This is part 2 of an article. Part 1 was: CORDLIFE Makes A Push Into China With Cord-Tissue Banking Service Cordlife is among the pioneers in Asia in offering cord blood banking. Image: CompanyCORDLIFE GROUP was established in Singapore in 2001.

Cordlife is among the pioneers in Asia in offering cord blood banking. Image: CompanyCORDLIFE GROUP was established in Singapore in 2001.

Just a year later, Cordlife assisted in stem cell transplants involving 2 leukemia patients in Singapore.

SingHealth approached Cordlife for assistance in setting up Singapore Cord Blood Bank as the first public cord blood bank not only in Singapore but also the region.

To that end, Cordlife seconded a few of its employees to SCBB.

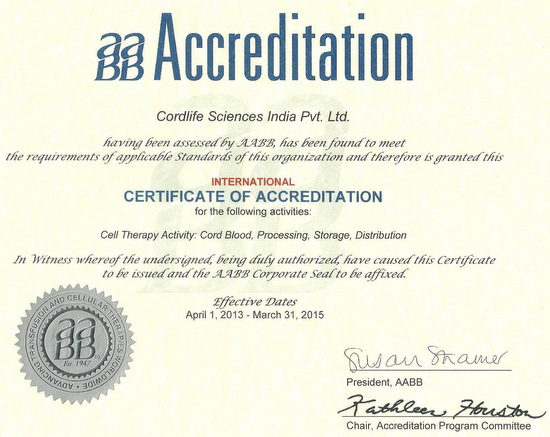

In the meantime, Cordlife was working towards achieving AABB accreditation, the gold standard in private cord blood banking, for its Singapore facility. This was attained in September 2005.

Over the years, Cordlife and SCBB developed their respective operations and in 2012, both formalised a business continuity agreement to back each other up in the processing of umbilical cord.

Given the historical ties and business relationship, Mr Jeremy Yee, CEO of Cordlife, expressed disappointment at a recent turn of events leading to a competitor from India setting up a joint venture in Singapore.

(See: New service provider for cord-blood banking -- ASIAMEDIC / CRYOVIVA JV)

Speaking with NextInsight, he asked: Why didn't SCBB, as a matter of courtesy, inform him of its impending agreement to be the contract lab to process cord blood for Cryoviva Singapore?

Speaking with NextInsight, he asked: Why didn't SCBB, as a matter of courtesy, inform him of its impending agreement to be the contract lab to process cord blood for Cryoviva Singapore?

How can a healthcare business be granted an operating licence even though it outsources its main operating business to a third party?

Will aspiring cord blood banking businesses similarly achieve licences even if they outsource their lab functions to a Health Ministry-licensed facility?

Cordlife has corresponded with the authorities and SCBB and "we are still seeking clarification," said Mr Yee.

The tie-up that SCBB has with Cryoviva Singapore is a commercial one and looks to be a means by which SCBB supports its operations. SCBB is not directly supported by the Health Ministry and has been raising funds from well wishers to fund its operations.

Contributions from well-wishers, corporate or otherwise, are likely to fluctuate.

Is Cordlife fearing the new competition? "We take issue with unfair competition but we can handle competition. In all the countries Cordlife has gone into, it has come from behind," said Mr Yee. Cordlife India at one of its marketing events. Photo: Facebook page of Cordlife India.He recounted the challenges that Cordlife overcame over a period of 3.5 years to secure an operating licence in India in 2009, especially meeting the requirement of setting up its own independent lab and securing a host of licences.

Cordlife India at one of its marketing events. Photo: Facebook page of Cordlife India.He recounted the challenges that Cordlife overcame over a period of 3.5 years to secure an operating licence in India in 2009, especially meeting the requirement of setting up its own independent lab and securing a host of licences.

And he highlighted that Cordlife India's facility in Kolkata is the largest and most advanced of such facilities in India.

Cordlife was the first in India to adopt the fully automated and sterile Sepax processing system for cord blood.

And it had the honour of being officially launched by Singapore Senior Minister and former Prime Minister Mr Goh Chok Tong.

Today, by revenue, Cordlife India has risen to the No.2 spot among about a dozen players in India. The No.1 spot is held by LifeCell.

In its main market of Singapore, Cordlife is No.1, and continues to expand its reach in Asia while adding complementary products to its range of offerings, such as cord tissue banking and metabolic screening. (See: @ CORDLIFE's AGM: Insights Into Its Growth Potential)

This is the latest accreditation for CordLife's operations in India. Once accredited, a facility goes through the accreditation process (on-site assessment phase) every two years.

This is the latest accreditation for CordLife's operations in India. Once accredited, a facility goes through the accreditation process (on-site assessment phase) every two years.

Image: Facebook page of Cordlife India