|

Chief Operating Officer Huang Ban Chin at a Best World product launch in the Philippines attended by about 500 people. Chief Operating Officer Huang Ban Chin at a Best World product launch in the Philippines attended by about 500 people.

Sales in the Philippines soared 608.7% from S$2.6 million in FY2013 to S$18.5 million in FY2014. Photo: Company

6. Challenges: From Best World's experience, when products sell well, copy-cats can be expected to emerge with lower pricing, which will erode its market share.

Historically, various markets have posed specific challenges. In Indonesia, for example, new regulatory criteria were imposed on imported goods during the 2008 global financial crisis, which impeded the import of Best World products.

Compiled by Boon @ Valuebuddies.comIn Indonesia, Malaysia and Vietnam, the depreciation of the local currencies have had significant negative impact on Best World too. Compiled by Boon @ Valuebuddies.comIn Indonesia, Malaysia and Vietnam, the depreciation of the local currencies have had significant negative impact on Best World too.

Going forward, forex fluctuations may have a positive impact. Best World, in its FY2014 results announcement, said: "Strengthening currencies of key markets the Group operates in against the SGD may positively impact the Group’s performance moving forward."

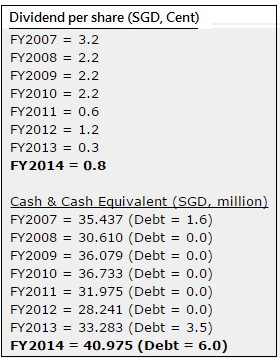

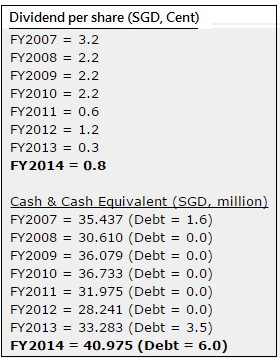

7. Cash: As at end-2014, Best World had S$41 million cash on its books at the group level. Of that, S$3.7 million are held at the company level (ie, the Singapore HQ's account), which means the rest of the cash is in its overseas subsidiaries which are required by local law to place deposits or have a minimum paid-up capital.

Best World had positive operating cashflow to the tune of S$11.1 million in FY2014, up from S$712,000 in FY2013.

8. Dividends: Best World has a dividend policy of paying a minimum of 30% of its earnings. For FY2014, the payout comprises a 0.3 cent interim dividend and a proposed 0.5 cent a share final dividend.

|

Some indications on how its products can be easily copied.