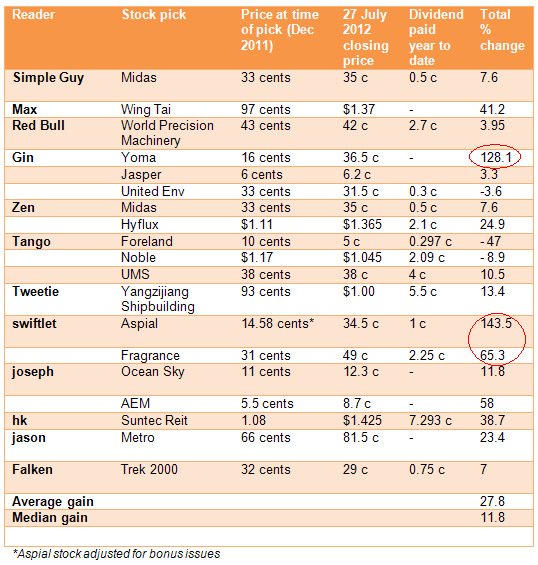

CONGRATS TO a bunch of NextInsight readers! Their stock picks made last December have turned out to be out-performers. (see table above).

They are among the picks of a dozen readers shown in an article Hey brother, what are your best stock ideas?

Their stock picks have gained 27.8% on average, outpacing the 13.3% gain in the Straits Times Index year to date.

There are outliers, though: Fragrance and Aspial on the positive side, and Foreland Fabrictech on the negative side.

The top winner:

> ‘swiftlet’ who picked Aspial Corporation and Fragrance Group, which have since shot to the sky with 144% and 65% gains, respectively.

Aspial has had a great year so far. It has, quite incredibly, announced 2 bonus share issues (each time 1 bonus share for 5 shares held), and spun off its financial services business (Maxi-Cash) on the Catalist.

It also reported a sterling $45.3 million net profit announced in February for FY2011 for the group, up from $4.8 million the year before.

(Maxi-Cash has done well post-IPO, up from listing price of 30 cents to 39 cents currently.)

As for Fragrance, it spun off its hotel arm (Global Premium Hotels) for a separate listing on the stock exchange.

Fragrance owns a 55% stake post-IPO. Global Premium Hotels, which listed at 26 cents, is currently underwater, at 24 cents.

Not too far behind is a stock pick by 'Joseph' -- AEM Holdings, which NRA Capital chairman Kevin Scully is bullish on.

AEM is up 58% or and has a 0.35-c dividend payout coming, which is a 4% yield on its current stock price of 4 cents.

The challenge with understanding this business is it's in some niche technology sector which looks opaque to all but techies.

See: KEVIN SCULLY: Why I am excited about AEM

Previous story: NextInsight readers score 38% gain on average in 1Q, beating STI

Now at 40 cents. Kevin Scully has target price of 58-66 cents conservatively. A stock with upside of about 50%. Not difficult to see why --- just look at the property projects it has sold and the revenue & profits that will be booked.