'SunVic Investor' contributed this article after sending an earlier one SUNVIC CHEMICAL: Huge Impact Of Factory Sale On Gearing, Profits, Etc

SUNVIC CHEMICAL caught my attention in January this year after it announced a deal to dispose of its acrylic acid (AA) plant in Taixing, China, for RMB3.9 billion.

SunVic produces fundamental ingredients widely used in the production of many industrial, consumer and agricultural products such as coatings, adhesives, diapers, textiles, detergents and herbicides. Photos: CompanyThe fact that the buyer is a major listed French company gave me some assurance regarding a number of aspects, including the buyer's ability to complete the deal as well as the production capability of the plant.

SunVic produces fundamental ingredients widely used in the production of many industrial, consumer and agricultural products such as coatings, adhesives, diapers, textiles, detergents and herbicides. Photos: CompanyThe fact that the buyer is a major listed French company gave me some assurance regarding a number of aspects, including the buyer's ability to complete the deal as well as the production capability of the plant.

The latter reflects well on SunVic.

Being an S-chip, it has been viewed in the past with varying degrees of sceptism by various investors, including me.

However, SunVic has done something not common among S-chips and, in the process, demonstrated that it could well be a "good" company.

I discovered that for myself in the course of my efforts to decipher this company.

The fact is, when SunVic listed on the SGX in Feb 2007, it had 603,450,641 shares.

SUNVIC CHEMICAL caught my attention in January this year after it announced a deal to dispose of its acrylic acid (AA) plant in Taixing, China, for RMB3.9 billion.

SunVic produces fundamental ingredients widely used in the production of many industrial, consumer and agricultural products such as coatings, adhesives, diapers, textiles, detergents and herbicides. Photos: CompanyThe fact that the buyer is a major listed French company gave me some assurance regarding a number of aspects, including the buyer's ability to complete the deal as well as the production capability of the plant.

SunVic produces fundamental ingredients widely used in the production of many industrial, consumer and agricultural products such as coatings, adhesives, diapers, textiles, detergents and herbicides. Photos: CompanyThe fact that the buyer is a major listed French company gave me some assurance regarding a number of aspects, including the buyer's ability to complete the deal as well as the production capability of the plant.The latter reflects well on SunVic.

Being an S-chip, it has been viewed in the past with varying degrees of sceptism by various investors, including me.

However, SunVic has done something not common among S-chips and, in the process, demonstrated that it could well be a "good" company.

I discovered that for myself in the course of my efforts to decipher this company.

The fact is, when SunVic listed on the SGX in Feb 2007, it had 603,450,641 shares.

On many occasions over the years, SunVic bought back its shares. In aggregate, the purchased quantity was 69,800,000 shares which represented a hefty 11.5% of its post-IPO share capital.

What's more, SunVic cancelled the shares, resulting in an enlarged pie of the company for the rest of the shareholders.

The share cancellation is a significant act because it's unlike many other companies that hold such shares as treasury shares to be issued at a later point when their employees exercise stock options.

The treasury shares also had an alternative use as currency for the companies when acquiring other businesses.

SunVic cancelled the shares -- it did not have any stock option scheme to begin with and it did not carry out M&A activities.

But I have been held back from investing in SunVic by my concern about its rising level of borrowings, which were mainly for the construction of a RMB1-billion plant.

As I wrote in an earlier article, the sale of another factory to the French company, Arkema, will bring in a large cashflow which will wipe out the debt.

.

What's more, SunVic cancelled the shares, resulting in an enlarged pie of the company for the rest of the shareholders.

The share cancellation is a significant act because it's unlike many other companies that hold such shares as treasury shares to be issued at a later point when their employees exercise stock options.

The treasury shares also had an alternative use as currency for the companies when acquiring other businesses.

SunVic cancelled the shares -- it did not have any stock option scheme to begin with and it did not carry out M&A activities.

But I have been held back from investing in SunVic by my concern about its rising level of borrowings, which were mainly for the construction of a RMB1-billion plant.

As I wrote in an earlier article, the sale of another factory to the French company, Arkema, will bring in a large cashflow which will wipe out the debt.

.

|

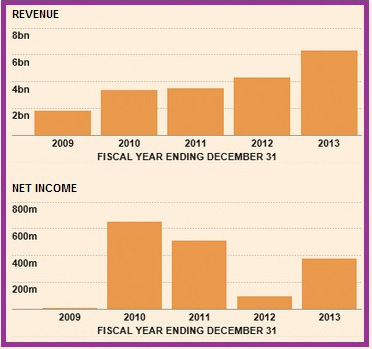

Cyclical industry  2010 profit came from 1 plant (in Yancheng). 2013 profit came from 2 plants (in Yancheng and Taixing) yet the profit was far lower mainly because of low margins. Source: FT.comInvestors thinking of buying shares of SunVic should, however, note the cyclical nature of the business that SunVic is in. 2010 profit came from 1 plant (in Yancheng). 2013 profit came from 2 plants (in Yancheng and Taixing) yet the profit was far lower mainly because of low margins. Source: FT.comInvestors thinking of buying shares of SunVic should, however, note the cyclical nature of the business that SunVic is in.SunVic's profit peaked in 2010 at RMB 650 m, with only one plant at Yancheng producing 228,000 tonnes. Then the average selling price (ASP) was RMB 14,000 per tonne while the gross profit margin (GPM) was a lofty 30%. SunVic paid an ordinary dividend and a special dividend (1 SGD cent a share each for a total of 2 cents per share) for FY2010 -- the third year it declared a dividend since its listing in 2007. Two years later, in 2012, SunVic sold 348,000 tonnes for ASP of RMB 11,400. However, the profit was a mere RMB 97 m. The GPM was 12%. The GPM in 2013 improved to 15%, while profit was RMB 375 m with 512,000 tonnes of AA sold.

SunVic's FY13 financial statement painted an optimistic outlook: "Sales of our main products, AA & AE as well as PMIDA & glyphosate, are expected to remain robust with selling prices staying firm. "Our AA plants have been running at near maximum utilisation for the past year due to long term sales contracts signed with certain major customers. We expect this high utilisation to continue. Our sales and profit margins for AA are secured for the next few years." The business outlook coupled with the Jan 2014 announcement of SunVic's deal to sell its Taixing factory to Arkema have sharply improved my sentiment towards the stock. Its trailing PE is 4.5X on the recent stock price of 63 cents. And its past track record of paying dividends raises hope that it would not be averse to paying a dividend for FY2014 when it is in a position to do so after receiving RMB1.45 billion cash by year-end for selling a 55%-stake in its Taixing plant. |