VALUATION

In my previous article about Avi-Tech, I estimated that the liquidation value to be about S$0.094 per share. Using the same method, the new liquidation value should be S$0.099. I continue to believe that this is the minimum valuation that should be afforded to the company, especially considering that the continued improvement in business operations should provide further support to its intrinsic worth. This new valuation excludes the proceeds that Avi-Tech could receive in the future from the disposal of its subsidiaries.

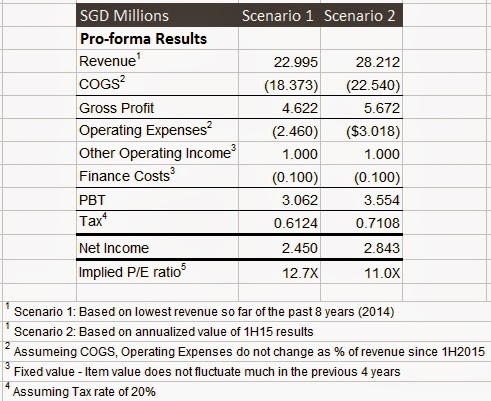

Another reasonable way of checking the valuation would be the use of pro-forma statements as shown above. The main assumption here is that management is able to continue to keep Cost of Sales and Operating Expenses at 79.9% and 10.7% of revenue, as per 1H15 results. Finance costs and Operating income have been pretty stable over the years and should not venture too far away from $0.100M and $1M respectively.

From Scenario 1, if we were to assume that revenue reverts back to its worst level seen so far in 2014 (for eg, if semi-conductor industry as a whole declines and affect sales badly), the implied P/E ratio at current price of S$0.091 is 12.7x. Do note that 2014 net earnings is negative. This difference is mainly due to management's cost cutting and productivity measures that I had highlighted above - which further shows the importance of such management actions. If we were to annualize the 1H15 results such that the revenue will at least maintain current levels (as in Scenario 2), the implied P/E becomes 11.0x.

These valuations ain't that demanding at all. Of course, the P/E based on my purchase price would have been much lower at 9.8x and 8.4x respectively. (I did not include Scenario 3, which is for those who feel the improvement in the industry as a whole will contribute further to sales growth. If this does happen, valuations will obviously be more attractive.)

|

CONCLUSION It seems that Avi-Tech Electronics has finally turned around. Although we can't be sure if these very much improved results can be sustained, we can take comfort that:

2. Share purchases by directors in the past couple of months and the resumption of dividends after >3 years indicate management's confidence about the prospects of the company. 3. Management seems to be actively taking targeted measures to ensure profitability since the company has been placed on the SGX Watchlist. 4. The current market price of the company is not too excessive, both on a liquidation and earnings basis. Having said all these and with the new estimated minimum liquidation value of $0.099 as a guide, I'll probably continue to hold on to my shareholdings until the price exceeds this or if there's any serious deterioration of fundamentals in the company that warrants my attention. Did any of you buy into Avi-Tech? Let me know your opinions! |

Recent story: AVI-TECH is "worth at least 11.7 cents," says CIMB