|

|

Highlights

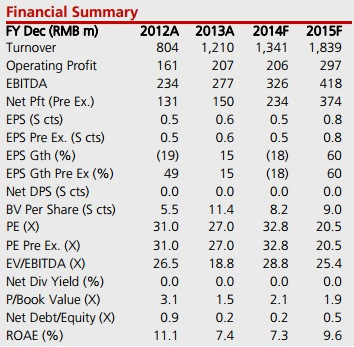

9M14 core profit is 70% of full year forecast

3Q14 net profit grew 75% y-o-y to RM67m although revenue only grew 10% to RMB306m. Stripping out forex gain and one-off disposal gain, core profit was Rmb51m, a shade lower than our Rmb54m estimate. Gross margin fell to 26% from 33% in 2Q13 and 27% in 2Q14, mainly due to lower construction margins for some projects in the quarter.  Source: Company, DBS Bank, Bloomberg Finance L.P.However, net margin improved to 22% from 14% in 3Q13 and 17% in 2Q14 due to much higher interest income (Rmb38m) as a result of late repayment of trade receivables.

Source: Company, DBS Bank, Bloomberg Finance L.P.However, net margin improved to 22% from 14% in 3Q13 and 17% in 2Q14 due to much higher interest income (Rmb38m) as a result of late repayment of trade receivables.

Overall, 9M14 profit grew 31% y-o-y to RMB171m, accounting for 72% of our FY14 estimate. 9M14 EPC revenue beat estimate, but Treatment fell short

YTD EPC revenue of Rmb370m (+62% y-o-y) is close to our full year forecast of Rmb386m despite the proposed sale of the business.

However, Treatment revenue of Rmb568m (+14% y-o-y) is only 56% of our full year forecast, implying lower treatment volume or utilisation rate.

Healthy balance sheet

Net gearing ratio eased to 0.4x from 0.6x in 2Q14 and 1.2x in 3Q13.

Outlook

Tweaked FY14F/15F earnings

SIIC is poised to continue to register positive growth on the back of strong industry dynamics. However, we trimmed FY14F/15F earnings by one percent after pacing out revenue recognition and raising interest income. Maintain BUY rating and S$0.22 TP.

Valuation

We used the sum-of-the-parts method to value SIIC, to capture the different earnings characteristics of the two businesses. Our target price is based on 12x PE for Construction, and 10-Year Discounted Cash Flow valuation for Water Treatment assuming 8% Weighted Average Cost of Capital, zero terminal growth, and flat tariff rates throughout the concession period.

Risks

Accounts receivable risks

Highly sensitive to fluctuations in accounts receivables.

Rising interest rate

Rising borrowing costs would be a risk since 60-65% of project investment costs are debt-funded.

Project delay

Delays in development of projects.