Excerpts from latest analyst reports...

OCBC Investment Research says MIDAS is just warming up

Analyst: Andy Wong

We maintain our BUY rating on Midas Holdings (Midas) and raise our fair value estimate from S$0.435 to S$0.51 in light of the brighter prospects in China’s railway sector.

The latest data on total railway fixed asset investments (FAI) in China exhibited an encouraging 92.7% YoY surge to CNY72.7b for the month of Sep, which we believe highlights the progressive recovery in the sector.

Another positive development came from the China Ministry of Railways’ (MOR) decision to raise its 2012 railway FAI target from CNY610b to CNY630b, having only previously done so in Sep.

Moving forward, we see further re-rating catalysts for Midas when China’s MOR resumes the re-tendering of new high-speed railway passenger train car contracts in the near future and continued traction gains in Midas’ orders win momentum from the urban rail and power industries.

Hence we ascribe a higher valuation peg of 1x FY13F P/B (previously 0.85x) to Midas in light of the brighter prospects in China’s railway sector.

This still represents a significant 61.1% discount to its average forward P/B since its IPO and is also a 29.2% discount to its 3-year average forward P/B.

Our fair value estimate on Midas is correspondingly increased from S$0.435 to S$0.51. Maintain BUY.

Recent story: Kevin Scully: "Accumulate MIDAS at S$0.40 level and below for earnings recovery in 2013"

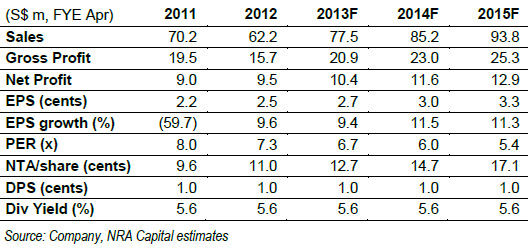

NRA says fair value of XMH is 22 cents, expects sustainable 5-6% dividend yield

Analyst: Joel Ng

We initiate XMH with fair value of S$0.22. This is based on 8x FY13 PER, a 30% discount to its peer average of 11.7x PER.

Given the strong balance sheet, we project the group should to be able to maintain its 1ct dividend payout, which translates to about 5-6% yield.

With a 20% upside potential and reasonable dividend yield, we initiate our coverage with an Overweight recommendation.

Strong balance sheet. The group is currently looking for M&A opportunity to bolster its in-house brands.

With zero debt and cash of S$39m as of FY04/12, we believe this will be sufficient to target a reasonably sized company to grow its business.

Recent story: XMH: 1Q revenue up 78.6% at S$21.9 m, cash level rose to $51 m