For most of its 15-year listing history on the Singapore Exchange, Uni-Asia Holdings operated a mix of businesses that sometimes earned enough to get by, sometimes not.

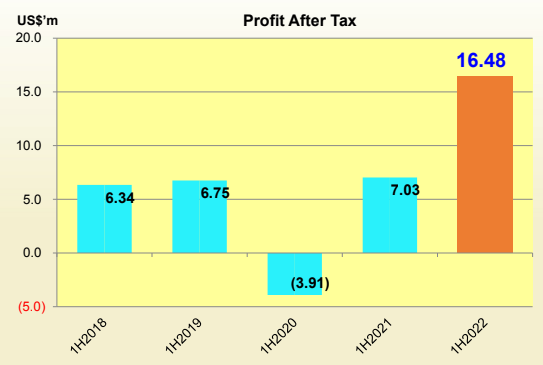

Shipping is by far the main driver of Uni-Asia, with property investments (in Japan and Hong Kong) being a distant second. In 1H this year, Uni-Asia booked revenue and profits like never before. Net profit came in at US$16.5 million, a 134% increase from 1H2021 (chart below):  |

||||||||||||||||||

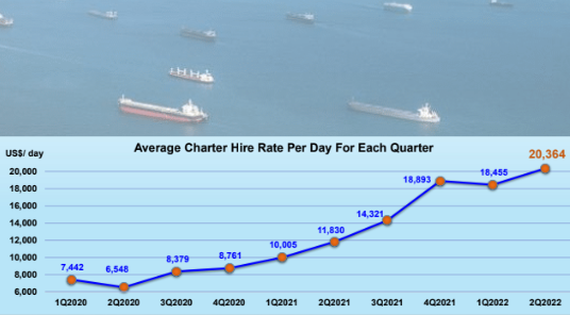

The average quarterly charter rate for its 10 wholly-owned vessels continued to trend up in 2Q2022 (see chart below): Source: Company

Source: Company

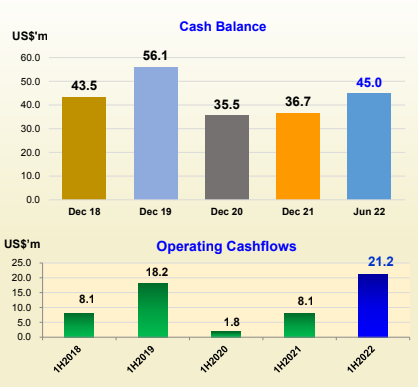

Uni-Asia's cash balance and operating cashflow have been enhanced, giving rise to an opportunity for a nice interim dividend.

Thanks to the high 1H2022 profit, which came close to beating the full-year 2021 profit of US$18 million (which itself was a record), Uni-Asia has declared an interim dividend of 6.5 Singapore cents a share.

This represents a payout ratio of about 22%.

The question now is have charter rates peaked for the Handysize dry bulk carriers that Uni-Asia owns?  Top: Chairman Michio Tanamoto. Bottom: CEO Kenji FukuyadoRates for these vessels, which typically carry commodities such as coal, iron ore, fertilisers and grains, have declined since May 2022.

Top: Chairman Michio Tanamoto. Bottom: CEO Kenji FukuyadoRates for these vessels, which typically carry commodities such as coal, iron ore, fertilisers and grains, have declined since May 2022.

Also weighing on 2H2022 performance will be the fact that 4 of the Group’s 10 wholly-owned dry bulk carriers are scheduled for dry-docking, with a total of around 110 off-hire days, said Uni-Asia.

"As such, the total charter income for 2H2022 may be lower than that of 1H2022 should 2H2022’s charter rates remain at the same level as that for 1H2022."

On the macro picture, Uni-Asia's commentary in its financial statement offers, on balance, a positive outlook. CFO Lim Kai Ching• While global recessionary pressure and the Russia-Ukraine war continue to weigh on demand concerns, disruptions to traditional trade patterns as a result of the Russia-Ukraine war have created new tonne mile demands, such as longer-haul EU coal imports as well as some Atlantic Russian exports moving eastwards. In addition, port congestion continues to provide market support.

CFO Lim Kai Ching• While global recessionary pressure and the Russia-Ukraine war continue to weigh on demand concerns, disruptions to traditional trade patterns as a result of the Russia-Ukraine war have created new tonne mile demands, such as longer-haul EU coal imports as well as some Atlantic Russian exports moving eastwards. In addition, port congestion continues to provide market support.

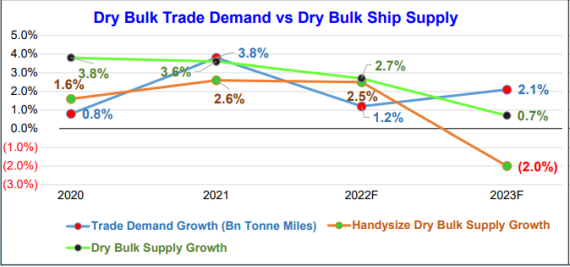

• The orderbooks for new dry bulk vessels have not jumped. There are several reasons for this. The current shipyards’ orderbooks are taken up mainly by containerships fuelled by the boom in container market.

In addition, while the shipping community is making efforts to reduce shipping’s carbon footprint, there is still uncertainty on the most commercially feasible technology to achieve decarbonisation.

With a lead time of 2 to 3 years from order to delivery, many dry bulk ship owners are hesitant to place new orders. Source: Clarksons Research Dry Bulk Trade Outlook July 2022

Source: Clarksons Research Dry Bulk Trade Outlook July 2022

As such, the orderbook in the bulk ship sector now stands at around just 7.2% of fleet capacity, a 30-year low, so dry bulk supply is expected to be low in the coming years.

For Uni-Asia's presentation deck for its 1H2022 performance, click here.