Derek Goh's purchases between 15 Feb 2013 and 14 March 2013.THIS YEAR is the 25th anniversary of Serial System, an electronic components distributor.

Derek Goh's purchases between 15 Feb 2013 and 14 March 2013.THIS YEAR is the 25th anniversary of Serial System, an electronic components distributor.Having survived some harrowing times and thrived by expanding in Asia, its co-founder, Derek Goh, has reason to be confident of his business.

That helps to explain why he has been a relentless buyer of his company's shares in recent years.

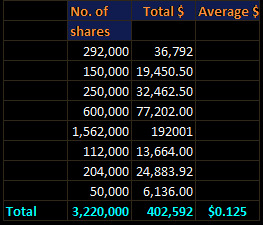

In the past month, he bought 3.22 million shares at an average price of 12.50 cents apiece.

This was after Serial reported that its 2012 net profit fell 29% to S$9.2 million. Serial typically pays 45-50% of its earnings as dividend.

Derek Goh, executive chairman & CEO.

Derek Goh, executive chairman & CEO. NextInsight file photoIt declared a payout of 0.52 cent a share, or a yield of about 4.1%, for 2012.

While Derek now holds a 36.31% stake in the company, its No.2 largest shareholder, Sam Goi, has built up his to 12.48%.

Between June 2012 and Jan 2013, the entrepreneur who is best known to invest in F&B companies bought 16,414,000 shares. Serial System is probably the only listed IT-related company he owns a substantial stake in.

Serial System shares, at 12.3 cents recently, trade at a historical PE ratio of 12X.

For more, read:

SERIAL SYSTEM: Once again, a decent dividend payout

Popiah King Sam Goi builds up stake in SERIAL SYSTEM

DUTY FREE INTERNATIONAL has just announced the completion of a deal to sell its assets in Zon Johor Baru for RM325 million.

Duty Free shares currently trade at around 17X earnings and sports a market cap of S$480 million. Chart: FT.comIt didn't say if it would dole out a special dividend from the sale proceeds, but the company has a track record of paying decent dividends.

Duty Free shares currently trade at around 17X earnings and sports a market cap of S$480 million. Chart: FT.comIt didn't say if it would dole out a special dividend from the sale proceeds, but the company has a track record of paying decent dividends.However, the running yield is just 2.6% after the stock price has gone up about 100% in the past year or so.

An independent director, Chew Soo Lin, has just upped his holding of the company's warrants by 1 million units to 1,110,784 units.

On 11 March, the off-market transaction was done at 10 cents apiece.

The warrants have a long shelf-life, expiring only in January 2016 and have been trading with little or no premium. Their excercise price is 35 cents and has a high gearing of 4X currently.

The buying by Chew Soo Lin looks bullish as the warrants are not entitled to dividends and are worth investing in only if the buyer perceives that they offer meaningful gearing and there is a good chance of the mother share rising in value.

Chew Soo Lin, 63, was appointed an independent director in August 2011, by which time he already owned 1,341,615 shares of Duty Free.

He is executive chairman of Khong Guan Flour Milling, which is listed on the SGX, and trades wheat flour and other edible products.

He made further purchases of 350,000 shares in March 2012, a move that has proved to be astute as those shares have doubled in value to 43 cents recently.

Based on current-year annualised earnings of RM cent 6.43 , Duty Free trades at a PE of about 17X -- which is not exactly cheap.

For more, read: STAMFORD TYRES, DUTY FREE, JEL CORP: Latest happenings.....