Uni-Asia shares (19.3 cents) trade at 0.5X price-to-book, trailing PE of 17X and dividend yield of 3.24%.

Uni-Asia shares (19.3 cents) trade at 0.5X price-to-book, trailing PE of 17X and dividend yield of 3.24%.

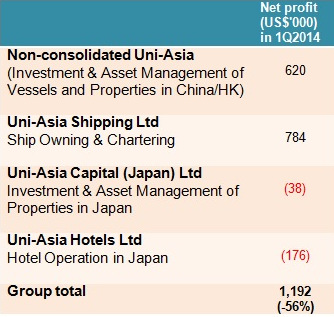

UNI-ASIA HOLDINGS reported a 56% decline in net profit for the recent 1Q to US$1.2 million on a fall in various types of fee income and a non-recurrence of a forex hedging gain of US$1.7 million which was recognised in 1Q2013.

However, at the core, its ship charter income rose 33.6% to US$4.6 million while expenses rose a slower 25.6%.

This business segment, under Uni-Asia Shipping, recorded after-tax profit of US$784,000, compared to US$2.1 million a year earlier.

On the other hand, in another segment, Non-consolidated Uni-Asia, a one-off item was realised in the recent quarter.

This took the form of a US$1.2 million gain in a distressed debt investment which was made after the Asian financial crisis of 1997.

As a result, this segment recorded an after-tax gain of US$620,000 compared to US$467,000 a year earlier.

Simply, one-off fees and other non-recurrent income are part and parcel of the business of Uni-Asia Holdings.

These income streams derive from brokerage commissions, asset management fees and the like for properties and ships. Uni Challenge is one of the dry bulk vessels owned by a joint venture which Uni-Asia Holdings is part of. Photo: http://www.shipspotting.com

Uni Challenge is one of the dry bulk vessels owned by a joint venture which Uni-Asia Holdings is part of. Photo: http://www.shipspotting.com

However, Uni-Asia is building up its recurrent income from ship chartering. This will become more evident as 4 newbuilds ordered since the start of 2013 join its charter fleet -- currently 5 ships -- over the next 24 months or so.

There will be 1 delivery in 3Q this year, 2 next year and 1 in 1Q2016.

All the nine vessels are 100% owned by Uni-Asia Shipping, except for 1 (to be delivered in 2015) which is 51%-owned.

And these are all handysize bulk carriers.

Explaining the choice of this vessel type, Uni-Asia CFO Lim Kai Ching said: "Because of the supply-demand profile, this segment has the most potential when the shipping industry gets better. In addition, such vessels can call at any port in the world." Michio Tanamoto (left) was recently appointed executive chairman and CEO following the retirement of his predecessor. NextInsight file photoExecutive chairman and CEO Michio Tanamoto added that the demand for handysize vessels is stable. Over 30% of the handysize carriers in the market are aged over 20 years and will be demolished soon while the supply is comparatively smaller vis-a-vis the bigger bulk carrier types.

Michio Tanamoto (left) was recently appointed executive chairman and CEO following the retirement of his predecessor. NextInsight file photoExecutive chairman and CEO Michio Tanamoto added that the demand for handysize vessels is stable. Over 30% of the handysize carriers in the market are aged over 20 years and will be demolished soon while the supply is comparatively smaller vis-a-vis the bigger bulk carrier types.

The current market rate for charter of handysize carriers is US$11,000 a day. Operating cost is US$4,000-5,000 a day, excluding depreciation.

Last year, Uni-Asia acquired a 51% stake in a ship mangement company which will be managing several of the new vessels of Uni-Asia, leading to lower expenses and better maintenance of the condition of the ships.

The long-term goal is for Uni-Asia to manage all its ships, including those co-owned with other partners and those owned under shipping funds managed by Uni-Asia, said Mr Tanamoto.

Aside from ships, Uni-Asia is into two other business activities:

Uni-Asia manages 9 hotels in Japan under the brand name Vista. Photo: annual report Uni-Asia manages 9 hotels in Japan under the brand name Vista. Photo: annual report

a) Hotel operations: The number of hotels it operated in Japan dipped to 9 from 11 in 1Q2013, contributing to a US$176,000 loss. b) HK property redevelopment: Uni-Asia is a 13.3% partner in a consortium that won a tender in May this year for a land parcel in Cheung Sha Wan Road for development into an office building by 2017. |

Recent story: UNI-ASIA HOLDINGS: FY13 Profit Up 56%, Ship Charter Income To Rise