US$4.7 billion order book -- that's what Yangzijiang Shipbuilding's main operating subsidiary, New Yangzi Yard, has. It is ranked no.2 in China and no. 6 worldwide as at 31 March 2016. US$4.7 billion order book -- that's what Yangzijiang Shipbuilding's main operating subsidiary, New Yangzi Yard, has. It is ranked no.2 in China and no. 6 worldwide as at 31 March 2016. Photo: Company Yangzijiang Shipbuilding is one of the few shipyards able to secure contracts in a prolonged industry downturn. |

Yangzijiang Shipbuilding has posted a 1QFY2016 revenue decline of 11% year-on-year to RMB 2.7 billion.

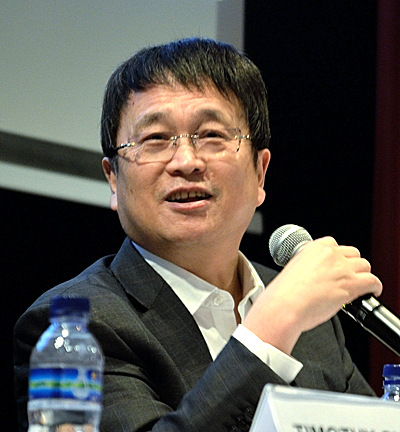

"I faced an uproar from my management team when I refused to accept jack-up rig orders after we secured the first one. If I had accepted them, you will feel like giving me a good thrashing today." - Executive Chairman Ren Yuanlin at Yangzijiang Shipbuilding's AGM on 28 April 2016 |

The Group’s shipbuilding business posted a 13% decline in 1QFY2016 revenue contribution to RMB 2.0 billion even though more vessels were delivered in 1QFY2016 as they were of smaller sizes. It delivered 15 vessels in 1Q2016 compared to 10 in 1QFY2015.

During the quarter, eight shipbuilding orders were terminated --- six 82,000DWT and two 64,000DWT bulk carriers. Construction work has yet to commence on one of these vessels.

Prospective buyers have been found for four of these vessels, and the Group is actively seeking for buyers for the remaining three.

Downpayment on these terminated contracts amount to 10% to 30% of the various contract values, and will be recognized as the Group’s revenue.

For details of the Group's 1QFY2016 results, click here.

At an analyst briefing on Friday, Executive Chairman Ren Yuanlin provided an update on how the Group was handling the industry’s downturn.

| ♦ Q&A session with Mr Ren and CFO Liu Hua | |

|

Q: Please provide details to the vessel terminations. The customers who terminated their vessel orders were mainly US funds. If no such buyers emerge for the 3 orphan vessels that construction has commenced on, our contingency plan is to transfer them to our ship chartering business segment. If we adopt these 3 vessels, they will be booked at construction cost less the down payment monies received from the initial customer.

Q: Please give an update of the jack-up rig on your books.

Q: What price can you fetch for the jack-up rig? An independent valuer has estimated the jack-up rig to be worth Rmb 110 million to Rmb 140 million based on current market prices. Its price depends on oil prices. Our impairment of Rmb 110 million for this asset is a conservative amount.

Q: Will the recent rebound in raw material prices affect the Group's profitability?

Q: What is your strategy for dealing with this weak market?

|