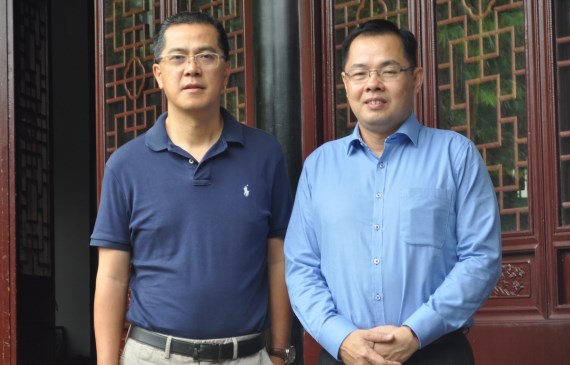

Future projects due for completion or to be launched, will offer better margins and will positively impact our bottom-line earnings as early as 4Q2016. The Group will deliver two major projects – The Suzhou Industrial Park Royal Mansion (Phase 1) and Suzhou Royal Palace (Phase 3) in 4Q2016. These projects are well received by the market, both sold above 90%. In view of the handover of these two projects by year-end, we are confident of achieving profitability for FY2016." Future projects due for completion or to be launched, will offer better margins and will positively impact our bottom-line earnings as early as 4Q2016. The Group will deliver two major projects – The Suzhou Industrial Park Royal Mansion (Phase 1) and Suzhou Royal Palace (Phase 3) in 4Q2016. These projects are well received by the market, both sold above 90%. In view of the handover of these two projects by year-end, we are confident of achieving profitability for FY2016."-- CFO Chua Hwee Song (right, with executive chairman Qian Jianrong). Source: Chiwayland announcement posted on SGX Photo by Leong Chan Teik |

Chiwayland International is confident of achieving profitability for FY2016.

This, despite 1HFY16 experiencing a RMB 54m loss, as compared to a loss of RMB 21m in 1HFY15.

In its powerpoint materials dated 5 Aug, the company made public key data on its property development projects. On closer examination, the data yields an indicative picture of the size of its profits for FY2016.

Note that, for overseas property development projects, Singapore-listed companies can recognise revenue and profits from projects only when they are completed.

Chiwayland has the following three projects which are due for completion in 4Q2016:

| Saleable GFA (sqm) |

Equity stake (%) |

% sold | ASP (RMB/sqm) |

Total cost* (RMB’m) | Launch date | |

| Xuancheng Chiway Top Town (Phase 2) | 28,489 | 100 | >80 | 4,688 | 112.1 | 4Q2014 |

| Suzhou Industrial Park Royal Mansion (Phase 2) | 120,784 | 60 | >90 | 21,002 | 1,818.5 | 4Q2014 |

| Suzhou Royal Palace (Phase 3) | 55,125 | 75 | > 90 | 19,289 | 551.0 | 2Q2015 |

* Land cost and construction cost

To derive an indicative gross profit for, say, Suzhou Royal Palace (phase 3), one can firstly multiply the saleable gross floor areas (GFA) by % sold and average selling price (ASP).

This is the revenue -- about RMB 956.9 million.

Deduct RMB551 million for land cost and construction cost, and you get RMB405.9 million in gross profit.

(This is before financing cost on loans that Chiwayland and its partner took for the project).

Chiwayland holds an equity stake of 75% in that project, so its share of profit is accordingly 75%.

Using the same method of estimating, one derives a gross profit (before financing cost) of RMB464.5 million for Suzhou Industrial Park Royal Mansion (phase 2). Chiwayland holds an equity stake of 60% in that project.

The current profitability of Xuancheng Chiway Top Town (phase 2) is less sparkling. It is just breaking even. (Of course, if the remaining 20% or so of its units get sold eventually in the future, there will be meaningful profits to book).

Adding up the gross profits estimated above for the first two projects, and deducting minority interest, you get a total of roughly RMB582 million (about S$116 million).

This is sizeable -- which will wipe out the 1H2016 net loss of RMB54 million.

Far more interesting is the size of the profit relative to the market cap of Chiwayland of about S$84 million (based on stock price of 12.5 SGD cents).

The company would soon be in a position to pay a dividend. Will it? Time will tell.

Looking to 2017, two out of the three Australian projects due for completion in 2017 are already decently profitable.

But the four China projects under development -- and two newly-launched projects in China -- will need more time to prove they can bring in bountiful profits.

Look out for the company's updates with every quarterly results announcements.

Click on video (2 mins 45 seconds) on our visit to Chiwayland.