Global Logistics Properties' acquisition of one of the largest industrial portfolios in the US follows the lack of construction there in the past 5 years coupled by rapid growth of online retail sales. Above: GLP Soja, Japan. Photo from company

Global Logistics Properties' acquisition of one of the largest industrial portfolios in the US follows the lack of construction there in the past 5 years coupled by rapid growth of online retail sales. Above: GLP Soja, Japan. Photo from companyExcerpts from analysts' report

DBS Vickers analysts: Derek Tan and Mervin Song

Acquires stake in US logistics portfolio

Global Logistics Properties (GLP) announced that it will co-invest with GIC (Singapore Government Investment Corporation) to acquire a US$8.1bn US logistics portfolio from Blackstone. The portfolio consists of 117m sqft of space across 36 major US submarkets.

GIC CIO Lim Chow Kiat, 44, is co-investing the sovereign wealth fund in US industrial real estate with GLP.

GIC CIO Lim Chow Kiat, 44, is co-investing the sovereign wealth fund in US industrial real estate with GLP.Photo from GICPost-acquisition, together with GIC, the group will be the 3rd largest logistics owner in the US (after Prologis and Duke Realty).

GLP plans to own 55% of the syndicate (GLP Income Partners I) at the point of acquisition (1Q15) but intends to pare down to 10% or an equity value of S$330m by Aug’15 as it has received strong indicative interest from other capital partners.

GLP intends to fund the initial stake through cash and short-term liabilities.

Assumption: GLP holds ultimate stake of 10% in GLP US Income Partners I. Chart from companyOperational risk is mitigated by

Assumption: GLP holds ultimate stake of 10% in GLP US Income Partners I. Chart from companyOperational risk is mitigated by

(i) having an experienced management team already onboard to run the business

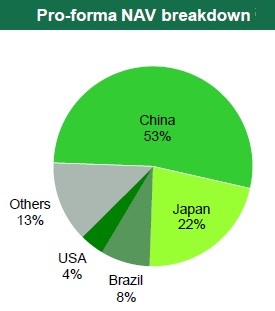

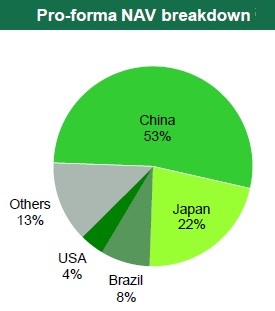

(ii) a final 10% equity stake which minimizes its exposure to c.4% of NAV

(iii) expected positive operational performance from

We remain positive on GLP, driven by its value creation from development projects in China and fee income business.

Our BUY call and target price of S$3.42 are based on parity to RNAV.

Acquisition driven by diversity; uplift in steady returns.

While this investment into the US might be deemed negative on the onset as it represents a departure from the group's focus on its core markets of China, Japan and Brazil.

However, while the US is a relatively new market to the group, we believe that the main driver for this deal is one of diversity as the target portfolio is forecasted to deliver stable returns (c.9% cash yield on the group's 10% stake of US$330m), thus further increasing its recurring income base while its development starts in China/Brazil ramps up over the coming quarters.

Assumption: GLP holds ultimate stake of 10% in GLP US Income Partners I. Chart from companyOperational risk is mitigated by

Assumption: GLP holds ultimate stake of 10% in GLP US Income Partners I. Chart from companyOperational risk is mitigated by(i) having an experienced management team already onboard to run the business

(ii) a final 10% equity stake which minimizes its exposure to c.4% of NAV

(iii) expected positive operational performance from

(a) higher rental reversions as in-place rents are c.7% below market

(b) expected occupancy uplifts from the current c.90% to 95% in the medium term.

(b) expected occupancy uplifts from the current c.90% to 95% in the medium term.

Maintain BUY

Our earnings forecasts are hiked up by c.2% as we price in this acquisition.We remain positive on GLP, driven by its value creation from development projects in China and fee income business.

Our BUY call and target price of S$3.42 are based on parity to RNAV.