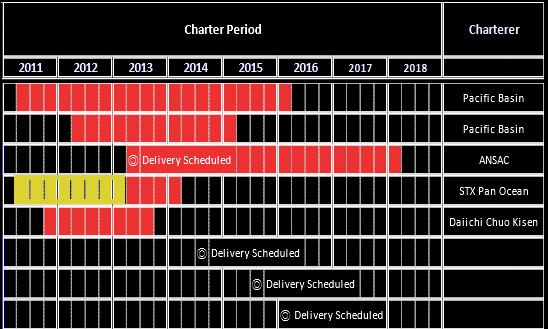

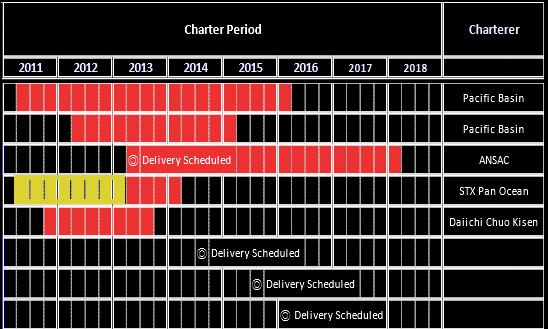

Red bars denote periods of charter for the respective vessel. Yellow bars denote charter period which expired in 1Q this year but has been extended by the charterer, STX Pan Ocean, by another 4 quarters. Source: Uni-Asia Holdings.

Red bars denote periods of charter for the respective vessel. Yellow bars denote charter period which expired in 1Q this year but has been extended by the charterer, STX Pan Ocean, by another 4 quarters. Source: Uni-Asia Holdings.

UNI-ASIA HOLDINGS (previously Uni-Asia Finance Corporation) looks set to reap rising profit from chartering its ships in the quarters ahead.

It has just renewed a charter with STX Pan Ocean for one of its bulkers for the next four quarters, starting from the current 2Q.

CFO Lim Kai Ching and Chief Operating Officer Michio Tanamoto. Company photoThen next month, a bulker will join its fleet of four, heading straight to charterer ANSAC, which has chartered it until 1Q of 2018.

CFO Lim Kai Ching and Chief Operating Officer Michio Tanamoto. Company photoThen next month, a bulker will join its fleet of four, heading straight to charterer ANSAC, which has chartered it until 1Q of 2018.

In the longer-term, from 3Q of next year till 1Q of 2016, three new bulkers will enlarge the Uni-Asia fleet to 8 wholly-/majority-owned vessels, which can transport cargo such as grain, metal ores, phosphate, cement, and logs.

Last month (April), Uni-Asia signed a deal to buy the 3 bulkers for a total of US$73 million from Japanese shipyard Imabari Shipbuilding Group. Uni-Asia expects that buying shipping assets in the current depressed market would result in much higher asset values in the years ahead.

Looking at the above chart, one may be concerned about the upcoming expiry of the charter contract of a bulker in the third quarter of this year.

But CFO Lim Kai Ching said at a 1Q results briefing yesterday (May 22) that negotiations are being carried out. In fact, there is no problem getting a charterer, he said, adding that it is just the charter rates that needed to be finalised.

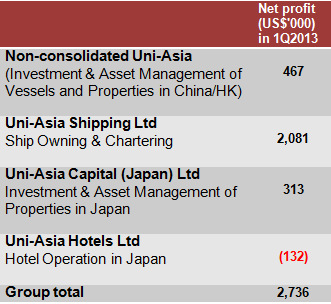

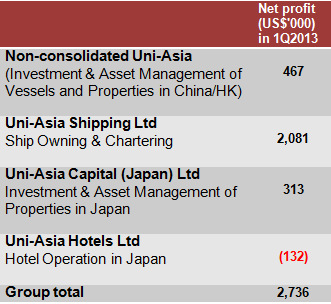

In 1Q2013, the ship fleet of Uni-Asia reported net profit of US$2.1 million on turnover of US$5.2 million which included realised gains of US$1.7 million from hedging of the yen against the USD before the yen began its recent rapid descent.

The significance of this business segment to the group is reflected in the fact that it contributed the majority (76%) of the group net profit which totalled US$2.7 million (see table on the right).

The significance of this business segment to the group is reflected in the fact that it contributed the majority (76%) of the group net profit which totalled US$2.7 million (see table on the right).

Mr Lim said Uni-Asia aimed to achieve annual net profit after operating expenses and finance costs of US$800,000 - US$1 million per ship.

This is derived from US$10,000 a day in charter income per vessel, translating into US$4 million a year.

Then deduct operating expenses and finance costs estimated at 75% of the charter income. Result: Roughly US$1 million a year in net profit.

The company's target is to expand the fleet to 10 vessels over the next two-three years to attain net profit of US$8-10 million from the fleet, he said.

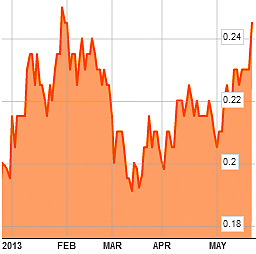

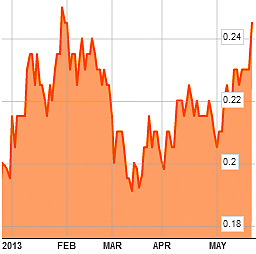

Uni-Asia stock traded recently at 24.5 cents, price/book of 0.66X, trailing PE of 15X, and a market cap of S$115 million. Chart: BloombergThere will continue to be revenue from other ship-related business, including:

Uni-Asia stock traded recently at 24.5 cents, price/book of 0.66X, trailing PE of 15X, and a market cap of S$115 million. Chart: BloombergThere will continue to be revenue from other ship-related business, including:

* Ship investments: Uni-Asia Finance is also invested in 6 vessels through its 35% stake in a ship investment fund -- the Akebono Fund, set up in 2007, through which Uni-Asia Finance as the fund manager and the fund itself enjoy tax benefits in Singapore under the Maritime Finance Incentive. In addition, Uni-Asia has invested with other investors in 5 other vessels.

* Fee income: Uni-Asia earns fees from services it renders to the Akebono Fund and is co-investments, such as managing vessels, brokering buy-sell transactions, and arranging ship financing for third parties.

Uni-Asia has several other business segments that deal with property and hotels. To find out more, read our previous article: UNI-ASIA FINANCE: Stock for recovery in ship charter rates & asset values

For the PowerPoint slides used in the 1Q results briefing, visit the SGX website.

Red bars denote periods of charter for the respective vessel. Yellow bars denote charter period which expired in 1Q this year but has been extended by the charterer, STX Pan Ocean, by another 4 quarters. Source: Uni-Asia Holdings.

Red bars denote periods of charter for the respective vessel. Yellow bars denote charter period which expired in 1Q this year but has been extended by the charterer, STX Pan Ocean, by another 4 quarters. Source: Uni-Asia Holdings. CFO Lim Kai Ching and Chief Operating Officer Michio Tanamoto. Company photoThen next month, a bulker will join its fleet of four, heading straight to charterer ANSAC, which has chartered it until 1Q of 2018.

CFO Lim Kai Ching and Chief Operating Officer Michio Tanamoto. Company photoThen next month, a bulker will join its fleet of four, heading straight to charterer ANSAC, which has chartered it until 1Q of 2018. The significance of this business segment to the group is reflected in the fact that it contributed the majority (76%) of the group net profit which totalled US$2.7 million (see table on the right).

The significance of this business segment to the group is reflected in the fact that it contributed the majority (76%) of the group net profit which totalled US$2.7 million (see table on the right). Uni-Asia stock traded recently at 24.5 cents, price/book of 0.66X, trailing PE of 15X, and a market cap of S$115 million. Chart: BloombergThere will continue to be revenue from other ship-related business, including:

Uni-Asia stock traded recently at 24.5 cents, price/book of 0.66X, trailing PE of 15X, and a market cap of S$115 million. Chart: BloombergThere will continue to be revenue from other ship-related business, including: NextInsight

a hub for serious investors

NextInsight

a hub for serious investors