THE SINGAPORE market has not done too badly despite the widespread investor gloom over the euro crisis.

As we reported recently, some 70 stocks were up more than 50% in the year to date (see 1H2012 Top Gainers: INTERRA, ASPIAL, SARIN, ROXY, SUPER)

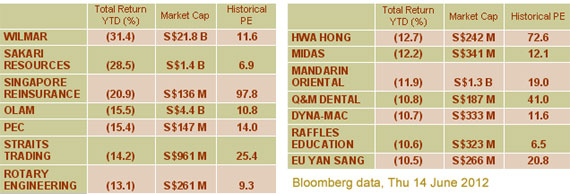

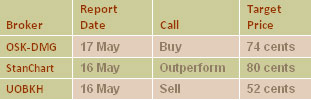

Now, we take a look at those that have been dragged down. As the table above shows, among the profitable dividend-paying stocks with market cap over S$100m, the losses have not been destructive. Only about 15 stocks were down by down more than 10%.

We take a look at 5 of them and highlight some reasons these stocks with good fundamentals have been sold down.

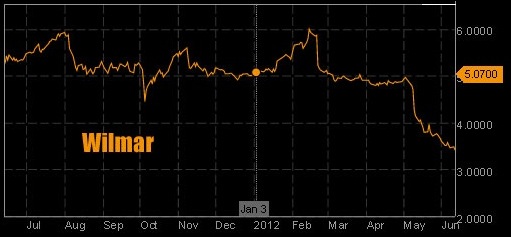

Wilmar - Oilseeds and grains margins hit by soft commodities slowdown

Shares of Wilmar International, the world’s largest listed palm oil player, is down 33% year-to-date. It last closed at S$3.41.

On 28 May, JP Morgan downgraded the stock to ‘Neutral’, lowered its target price to S$4.30 and said that Wilmar was likely to continue in the red for its oilseeds and grains segment.

Wilmar has oilseeds and grains processing plants in China for soya bean, rapeseed, groundnut, sunflower seed, sesame seed, cottonseed and grains (wheat and rice) into edible oils, meal, flour, rice and related products.

JP Morgan expects this segment, which accounts for about 25% of group revenue, to perform negatively as industry sources such as China National Grains & Oils Information Center are reporting no signs of recovery in downstream markets such as soybean meal and soybean oil.

Its sugar business, which accounts for about 4% of group revenue, is also in the red.

Its 1Q2012 consolidated net profit was US$256 million, down 34% year-on-year.

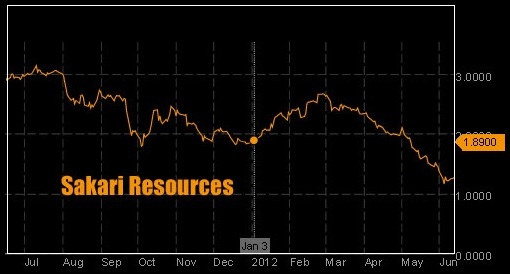

Sakari Resources – to benefit from Indon coal export quota

There is now an oversupply of coal and leading Indon exporter of thermal coal, Sakari Resources, is another commodity player hit by the commodities slowdown.

At S$1.225, its stock price is down 35% year-to-date.

Sakari’s 1Q2012 net profit was down 65% year-on-year at S$14.5 million, as the company was affected by an oversupply situation in coal, lower production due to heavy rainfall and pit developments works, as well as an inflationary operating environment in Indonesia.

AmFraser however, believes that the fears on coal mining have been overplayed, and issued a ‘Buy’ recommendation on Sakari on 12 June, citing the following positives:

Firstly, coal demand from China will hold up as demand for coal-generated electricity will still grow. Near-term price pressures from US coal exports are still present.

“We see will be near-term downside risks to coal prices, and a recovery in coal prices towards the end of the year.”

Secondly, it expects Indonesia’s restriction on coal exports to benefit Sakari, which owns mines for top grade thermal coal.

”Contrary to what the market fears and hence a sell-off, we see Sakari benefitting from regulatory trade restrictions on lower grade coal.”

It’s fair value estimate for Sakari is S$1.46, translating into a stock upside of 15%.

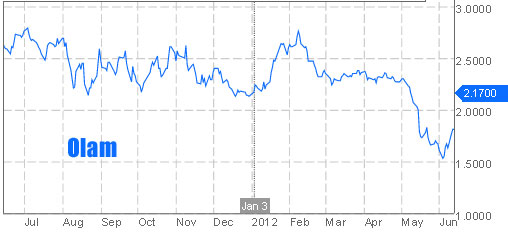

Olam – price correction overdone for solid food business

Olam’s share price has recovered 10% since it announced a share buyback program on 8 Jun, but even at its recent close price of S$1.80, the shares are still down 17% year-to-date.

On 8 Jun, Olam bought back 3.2m shares (representing 0.13% of its issued share capital) at an average price of S$1.63 per share.

The global supplier of agricultural commodities ended March with 3Q2012 net profit down 19% at S$102.3 million, but there are analysts who think that the price correction is overdone.

On 12 Jun, OSK-DMG issued a ‘Buy’ call on Olam, maintaining its price target of S$2.56.

”Olam also has the financial resources to execute the share buyback program. We remain positive on Olam’s fundamentals, as 90% of its net contribution comes from the food business, which continues to see strength.” - OSK-DMG analyst Leng Seng Choon.

Morgan Stanley is also positive on Olam. The foreign broking house believes that weakness in its non-food segment is cyclical, rather than structural, and maintained its ‘Overweight’ rating on 5 Jun, citing as positives attractive valuation for a solid food business.

Its target price range for Olam is S$2.50 to S$3.40.

Bloomberg data

Eu Yan Sang – Inflationary and expansion pressures

Investors have sold Eu Yan Sang down 10% year-to-date on concerns over its ability to successfully penetrate the China and Australia markets.

Eu Yan Sang plans to drive top-line growth through accelerating store expansion and acquisitions. During the first 3 months of 2012, it added 94 retail stores in Australia via M&A and 6 in China, growing its retail network to more than 300 outlets.

Its stock price fell by about 10% to 60 cents after it announced that 9M2012 net profit was down 62% year-on-year at S$7.3 million.

Retail revenue from Hong Kong, its main market, was impacted by relocation of stores due to higher rental renewals at original retail locations. The new geographic segments have also yet to break even.

The management expects to narrow losses in its start-up businesses and hopes to acquire more pharmacy licenses in China.

Long-term investor Aberdeen purchased 1.5 million Eu Yan Sang shares from the open market on 23 May, bringing its interest to 13.13%.

Bloomberg data

Related story: OSIM, EU YAN SANG: 'Buy' Calls Maintained By DMG

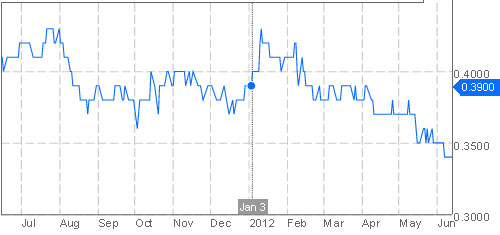

Q & M Dental - Buying opportunity for Singapore's largest dental group?

Investors eyeing Singapore’s largest dental group, Q & M Dental, may finally get a chance to accumulate the stock.

Its stock price has been sheding its excessive valuation, and is down 13% year-to-date.

It is now 34 cents, with Bloomberg consensus PE for 2012 at 34 times. It was as high as 42 cents at its peak this year.

Q & M has 46 dental clinics, four dental centres and one mobile dental clinic in Singapore.

It also owns two dental supplies and equipment distribution companies, and has interests in dental healthcare groups in China and Malaysia.

Healthcare is a stable recession-resilient business and the group has grown net earnings by CAGR of 9% over the past 5 years. 1Q2012 net profit was S$1.1 million, up 6% year-on-year.

The management believes that rising demand for higher value specialist dental healthcare services as its key markets have an increasingly affluent and aging population.

Bloomberg data

NextInsight readers are invited to visit Q & M Dental on 23 Jun. More info here.

Related story: Q&M Dental: Initial Ventures In China Paving The Way For Mega Deals?