| • The oh-so-good peak pandemic profits are definitely over for glove producers like Singapore-listed Riverstone Holdings. • Not only has demand for healthcare gloves normalised but supply has gone up with the emergence of Chinese producers during the pandemic. Trouble is, the Chinese players are willing to accept razor-thin margins -- or even no profits just to keep the machinery running. • What's to like about Riverstone then? Profits are decent with RM93.6 million (S$27.6m) in 1H2023. It's the dividends that keep investors holding the stock.

• Aside from a high payout ratio for dividends, and unlike its peers, Riverstone has a resilient business producing high-margin cleanroom gloves -- ie, gloves meant for use in cleanrooms in the electronics sector. Sure, it has not been spared some impact from the downturn in the semiconductor cycle but Riverstone is confident of a recovery in 2024. For CGS-CIMB's report on the 1H2023 performance of Riverstone, read on .... |

||||||||

Riverstone generated net operating cash flow of RM138.8 million in 1H2023 -- which is significant even though it's 42% lower y-o-y.

Riverstone generated net operating cash flow of RM138.8 million in 1H2023 -- which is significant even though it's 42% lower y-o-y.

Excerpts from CGS-CIMB report

Analyst: Ong Khang Chuen, CFA

| 2Q23: Stable performance |

● 2Q23 net profit of RM47m (flat qoq, -53% yoy) was in line with expectations, with 1H23 net profit forming 52% of our full-year forecast.

|

Riverstone |

|

|

Share price: |

Target: |

Interim DPS of 5 sen represents a 79% dividend payout ratio.

● Revenue was weaker qoq due to lower healthcare gloves volume, but GPM improved, helped by better product mix given

1) higher demand for its customised healthcare glove products,

2) favourable FX trends (from weaker ringgit), and

3) lower raw material costs.

| Focusing on customised gloves to navigate pricing competition |

● RSTON said that as selling prices for generic healthcare gloves remain depressed amid intense industry competition, it has pivoted its focus to grow the orders of higher-priced customised gloves, which are usually in smaller order volumes and require nimble manufacturing capabilities.

Depending on customer specifications, RSTON can charge a price premium of between 20% to 10-fold that of generic glove products.

● In 2Q23, customised gloves accounted for c.30% of RSTON’s healthcare segment volume, and management aims to further improve its sales mix in 2H23F.

| RSTON hopeful for a better FY24F for cleanroom segment. |

● RSTON said it cleanroom sales volume was largely stable qoq in 2Q23 as new customer wins offset the lower volume offtake by existing customers.

RSTON expects sales volumes and selling prices (c.US$95/carton) to remain steady in 2H23F, and it sees indications of better volume recovery in early-2024F.

| RSTON said its cleanroom sales volume was largely stable qoq in 2Q23 as new customer wins offset the lower volume offtake by existing customers. |

● RSTON sees room to further penetrate into the corrosion-resistant and lower-end segment (e.g. Class 1000 gloves) of cleanroom gloves via expansion of product offerings.

This will be enabled by the capacity expansion (specialised dipping lines for cleanroom gloves) that RSTON is currently undertaking at its Taiping plant which management expects to commence operations by mid-2024F.

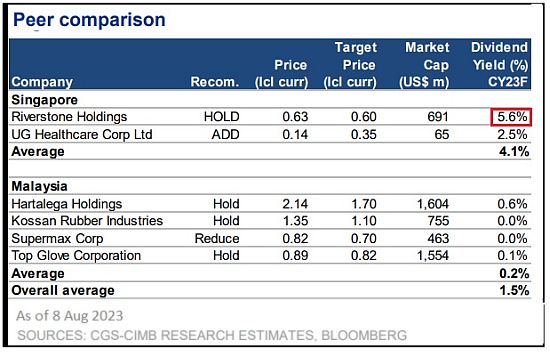

● Reiterate Hold. While we see signs that the glove industry is bottoming, the pace of the sector’s recovery remains uncertain given the intense competitive pressure from Chinese glovemakers. |

Full report here.