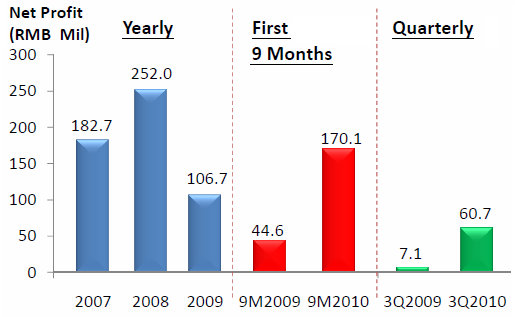

THERE ARE A few key financial points worth keeping in view following a presentation by Patrick Kan, the CFO of China Taisan, at CIMB during lunch yesterday.

1. The 4Q is typically the strongest quarter for the business.

Any investor can then surmise that if this also holds true for 4Q10, then China Taisan’s net profit would be in excess of RMB170.1 million (first 9 months’ earnings) + RMB 60.7 million (assuming 4Q is equal 3Q earnings).

In other words, in excess of RMB230.8 million.

That would be about 4 Singapore cents in earnings per share, taking into account the 125 m shares issued for its TDR in 4Q.

With that, it looks like Taisan (yesterday's closing price of 18.5 cents) is trading at a PE of about 4.6X last year’s estimated earnings.

Compared to its Net Asset Value, Taisan stock trades at slightly below its Net Asset Value of 99.96 RMB cents, or about 19.6 Singapore cents.

2. Taisan will propose a dividend next month along with its full-year results.

For FY08 and FY09, subsequent to its IPO in 2008, Taisan had paid out 30% of its net profit as dividend, becoming a rarity of sorts among S-chips which tend not to declare dividends. Taisan paid out 3.45 RMB cents and 8.15 RMB cents for FY 08 and FY 09, respectively.

Whether Taisan will maintain the 30% payout for FY10 is unclear since the company needs to fund its expansion plan. If the dividend is unchanged in absolute terms from last year's, that would translate into a yield of about 3.7%.

Taisan has said it would spend RMB211 m in the 1H of this year to expand the production capacity of its existing factory. It is utilizing its TDR proceeds to build a new factory which is targeted for completion in 2012 and could cost around RMB350 m.

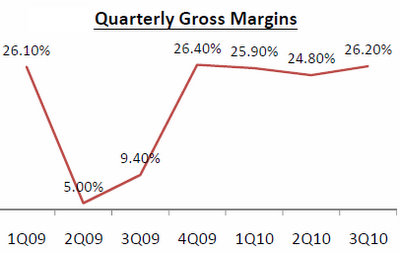

3. The RMB200 m capacity expansion in 1H this year is in response to urgent demand.

Throughout 2010, the factory utilization rate has been above 80%, said Patrick.

“It’s not for nothing that we want to expand capacity now,” he said. “Our order book is very good. There is a need for us to quickly ramp up our capacity. The feedback from customers is very good and they want us to supply to them.”

4. Taisan has lots of cash – and the business had positive operating cashflow.

As at end-Sept 2010, it had RMB476.4 million (S$93.4 million) net cash. Its TDR listing raised another S$31.9 million in gross proceeds.

Its operating cashflow for 9M10 was RMB109.8 million.

Recent story: TEXTILE S-CHIPS' earnings rebound but stocks like Taisan and Gaoxian still undervalued