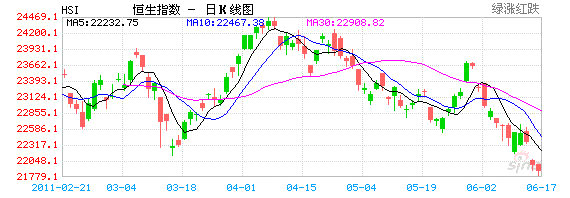

HONG KONG’S benchmark Hang Seng Index lost 3.2% on the week, falling another 1.2% today to close at 21,695.26 on global economic worries and more rate action from Beijing.

Meanwhile, the Shanghai Composite – which tracks A and B shares in the PRC – lost another 0.8% today to hit 2,642.82, a nearly nine-month low.

The Hang Seng closed at levels not seen since Sept 16 of last year on relatively robust trading turnover today of 76 bln hkd on a flurry of short-selling transactions.

Another hike in the reserve requirement ratio this week an expectations of a possible upward adjustment in the prime lending rate this weekend by the People’s Bank of China had lenders on edge for most of the week.

The Financial Sector Sub-index lost 0.77% today, while the Public Works Sector Sub-index – highly captive to credit availability – fared even worse, shedding 1.29%.

Real estate developers, also highly reliant on spending capital to boost land banks, also suffered from the credit woes, with the Property Sub-index falling 0.60%.

China Unicom (Hong Kong) Ltd (HK: 762) was one of the biggest blue-chip losers today, closing down 5.61% at 14.8 hkd on earnings concerns and auditing irregularities.

A Chinese-language piece in Sinafinance said that a possible slowdown in the heretofore perennially reliable Mainland Chinese economy as well as continued sluggish recovery figures coming out of the EU and North America put energy firms on alert.

China Shenhua Energy Company Ltd (HK: 1088) plummeted 4.47% to 34.2 hkd, Aluminum Corp of China Ltd (Chalco, HK: 2600) lost 2.48% to 6.28, oil giant CNOOC Ltd (HK: 883) fell 1.98% to 17.86 and China Coal Energy Co Ltd (HK: 1898) was down 0.58% at 10.2.

Bucking the trend were PetroChina Co Ltd (HK: 857) which added 1.49% to close at 10.88 hkd and electricity generator China Resources Power Holdings Co Ltd (HK: 836) which rose 1.84% to 14.38.

Real estate developers were down across the board on tighter credit concerns.

Sun Hung Kai Properties Ltd (HK: 16) lost 1.77% to close at 111.1 hkd, Hutchison Whampoa Ltd (HK: 13) shed 1.48% to 83.25, Wharf (Holdings) Ltd (HK: 4) gave up 1.43% to 51.6, and Swire Pacific Ltd (HK: 19) was down 1.41% at 111.8.

Hong Kong-listed lenders were in the same boat on worries that they will be required to keep more of their money in banks, and out of the hands of interest-paying borrowers.

Bank of East Asia Ltd (HK: 23) was down 1.40% at 31.8 hkd, Hang Seng Bank Ltd (HK: 11) fell 0.98% to 121.4, BOC Hong Kong (Holdings) Ltd (HK: 2388) shed 0.87% to 22.75, Bank of Communications Co Ltd (HK: 3328) gave up 0.69% to 7.23 and Bank of China Ltd (HK: 3988) was 0.26% lower at 3.82.

Index heavyweight HSBC Holdings Plc (HK: 5) lost 1.04% to close at 76.05 hkd.

Bucking the banking trend today was China Construction Bank Corp (HK: 939) which rose 0.45% to 6.64 hkd.

The report cited a KAB Finance analyst as saying: “Recently trading turnover in Hong Kong has been quite light. The best time to jump back into the market is when volume picks up. But investors should know that there is little near-term possibility of a return to robust daily turnover.

“The index is likely to trade over the next few sessions within a narrow range, likely 21,500 to 21,700. There is a lot of money in the hands of more conservative investors and wait-and-seers who are sitting tight until the current bout of short-selling blows over.”

See also:

HK WEEKLY WRAP: Index Down 0.8% Friday For 7th Straight Loss

MAN WAH: Breaks Into Top 10 In US Furniture Market