CHIP ENG SENG's Q3 gross profit of $93.3 m came from Belvia (lump sum) plus 9 Residences and Junction 9 and sale of remainder units (no mention of Fulcrum).

This is a pretty big figure, but as no breakdown was given, I can’t tell exactly where it came from. However, my gross profit estimate for Belvia was only $52.8m. That leaves $40.5m for the rest (including construction), which is highly unlikely.

In other words, I probably underestimated profit for Belvia, which is good.

Sited next to the IKEA store in Alexandra Road, Chip Eng Seng's hotel-cum-retail mall project called Alexandra Central is nearing completion. NextInsight file photo.Q3 share of profit from associates amounted to $7.9m, which came from remaining share of profit from Belysa. This brings total share of profit from Belysa to about $16.4m (Q2 $8.5m) which is very close to my own estimate of $16.2m.

Sited next to the IKEA store in Alexandra Road, Chip Eng Seng's hotel-cum-retail mall project called Alexandra Central is nearing completion. NextInsight file photo.Q3 share of profit from associates amounted to $7.9m, which came from remaining share of profit from Belysa. This brings total share of profit from Belysa to about $16.4m (Q2 $8.5m) which is very close to my own estimate of $16.2m.There are some paper losses due to weakening Aussie dollar. This forex risk is to be expected as the co ventures overseas. Not a big concern.

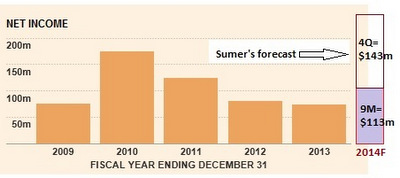

9M earnings is now $113.1m or EPS of 17.7 ct. NAV surged to nearly 91ct.

My forecast for Q4: gross profit from Alexandra Central could come in at $145m, and another $15m perhaps from other projects/construction. Total: $160m.

Net profit (assuming 17% tax rate) would be about $133m or EPS of 20.5ct.

Historical figures for Chip Eng Seng are from FT.comFull year net earnings will therefore hit $246m or 38.2ct, giving the stock a PE of 2.3X. NAV should rise to above $1.10.

Historical figures for Chip Eng Seng are from FT.comFull year net earnings will therefore hit $246m or 38.2ct, giving the stock a PE of 2.3X. NAV should rise to above $1.10.Meanwhile, I have seen an ad for a project manager for its Melaka land. Final approval for this land purchase, however, has not been received.

Recent story: CHIP ENG SENG -- Strong share buyback ahead of FY14 bumper earnings