Yongmao is making a comeback in Australia, where its cranes are being used to build the Sunshine Coast Public University Hospital. Photo: Company

Yongmao is making a comeback in Australia, where its cranes are being used to build the Sunshine Coast Public University Hospital. Photo: Company

Yongmao is known for its capability in customising high tonnage tower cranes. Above: high tonnage Yongmao luffing crane. NextInsight file photo

Yongmao is known for its capability in customising high tonnage tower cranes. Above: high tonnage Yongmao luffing crane. NextInsight file photoYONGMAO HOLDINGS is foraying into Taiwan, and revisiting its market presence in Australia and North America, where construction activity is booming.

These pockets of growth outside its main market, China, have mitigated the impact of a PRC property slump on its earnings: FY2015 gross profit was down 1.1% year-on-year at Rmb 245.4 million.

The good news is: the Group has proposed a final dividend that is 60% higher compared to the previous year, on the back of net profit growth of 36.6% year-on-year to reach Rmb 77.9 million.

FY2015 net profit was boosted by a fair-value gain of Rmb 12.1 million from the restructuring of its shareholdings in Tat Hong's PRC subsidiaries.

Its proposed 0.6 cent final dividend plus a 0.2 cent special dividend for FY2015, translates into a yield of 5.5% based on a recent stock price of 14.5 cents.

"We understand the importance of dividends to shareholders and want to reward those who have held on to our shares," said executive director and General Manager Sun Tian at a recent meeting with NextInsight.

"We are returning to a focus on export sales, our mainstay before the 2008 global financial crisis," said executive director and general manager Sun Tian. Photo by Leong Chan Teik

"We are returning to a focus on export sales, our mainstay before the 2008 global financial crisis," said executive director and general manager Sun Tian. Photo by Leong Chan TeikThe Group posted a 20.5% growth in FY2015 revenue from Asia outside PRC to reach Rmb 272.8 million, or a third of Group revenue.

"Progress in economic co-operation between China and Taiwan is birthing a new market for PRC cranes in Taiwan," said Mr Sun.

"Cranes in Taiwan are relatively old because there has not been a regulatory limit on their lifespan," he added.

"With the attention on worker safety, there are talks that the government may impose limits on the age of cranes in use, giving rise to replacement demand."

Increased concern over worker and public safety is boosting demand for new tower cranes in Taiwan.

The Taiwanese are showing interest in Yongmao cranes as they are widely used in China and also enjoy a strong reputation in the global market.

Yongmao's cranes can be customised to handle lift loads of ultra high tonnage, and are less pricey compared to those manufactured in developed countries.

The Group is foraying into the Taiwanese market by offering crane rental and maintenance services.

It believes its crane rental presence in Taiwan will eventually translate into crane sales there.

Booming US construction market

In the US, there is strong replacement demand for Yongmao cranes as its economy recovers from recession.

Prior to the global financial crisis in 2008, the Group had sold close to 100 units of cranes to the US.

"Even though rental services generate higher margins, we prefer to focus on manufacturing sales for two reasons. Firstly, we do not wish to jeopardize our relationship with customers which are crane rental companies by openly competing with them. Secondly, working capital requirements for manufacturing cranes is much lower than for the crane rental business," said CFO Yap Soon Yong.

"Even though rental services generate higher margins, we prefer to focus on manufacturing sales for two reasons. Firstly, we do not wish to jeopardize our relationship with customers which are crane rental companies by openly competing with them. Secondly, working capital requirements for manufacturing cranes is much lower than for the crane rental business," said CFO Yap Soon Yong.Photo by Leong Chan Teik

"Following the global financial crisis, the property market tumbled and cranes, with no work for them in the US, were shipped out to other parts of the world," said Mr Sun.

There are currently less than 40 units of Yongmao's cranes left in the US.

"We believe the US economic recovery will renew demand for new Yongmao cranes there," he said.

The American Institute of Architects’ Consensus Construction Forecast projects that spending on non-residential construction is expected to rise 7.7% in every commercial property sector this year.

Separately, Jones Lang LaSalle projected construction growth where replacement costs have become lower than leasing, and where new facilities are needed to support sophisticated logistics strategies.

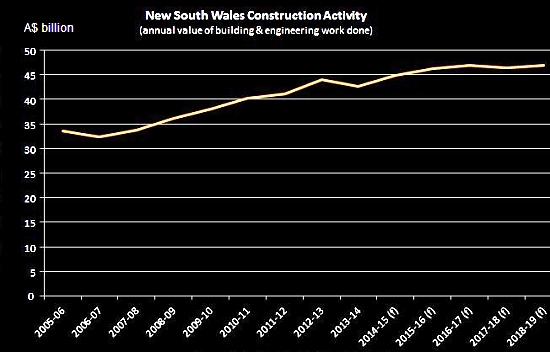

Data from Australian Construction Industry Forum

Data from Australian Construction Industry ForumConstruction output in New South Wales is expected to increase from record levels of A$42.6 billion in 2013/2014 to more than A$46 billion by 2016/2017, according to the Australian Construction Industry Forum.

The Australian government has planned major infrastructure upgrades to transform Western Sydney's economy, including the construction of a second airport in Sydney that will cost about A$4 billion.

The Group recently clinched a S$2.5 million order from Australia.

"Our people have gone into Taiwan, Australia and North America to tap on the demand potential there," said Mr Sun.