Excerpts from this morning's analyst reports

CIMB is negative on residential property sector

Analysts: Donald Chua, Tan Siew Ling and Lee Syn Yi

We retain our negative view on the Singapore residential sector as we continue to see a rising threat of vacancy with an acceleration in physical completions in 2013-15.

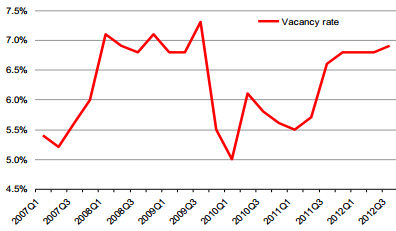

Vacancy rates for non-landed private units had increased from 5.9% to 6.1% qoq in 3Q12 as take-up continued to lag physical completions.

URA estimates that completions will rise from 16.1k units in 2013 to 23.1k units in 2015, 2-3x more than the historical average occupancy rate of 8k units per year.

This will be compounded by impending completion of HDB units following aggressive building in the last three years. Around 83% of local residents still live in HDB flats. Incremental demand should also come under pressure from the Singapore government’s continuous reassessment of its liberal immigration policies.

PR conversions have tapered off, a glimpse of how tighter immigration is taking shape. Rising inventories against normalised population growth do not augur well for future take-up, in our view. While prices remain at record highs on low interest rates, policy risks remain an overhang.

We forecast that physical residential prices will fall by 5% by end-FY13, with vacancy rates for private units up from 6.1% currently to 7.2%. We retain our Underperform view on CityDev and see value in laggards such as Wingtai and Hobee.

Related story: ROXY-PACIFIC: Not adversely affected by new URA rules on shoebox units

UOB Kayhian upgrades Noble Group from sell to hold

(NOBL SP/HOLD/S$1.11/Target: S$1.17)

FY12F PE (x): 17.9

FY13F PE (x): 13.7

Noble has underperformed the FSSTI by 13% (-13.3% vs FSSTI’s 0.3% decline) following the announcement of its 3Q12 results on 8 Nov 12, which were below expectations. We upgrade Noble from SELL to HOLD as the stock has become less expensive when weighed against our valuation of S$1.17.

Screenshot from Bloomberg TV interview

Recent insider transactions could set near-term boundaries. On 15 November, Noble’s vice-chairman Harindarpal Singh Banga sold 225m shares at S$1.10. Following the sale, he ceased to be a substantial shareholder of the group with just a 2.27% stake (previous: 5.74%).

One day later, Chairman Richard Elman and CEO Yusuf Alireza bought shares after the decline in stock price.

Upgrade to HOLD from SELL. Our change in recommendation comes as stock price has declined and stabilised at a more attractive price range.

There is no change to our target price of S$1.17, which is pegged at 1.3x P/B (excluding perpetuals), derived from a dividend discount model (required rate: 9.7%, terminal growth 2.3%).

For Bloomberg TV's interview with Yusuf Alireza, click here.