devices for ease of mobile computing and consumption of digital content.

To support the Group’s growing customer base, Hi-P is investing S$300 million to build a plant in Nantong, China, comprising six blocks with a built-up area of about 190,000 square meters on a land parcel of 100,000 square meters.

Hi-P's production space will increase by about 50%.

The new plant will allow the Group to integrate different production lines under one roof, thereby streamlining manufacturing processes and creating economies of scale.

The new plant is expected to commence operations in 2H2013 and become fully operational in 1H2014.

The company held a results briefing at the Ritz Carlton Hotel on Fri. Below is a summary of questions raised and the replies given by executive chairman Yao Hsiao Tung, chief financial officer Samuel Yuen and chief operation officers Gary Ho and ML Tjoa.

Q: What is causing the delay in project ramp up?

Our products rely on components from other suppliers and there have been delays from some of them. The bottleneck situation is improving.

Q: What are the products that are facing project delay?

Smartphones, tablets and e-books.

Q: Why are your inventory levels at a record high?

Inventories are higher because we bought raw materials based on forecast demand that is higher than what was realized. A second reason is we are preparing for higher demand in the fourth quarter.

Our inventories comprise of raw materials, work-in-progress and finished goods.

Q: What is your ramp-up visibility?

We do not have complete visibility because we are also dependent on other component suppliers. We believe the demand forecasts provided to us by the final assemblers are fairly accurate.

Q: How do you know the demand for your huge capital investment will be sustained?

We review our project pipeline regularly, as frequently as weekly. Based on our reviews, we believe we need the new production facilities. We do acknowledge that over-investment is a risk in the high-tech industry that we are in. However, to get larger orders, we have to prove to the customer that we have the ability to deliver. Q: Your plant, property & equipment increased by close to S$60 million to about S$340 million. How much of this is from your Nantong project?

Q: Your plant, property & equipment increased by close to S$60 million to about S$340 million. How much of this is from your Nantong project?

None of our capex for the Nantong project has been included yet.

Q: How much capacity / sales will be added with the S$300 million capex?

By 2H2013, annual capacity will increase by more than 30%. By 2014, our capacity will have increased by 50% from current levels. We will expand the volume for current processes, and add new processes.

Q: For the first 9 months, what portion comprise of components?

About 35% is high-level assembly and the rest are components.

Q: How many CNC machines do you have?

We have more than 700 machines. More than 500 are for metal and the rest are for plastic. By year-end, I believe we will have close to 800 machines.

Related story: BIOSENSORS, HI-P, K1 VENTURES: What Analysts Now Say...