THE SHARE PRICE of Sino Grandness has been reaching new altitudes in the past two months, touching 70 cents yesterday (29 March).

It has been a solid 133% ride up (from 30 cents) since end-Jan 2016. This is sweet reward for shareholders who have kept faith with the company (despite the S-chip stigma) for more than a year during which Sino Grandness was bogged down at cheap valuations (3-4X PE).

Of late, it has cast off the heavy weights secured around it by a (now discredited) short-seller report and by the disturbing uncertainty over its ability to repay its convertible bonds.

The happy ascent started after Sino Grandness called for an EGM in Feb 2016 to garner shareholders' approval to dilute its stake in Garden Fresh during the latter's upcoming IPO. (See: SINO GRANDNESS Soars after EGM notice signals Garden Fresh IPO is around the corner - finally!)

Chart: FT.comThe EGM, held on 23 Feb, signalled that the long-drawn IPO preparatory work -- itself a source of concern for shareholders -- was nearing completion (and not just wayang), and the IPO is for real.

Chart: FT.comThe EGM, held on 23 Feb, signalled that the long-drawn IPO preparatory work -- itself a source of concern for shareholders -- was nearing completion (and not just wayang), and the IPO is for real.

Just a week later, on 1 March, Sino Grandness inked an agreement with bondholders to repay them in cash and Garden Fresh shares.

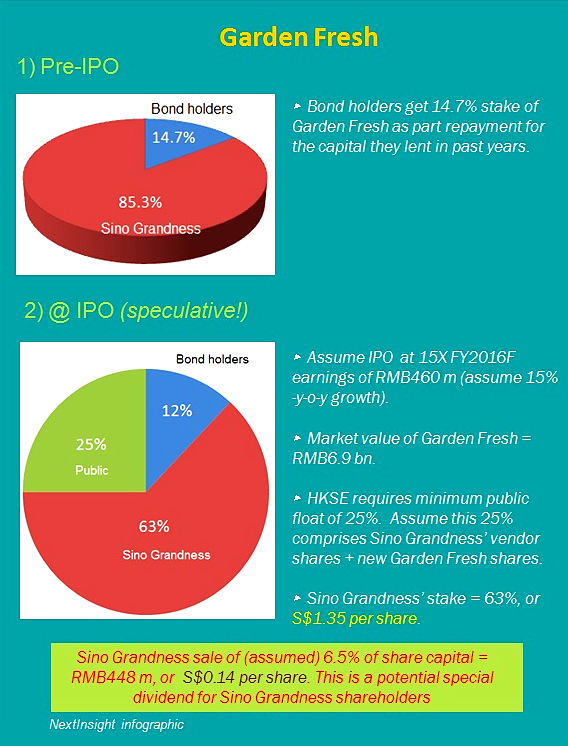

Investors may now ask: What would Garden Fresh be worth at its IPO? And to what extent will Sino Grandness' stake be diluted and what could it be worth?

As the IPO application has yet to be made, not all relevant information has been released by the company for investors to accurately determine the answer.

There's enough though and, using a few educated guesses, we think the following infographic might give you an idea: Notes:

Notes:

1. In its EGM circular, Sino Grandness alluded to a possible sale of its vendor shares amounting to a maximum of 6.5% of the enlarged share capital of Garden Fresh.

2. The median PE for 37 profitable F&B companies on the HK Stock Exchange was 15.7X as of end-Dec 2015. (Source: HKSE)

After spinning off Garden Fresh, Sino Grandness is left with its canned food business -- which has both export and domestic markets.

The business achieved RMB120 m in net profit in 2015. Ascribing a PE of 8X to that business, one gets a valuation of 30 cents per Sino Grandness share.

Thus, Sino Grandness can be said to be potentially worth S$1.35 + 30 cents = $1.65 a share. Then there is also the one-off special dividend of potentially 14 cents a share (as described in the infographic) to put into one's pocket.

All this brain exercise may be akin to counting the chickens before they are hatched -- that is, before the HK Stock Exchange approves the IPO.

In fact, the application for the IPO has yet to be submitted! In due course, probably. Hopefully.

(While waiting for further developments, you may wish to read SINO GRANDNESS (The story up to now): On verge of filing for beverage subsidiary's IPO)

Thank you for the article.

Please write more on such articles and share you experiences and knowledge.

Best wishes