Excerpts from latest analyst reports....

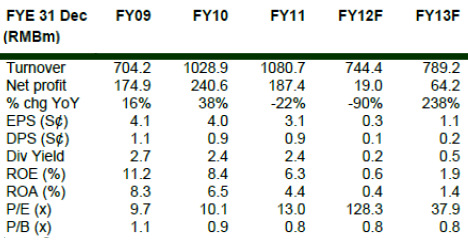

DMG sets 50-cent target for MIDAS on FY13 recovery

Analysts: Melissa Yeap & Terence Wong, CFA

FY12 will be lacklustre. 2H12 is likely to remain weak, as there are few orders to be delivered during this period.

With the recent stimulus for the railway industry, we believe Midas would be able to grow its order book, increase the utilisation at its lines and progress towards a recovery from FY13.

During 2009 and 2011 when there was good order flow, Midas traded above 2.0x P/B.

Given the positive outlook for the industry and the potential order flows, we think Midas should trade higher than its current 0.8x P/B.

Pegging it to 1.0x FY13 P/B, we arrive at a TP of S$0.50. We upgrade our recommendation to BUY.

Recent story: DBS Vickers' small/mid-cap picks, HI-P is DMG's sure bet

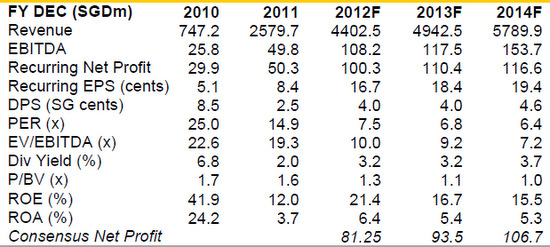

Maybank KE has $1.90 target for CWT

Analyst: James Koh

CWT announced yesterday a minor acquisition of another commodity trading house, LN Metals International (LN), for a total consideration of USD12.3m (SGD15.4m).

The price was mostly decided on book value.

While earnings accretion is only likely some 6-9 months down the road from completion, this acquisition is aimed at improving CWT’s capabilities via the integration of several key personnel and adding to CWT’s commodity trading volume.

We continue to see significant value in this growth stock and reiterate our SGD100m FY12 profit estimate, which is ahead of the street.

We also adjust FY13-FY14F earnings upwards by 3-7% and maintain BUY with SOTP TP of $1.90.