Otto Marine clinches time-charter contract worth US$14.9 million in Gulf of Mexico

FOLLOWING A SERIES of chartering contract wins in Africa, India and Australia, Otto Marine has secured for the first time a time charter contract in the Gulf of Mexico.

The contract with a prominent Mexican offshore platform construction company is worth US$14.9 million and extends over a 450-day period, or about 15 months.

The contract comes with an option to extend for another 12 months, bringing the potential value of the contract to approximately US$20.0 million.

The 4,200 bhp work maintenance vessel Oranda 1 measures 75 x 24 meters and is ABS classified.

Oranda 1 has achieved a 96% utilization rate and has completed 4 projects in South East Asia since May 2010.

Oranda 1’s deployment will support general topside platform maintenance works undertaken by diversified energy service companies.

Deputy President of Otto Marine, Aw Chin Leng, said: “Mexico is shaping up to be a very active market in 2012 and fits well into our strategy to grow the Group’s geographical presence in this neck of the woods over the next couple of years.”

Otto Marine’s chartering division contributed S$288.3 million in revenue last year to the Group’s overall S$520.8 million.

Gross profit for the chartering division was S$39.3 million -- which greatly helped the Group’s overall gross profit to stay in the black at S$3.97 million. The Group suffered losses in its shipbuilding and geophysical divisions.

Meanwhile, Otto Marine has promoted Michael See from CFO/Senior VP to Group CFO/ Executive VP with effect from 1 March 2012.

Recent story: OTTO MARINE: Vessel cancellation drags down FY2011 earnings; bright spark in chartering segment

STRACO resumes share buyback, has $82 million net cash

MINORITY SHAREHOLDERS sometimes gripe about the management of companies that do not do share buybacks despite their being grossly undervalued by the market.

These shareholders hold that share buybacks can send positive signals to the market, aside from improving financial ratios such as earnings per share, net tangible assets per share and Return on Equity.

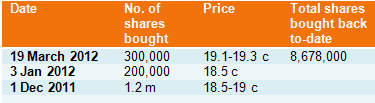

Minorities holding shares of Straco Corporation would have no such complaint, as the management has been enthusiastically buying back its shares (see table above).

Yesterday, it bought back 300,000 shares, accounting for nearly half of the 587,000 shares transacted on the market. The stock is not exactly liquid.

This is the first time Straco has bought back shares since announcing its FY2011 results.

Just before that it had bought 1.4 million shares in two days.

In all, Straco holds 9.36 million treasury shares, of which 8.678 million were purchased under the existing buyback mandate.

The company has ample war chest to continue its buyback.

As at end-2011, Straco had no borrowings and $82.18 million of cash, which accounts for half of its market capitalisation.

Its business was highly cash-generating. In 2011, cash from operating activities amounted to $21.15 million.

Cash flow from investing activities amounted to $396,000.

Cash outflow from financing activities amounted to $8 million – this would have made shareholders happy since $6.51 million went to paying out dividend and $1.56 million to buying back its own shares.

Recent story: YANLORD loses Aberdeen; STRACO & LMA, LIAN BENG boss grab more shares