Who knows, the chicken in the chicken rice meal you are consuming may have orginated from Bintan, Indonesia, thanks to Singapore-listed Japfa. Japfa operates a chicken farm in Bintan, among other places. In May 2023, Japfa was the source of the first shipment of 23,000 live broiler chickens from Indonesia to Singapore. Japfa operates a chicken farm in Bintan, among other places. In May 2023, Japfa was the source of the first shipment of 23,000 live broiler chickens from Indonesia to Singapore. Prior to that, Malaysia was the sole supplier of such chickens. Malaysia's temporary ban on such exports led to Singapore seeking an alternative source -- and who else but Singapore-headquarted Japfa (market cap: S$448 million) stepped up to the challenge and met the stringent criteria. |

While Japfa-supplied chickens bring a smile to consumers, investors may like what they read in a recent article on the SGX website.

In an interview with Japfa, a question raised was: Why should investors take a closer look at Japfa?

Japfa's answer was as follows:

| ▪ Agriculture and livestock production are vital sectors that touch people’s lives and other industries. In the countries where we operate, protein consumption is still low, and undernourishment remains an issue. For example, in Indonesia the level of stunting is still at 21.6% in 2022 despite a decrease from 24.4% in 20211. We believe that demand for protein will continue to grow on the back of rising affluence of middle- and lower-income consumer groups as well as growing urbanisation. ▪ Although the short-term performance in the agri-food sector may be volatile, we believe that growth opportunities for Japfa remain strong based on the Group’s strength in staple proteins and prospects for protein consumption in our key markets. By investing in Japfa, investors can also contribute towards food security in Asia. ▪ Based on the share price at S$0.22 (as at 16 Nov 2023), Japfa’s market capitalisation is around S$450 million. Its subsidiary PT Japfa Tbk, which is listed on IDX, is trading at IDR1,220 per share. Taking into consideration Japfa’s 55.4% shareholding in PT Japfa Tbk (as at 31 Dec 2022), the attributable value to Japfa is about S$660 million, not including its businesses in Vietnam, Myanmar, India and Bangladesh. |

The third and last point is worth highlighting.

Operationally, Japfa's loss-making 1H2023 was impacted by rising input prices, but it turned around decisively in 3Q2023.

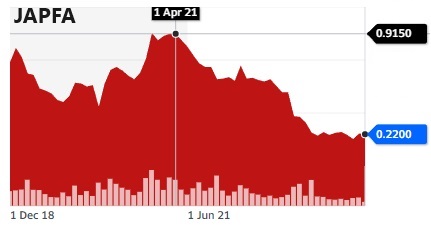

"In 3Q2023, there was a clear trend reversal in profitability," says the company's press release.  Will Japfa stock re-rate on strong 3Q results? Chart: Yahoo!"As a result, in 3Q2023 alone, the Group operating profit stood at US$101.8 million, with a solid contribution from feed, which remains a strong pillar of profitability, and higher selling prices of poultry in Indonesia and swine in Vietnam."

Will Japfa stock re-rate on strong 3Q results? Chart: Yahoo!"As a result, in 3Q2023 alone, the Group operating profit stood at US$101.8 million, with a solid contribution from feed, which remains a strong pillar of profitability, and higher selling prices of poultry in Indonesia and swine in Vietnam."

|

JAPFA |

|

|

Share price: |

Target: |

The operating profit is before finance costs, tax, forex, etc.

As the market is slow to re-rate the stock, Japfa has been happy to buy back its stock on a regular basis, albeit in small quantities.

CGS-CIMB, in a note on 2 Nov, set a target price of 28 cents, expecting Japfa's 4Q to be only slightly less profitable than 3Q.