Rex International Holdings Ltd (REXI SP): Upside bias for oil prices

- BUY Entry – 0.39 Target – 0.50 Stop Loss – 0.35

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Joining the big guys. The company announced on 26 Jan 2022 that it has obtained approval-in-principle from SGX for the transfer of listing from the Catalist Board to the Mainboard. The board believes that the Mainboard Listing would provide the company with a wider platform to reach out to a larger investor base. This could potentially facilitate greater access to equity and debt markets, if applicable, to maximise the group’s growth potential.

- Geopolitical risks are a boost to oil prices. Both Brent and WTI rose around 3% last Friday to US$94.44 and US$93.10 respectively, closing at their highest levels since Sep 2014, after a senior White House official warned that Russia could invade Ukraine very soon.

Even without the prospect of war, oil supply challenges among exporting countries still threaten to increase the tightness in oil markets and may continue to push prices higher, according to the International Energy Agency.

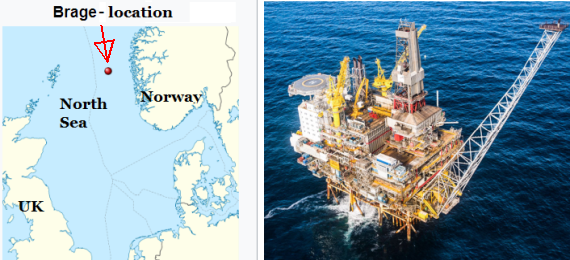

Earnings watch. Rex is due to report its full year results on Friday, 25 February 2022. This set of earnings will be closely watched as it will include contributions from the Brage Field in Norway that Rex acquired in 2021