Excerpts from latest analyst reports....

CIMB says: Hi-P Hi-P hooray as Apple grows in significance for HI-P INTERNATIONAL

Analysts: Jonathan Ng & Renfred Tay

We believe Hi-P’s proposed S$300m China investment, announced last Friday, is linked to greater allocations from Apple and a testament to Hi-P’s ability to offer quality components at competitive prices.

The project will boost FY13-14 earnings, and should catalyse its stock price. It also brings further confirmation to investors that Hi-P is no longer that reliant on RIM.

We expect contributions from this project to come in by 2H13 and raise our FY13-14 EPS by 10-17%.

With an unchanged valuation basis of 10.2x CY13 P/E (5-year historical average), our target price is raised accordingly. Outperform maintained.

DMG & Partners analyst Edison Chen says ......

While the announcement seems routine on the surface, our channel checks with Apple’s supply chain reveals that Hi-P is poised to benefit tremendously from Apple’s future production ramp.

As part of Apple’s ongoing efforts to diversify its supplier base, we believe that Apple has chosen Hi-P to be a key component supplier along its supply chain and is likely to provide Hi-P with substantial orders for its upcoming product launches.

The new plant when completed will increase Hi-P’s production space by 50%, and lead to a corresponding doubling of production capacity by the end of 2014.

This will enable it to enable it to fulfill the drastic increase in orders going forward. We see positive implications from the latest capex ramp-up and remain upbeat over the group's outlook.

Recent story: BIOSENSORS, HI-P, k1 VENTURES: What analysts now say...

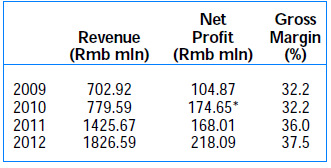

Lim & Tan Securities highlights profit track record of DUKANG DISTILLERS

Dukang reported 30% increase in net profit to Rmb 128.09 mln (S$43.03 mln) on 28% increase in revenue to Rmb 1.83 bln for year-ended June ’12.

Fact is since listing, Dukang has been reporting steady profit growth (see table).

Yet, stock has been languishing at the bottom end of trading range since listing in Sept ’08.

In fact, it is yet another half-on-half story: from 92 cents in Dec ’10 to 46 cents in Sept ’11; and then to 21 cents in May this year.

At 22 cents, historic PE is 4.2x with current market cap of almost S$180 mln, of which just half represents cash reserves of Rmb 469.2 mln / S$92 mln!

Recent story: DUKANG DISTILLERS hosts eye-opening visit for investors

OCBC says 'stay invested in TAT HONG'

Analysts: Chia Jiunyang, CFA & Eric Teo

Operating leverage: Being a crane rental company, a large portion of Tat Hong’s expenses are depreciation and financing costs relating to the hire-purchase of its crane assets.

This means that beyond a certain point where revenue covers the overheads, any increase in rental rates or crane utilization will go straight to the bottom-line.

This is exactly what is happening now – both the utilization and rental rates are trending upwards over the medium term and we expect Tat Hong to deliver record profits for FY12-13F.

Maintain BUY with unchanged S$1.39 fair value estimate.