"Other than earnings, cashflow is an area that companies can manipulate to dress up their financial performance," said forensic accounting expert Jennifer Latz. Photo by Sim Kih

"Other than earnings, cashflow is an area that companies can manipulate to dress up their financial performance," said forensic accounting expert Jennifer Latz. Photo by Sim Kih

This article is republished, with permission, from the latest CFA Singapore quarterly newsletter which is produced by NextInsight.

CFRA is the global leader in forensic accounting research. Its Vice President, Jennifer Latz, was in Singapore in June to share her insights with CFA Singapore members on how companies may boost reported figures of cash flow from operations.

According to Ms Latz, there are four broad categories of cash flow manipulation – fraud, non-GAAP metrics, timing in payment of suppliers, and geographical allocation.

Here are a few examples from the discussion by Ms Latz, of how some companies make their cash flow metrics appear prettier.

Cash Balance Fraud

A fraudulent financial statement is the hardest to spot because one relies on the accuracy of numbers to draw conclusions.

Satyam Computer Services was a case of fraud that unfolded in 2009 when its chairman confessed to manipulating accounts by US$1.47 billion.

Investors wondered why US GAAP financials on Satyam accounts for the year ended March 2007 showed a highly unusual item: negative proceeds from sale of fixed assets. Indian accounting standards on the same showed positive proceeds.

It turned out that its senior management prepared materially false bank statements from fiscal year 2003 through September 2008.

During the 2008 Satyam audit, external auditors received conflicting information from two different branches of an Indian bank – one showed the presence of cash balances of US$176 million, another showed zero.

Unfortunately, the external auditors failed to make direct contact with the banks, choosing to rely exclusively on information provided by the Satyam management.

An investor can fall back on a couple of questions when examining company accounts:

- Is this really cash that is related to customers, suppliers or employees?

- Is the increase in cash flow from operations sustainable?

Faking Revenue Quality

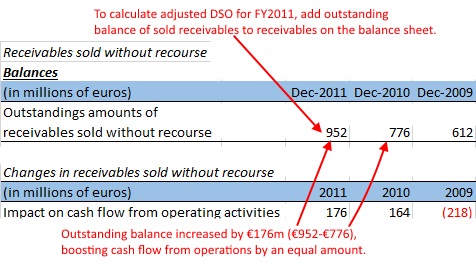

Factoring is a big thing for Asian companies that want to improve the appearance of their cash flow metrics. A business can sell business receivables to a financial institution (a factor) at a discount to the outstanding amount stated on the invoice. The debtor would then direct his payment to the new owner of the invoice.

That are two types of factoring: The first is when the invoice ownership is transferred with recourse, giving the factor (purchaser of the receivables) the right to collect the unpaid invoice amount from the transferor (seller) in event of account debtor default. The second is when the invoice ownership is transferred without recourse, which means the factor must bear the loss if the account debtor does not pay the invoice amount.

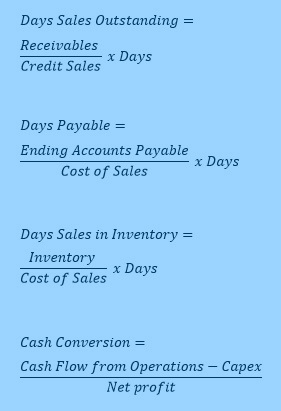

High quality revenue is marked by predictability, profitability and diversity. The factoring of receivables without recourse can mask revenue growth that ends up with uncollectible receivables. Huge increases in factored receivables will decrease the Days Sales Outstanding (DSO), giving the appearance that the company collects quickly on its credit sales. A low DSO can be due to the derecognition of receivables.

High quality revenue is marked by predictability, profitability and diversity. The factoring of receivables without recourse can mask revenue growth that ends up with uncollectible receivables. Huge increases in factored receivables will decrease the Days Sales Outstanding (DSO), giving the appearance that the company collects quickly on its credit sales. A low DSO can be due to the derecognition of receivables.

Factoring will also provide an early boost to Cash flow from Operations because of earlier cash inflow (from the factor), when there was actually a haircut to the receivables.

Faking Cash Conversion Rate

Here is an example of a company meeting a steep cash conversion target by not paying suppliers.

Elekta, the leading provider of radiotherapy equipment for treatment of cancer and brain disorders, had steep targets for revenue growth and cash conversion.

Cash conversion was 44% during 9MFY2013 versus a full-year target of 70%. During 4QFY2013, it grew revenues by 20% and raised full-year cash conversion to 76%, thereby achieving both full year targets.

However, the time it took to pay suppliers increased to an all-time high (Days Payable was close to 60 days). This was not matched by an increase in inventory. Days Sales of Inventory declined year-on-year.

Typically, when a manufacuring or distribution company is in its growth phase and its payables increase, it is important to check the payables increase against the inventory trend.

If a company discloses the amount of receivables it has factored (as in the case of Alcatel Lucent above), an analyst can adjust the DSO by adding the outstanding balance of sold receivables to the receivables on the balance sheet. If the company does not disclose factored receivables, its quantum can be inferred by movements in finance/interest expense. When receivables are factored, a discount is effectively ‘paid’ to the buyer and this discount is recorded as a finance cost by the seller. Rising finance costs may highlight higher factoring levels. Chart: CFRA Research

If a company discloses the amount of receivables it has factored (as in the case of Alcatel Lucent above), an analyst can adjust the DSO by adding the outstanding balance of sold receivables to the receivables on the balance sheet. If the company does not disclose factored receivables, its quantum can be inferred by movements in finance/interest expense. When receivables are factored, a discount is effectively ‘paid’ to the buyer and this discount is recorded as a finance cost by the seller. Rising finance costs may highlight higher factoring levels. Chart: CFRA Research

Accounts Payable Financing

Here is an example of how bank financing on accounts payable can boost cash flow from operations.

Sinopharm, a leading PRC pharmaceutical company, had increased its FY2012 borrowings by Rmb 2.2 billion to Rmb 16.1 billion. However, this did not match its cash flow statement, which had the following anomalies.

- Increased borrowings did not increase its cash flow from financing.

- On the other hand, it reported a net use of Rmb 2.7 billion of cash from borrowing activities.

- Trade payables appeared as a Rmb 12.0 billion source of cash.

- Balance of payables increased only Rmb 7.6 billion during the year, even with M&A activity.

It turned out that Sinopharm had an accounts payable financing program with certain banks whereby the bank repaid accounts payables on behalf of the company with an equivalent sum drawn as borrowings. Such a draw-down of borrowings is a non-cash transaction. The Group lowered its reported cash outflow from operations by not paying its supplier directly.

Only when the company repays its borrowings is there financing cash outflow.

“When the bank paid off the payables, there should have been an entry to reduce cash flow from operations that is net off against cash flow from financing,” said Ms Latz.

Sinopharm’s cash flow presentation of this payable financing program enabled it to report positive cash flow from operations in 1HFY2013 and FY2012. Adjustment to account for use of cash for payables would have resulted in negative cash flow from operations.

Exclusion of Interest Paid

Under US GAAP, interest is classified under cash flow from operations. On the other hand, under IFRS, interest may be classified under cashflow from financing. Since cash flow from operations is boosted if a company classifies interest paid as a financing activity, the analyst who is doing peer comparison needs to check that interest is classified in a similar manner.

In the case of food and industrial raw materials trader, Olam, interest and taxes are excluded from Net Operating Cashflow in its investor presentations.

It also presents an adjusted free cashflow figure which is bumped up by readily marketable inventories.

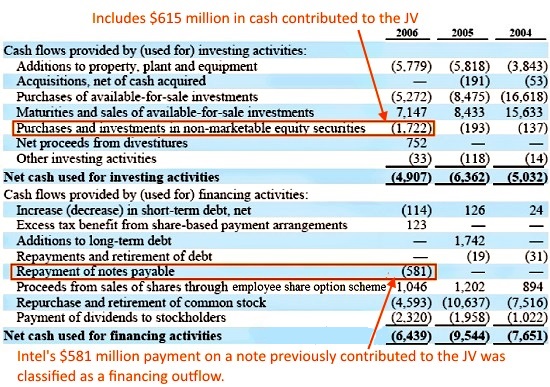

Hiding Capex in a JV Vehicle

By classifying deferred payment for capex as financing, rather than as use of cash in investing, a company can make its capital expenditure look very healthy.

Intel formed a joint venture with Micron in January 2006 to manufacture NAND flash memory products. The JV was IMFT and production began in early 2006.

As part of the initial capital contribution of US$1.2 billion to IMFT, in exchange for a 49% share stake in IMFT, Intel paid US$615 million in cash and issued US$581 million in non-interest bearing notes.

The table below shows that Intel masked US$615 million of capital expenditure as purchases and investments in non-marketable equity securities.

CFRA analysis of Intel's cash flow |

During 2006, Intel paid the entire balance of US$581 million toward the non-interest bearingnotes, and posted it as a financing activity on the consolidated statement of cash flows.

It is important to look at cash flow from capital contribution to JVs. This can be hidden in cash flow from operations. Ask the management:

- “Is the cashflow capital expenditure to fund infrastructure or equipment?”

- “Is it working capital for operations?“

Then, reclassify the financial metrics accordingly.

Capital Leases

The use of capital leases can also make cash flow from investing activities look very healthy and provide an unsustainable boost in cash flow from operations.

Capital leases increase the company’s accounts payables as it needs to make principal payments on the capital investments going forward.