This is Part 2 of a 2-part report. Part 1: ASMPT: Business segments which buoyed 2022 profit after 2021 supercycle year

Below are excerpts from a Q&A session during ASMPT's FY2022 results briefing this week (results announcement here). The answers point to a positive near-term and mid-term outlook for ASMPT in terms of orderbook and gross margins as it navigates the current semiconductor downcycle.

• Gokul Hariharan, JP Morgan analyst:

Are you starting to see any kind of recovery in bookings in the current quarter for the semiconductor solutions -- we have seen the bookings declined substantially over the last several quarters.

Are you seeing some encouraging signs from customers Q1 is likely to be the bottom for the semiconductor solutions business?

And also related to the semi business itself, could you also talk about pricing dynamics?

You saw encouraging pricing dynamics in 2021 during the super cycle. Is any of that getting reversed right now given you've been able to hold your gross margins pretty steady even while bookings and revenues have declined more than 50% from peak levels. |

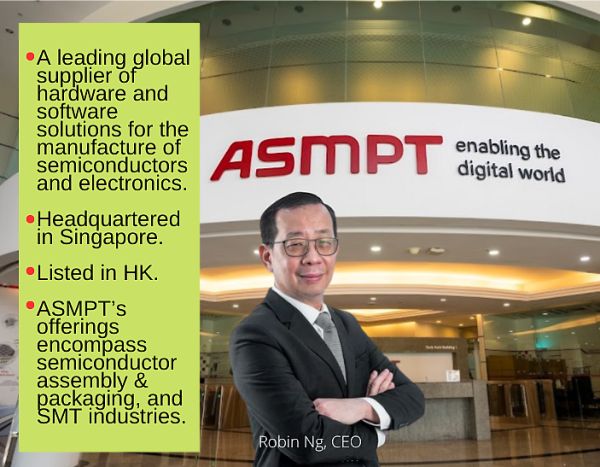

• Robin Ng, CEO, ASMPT:

• Robin Ng, CEO, ASMPT:

We expect group Q-o-Q bookings to increase by maybe 10 to 20%, so Q1 will be higher than Q4 by 10 to 20%.

This is largely in line with seasonality trends where Q1 bookings tend to be higher than Q4.

We see strength still in certain segments like automotive. Likewise I think for industrial segment and advanced packaging.

The whole industry is hopeful that China will start to recover after lifting its COVID-19 restrictions. We do see some pockets of buying interest so far in Q1 from certain China customers -- for high-end smartphone applications and also automotive. But this is not a sign of a broad-based China recovery.

We do a lot of channel checking -- with our customer base -- and also look at how industry watchers or independent research houses look at where the semiconductor industry will go from here.

Feedback from our customers and generally the industry view is that the recovery could begin in the second-half of 2023. And many, many customers of ours who have announced their result also cited that one possible tail wind for this to happen is the positive effect of the Chinese economy from the lifting of the COVID-19 restrictions.

• Katie Xu, CFO, ASMPT:

• Katie Xu, CFO, ASMPT:

As we have communicated in previous quarters, and as you pointed out, we have increased our price during the supercycle year in a very sensible way, in a very targeted way, and so far we have been able to sustain that pricing level.

Now of course it's a competitive market and especially for our orders quoted in U.S. dollars because of the US dollar strengthening last year, we had some headwind on the FX side.

But for equipment sale, pricing is determined by manufacturers, right?

And the customers do consider our solutions, our strong relationship, our leading technology and our after sales services in a combined way. The short answer to your question -- from the gross margin performance you can tell that we have been able to sustain the pricing level.

• Kyna Wong, Credit Suisse analyst:

You mentioned the auto, industrial and advanced packaging momentum continues to stay steady and strong, especially auto. So can we see the gross margin sustain at 40% above level this year? |

• Katie Xu, CFO, ASMPT:

The group delivered another very solid gross margin quarter, making the 7th consecutive quarter of the margin above 40%.

To put this into perspective, in the last downcycle, the group's gross margin level was hovering around 35 to 38%. So, we believe there is a step change.

Now in terms of the sustainability of gross margin, I'd like to look at the drivers of the solid performance, so far. There are three layers:

One is both semi and SMT gross margins have improved year over year.

Second, the product mix -- the auto, industrial and AP momentum -- have contributed. Their revenue has become very sizable compared to the group revenue and margins from those end markets and solutions are relatively accretive to the gross margin of the company.

Also, I want to point out as we were coming into the downturn, the group has reacted quite timely in terms of cost control measures.

The measures include, especially on the SEMI side, the sensible hiring only for very critical positions, flexible workforce reduction, and some prioritization of strategic investment, etc.

All that, we believe, will be sustainable.

Having said that, I want to put a pretty large caveat out there. The group's margin is influenced definitely by volume and also the segment mix between SMT and SEMI and lastly, product mix if the mainstream products rebound in a big way.

I hope I have given you enough color on the gross margin going forward.

(Q&A content has been edited for brevity and clarity)