WHEN MIGHT a big buying opportunity present itself this year?

DBS Vickers’ head of research, Timothy Wong, told the current edition of The Edge weekly: “A selling climax of sorts could occur in 2Q2012. Focus is on the eurozone debt.”

February-April is when a large part of the debt matures, and the markets will be nervous, said Timothy.

The European Central Bank may have to take bolder steps than it has so far to address the issues.

In 1Q also, Singapore’s economy should bottom out and earnings downgrades subside.

Given the confluence of these 2 key scenarios, an inflection point in the market could be realized, according to Timothy.

For the house’s stock picks and more, which are presented in a full-page article, go buy The Edge which costs $3.80 at the news-stands.

Recent story: Should investors just forget about 2012?

In a full-page article on Monday (Jan 16), Business Times senior correspondent Teh Hooi Ling wrote that based on equity risk premium, the Singapore market is at its cheapest since 1999 with the exception of the period during the global financial crisis in 2008/2009.

Equity risk premium is a measure of the expected return of an equity investor over and above the risk-free rate.

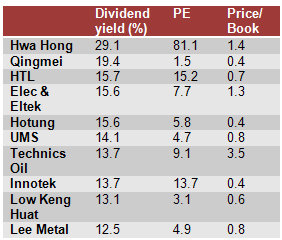

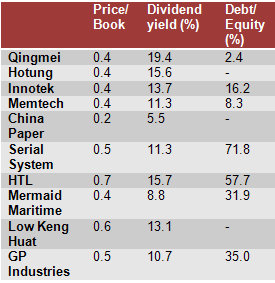

She also considered other metrics: forecast PE for next year, historical PE, dividend yields and price-to-book ratios.

“Overall, the various metrics suggest that we should be putting some new money to work in the market but not to the extent of using up all of one’s cash. It is still advisable to keep some powder dry,” she wrote.