The Malaysian-headquartered group derived 80% of its net profit in FY09 from its diaries division, which mainly manufactures and distributes milk products – chiefly, sweetened condensed milk and evaporated milk.

The products are sold to clients ranging from hypermarts to restaurants to the humble mamak stalls in Malaysia.

They are also exported to over 50 countries, including ASEAN, North and Central Asia, Middle East, Asia Pacific region, Central America and the Caribbean, and Africa.

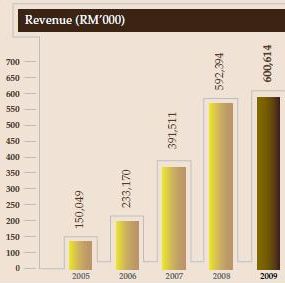

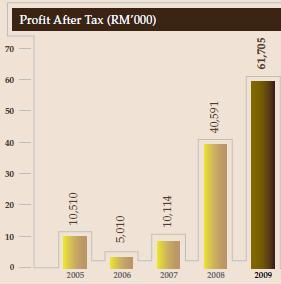

Patient investors since its 2004 listing on the Sesdaq board of the Singapore Exchange would have reaped the benefits of a long-term uptrend in its performance from FY05 to FY09:

* Revenue is up 300% to RM600.6m.

* Net profit is up 495% to RM61.7 m

* Earnings per share is up 245% to 24.5 sen.

* Dividend per share is up 666.7% to 6.9 sen.

Lacklustre since IPO, Etika’s share performance had been remarkably sizzling only in the past 12 months, soaring from 15.5 cents to close at 70 cents yesterday for a 351% return.

Its market capitalisation is $187 million.

Etika’s deputy chief operating officer, Khor Sin Kok, and CFO, Desmond Thong, was at CIMB-GK yesterday to present the business fundamentals to investors.

A lot of investor interest centred around Etika’s recently-completed acquisition of 100% of a Vietnamese UHT milk producer, Tan Viet Xuan Joint Stock Company, for about USD 9 million.

Etika intends to develop a distribution network for its products in Vietnam and Indo-China.

Etika’s dairy division is expected to maintain its

profit margins and grow its sales volume, said Mr Khor.

It has raised by 30% its production capacity of evaporated milk.

Here are some highlights from the Q&A session:

Q: What were the revenue and profit achieved recently by the Vietnamese company?

Mr Khor: Prior to our takeover, the revenue ranged from USD9-10 m a year. I am afraid we are not allowed to disclose the profit. As a first step, we aim to increase the revenue to USD 1 m a month.

Q: How is the provision for bad debts?

Mr Khor: It is very low because of our good credit control system. In Vietnam, most business transactions are in cash – for the small traders and retail outlets. The hypermarts get one month’s credit.

Q: There does not seem to be any immediate synergy between your existing operation and the Vietnamese acquisition…

Mr Khor: We see synergy because, before being acquired, the Vietnamese company was family-run and limited in financial resources, technical know-how and marketing and distribution expertise. We are well-versed in the milk industry.

For sourcing, we can immediately help by buying raw materials cheaper, provide technical know-how to achieve a better quality product, as well as lower-cost formulation. Right now, their distribution network is limited because of a lack of financial resources. We can extend the network and have better control in logistics and warehousing.

Vietnam is a big market with 86 million people – we see the potential there. We are not limiting ourselves to just dairy products. Later on, there will be other products.

Q: After selling 100%, what will the owners do? Will they still be running the operations?

Mr Khor: We understand that they intend to migrate out of the country.

Q: How many people are being retained to run the company?

Mr Desmond Thong: Except for the 3 vendors in the sale of the company, the rest – the managers - continue to work for the company.

NRA Capital analyst Angelia Phua issued a report on Etika on 20 May. Excerpt: "We value Etika at S$1.51(S$1.23 previously). Maintaining our 50% discount to valuation, we arrive at a target price of S$0.88 (previously S$0.615), implying an undemanding PER of 7.6x (FY9/10) and 6.4x (FY9/11) and a upside of about 22%.Further, investors will reap a dividend yield of about 5%. Maintain BUY."

Our recent coverage of another CIMB-GK seminar: CHEUNG WOH TECH: 'Momentum strong, no impact from Greek crisis'

Stock Price

AEM Holdings (AWX) 2.360 0.000 (0.00%) Best World (CGN) 2.450 0.000 (0.00%) Boustead Singapore (F9D) 0.955 0.000 (0.00%) Broadway Ind (B69) 0.126 0.000 (0.00%) China Aviation Oil (S) (G92) 0.930 0.000 (0.00%) China Sunsine (QES) 0.415 0.000 (0.00%) ComfortDelGro (C52) 1.490 0.000 (0.00%) Delfi Limited (P34) 0.910 0.000 (0.00%) Food Empire (F03) 1.280 0.000 (0.00%) Fortress Minerals (OAJ) 0.310 0.000 (0.00%) Geo Energy Res (RE4) 0.305 0.000 (0.00%) Hong Leong Finance (S41) 2.510 0.000 (0.00%) Hongkong Land (USD) (H78) 3.210 0.000 (0.00%) InnoTek (M14) 0.550 0.000 (0.00%) ISDN Holdings (I07) 0.305 0.000 (0.00%) ISOTeam (5WF) 0.044 0.000 (0.00%) IX Biopharma (42C) 0.043 0.000 (0.00%) KSH Holdings (ER0) 0.250 0.000 (0.00%) Leader Env (LS9) 0.050 0.000 (0.00%) Ley Choon (Q0X) 0.049 0.000 (0.00%) Marco Polo Marine (5LY) 0.070 0.000 (0.00%) Mermaid Maritime (DU4) 0.141 0.000 (0.00%) Nordic Group (MR7) 0.315 0.000 (0.00%) Oxley Holdings (5UX) 0.086 0.000 (0.00%) REX International (5WH) 0.132 0.000 (0.00%) Riverstone (AP4) 0.785 0.000 (0.00%) Southern Alliance Mining (QNS) 0.430 0.000 (0.00%) Straco Corp. (S85) 0.485 0.000 (0.00%) Sunpower Group (5GD) 0.205 0.000 (0.00%) The Trendlines (42T) 0.065 0.000 (0.00%) Totm Technologies (42F) 0.022 0.000 (0.00%) Uni-Asia Group (CHJ) 0.820 0.000 (0.00%) Wilmar Intl (F34) 3.230 0.000 (0.00%) Yangzijiang Shipbldg (BS6) 1.760 0.000 (0.00%)