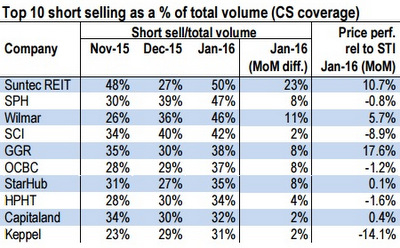

CREDIT SUISSE, in a report today (2 Feb), said there has been a surge in short-selling activity on SGX. CREDIT SUISSE, in a report today (2 Feb), said there has been a surge in short-selling activity on SGX. Now, we know a bit more about who (or which group of market participants) have been causing investors lots of agony. Credit Suisse said total short-selling activity surged from S$3.2 bn in December 2015 to S$5.6 bn in January 2016, representing 25% of total turnover. Stocks with the highest short selling as a percentage of total volume in January include Suntec REIT (50%), SPH (47%), Wilmar (46%), SembCorp Industries (42%), and Golden Agri (38%). Other victims include: OCBC, StarHub, Capitaland, Hutchison Port Holdings Trust, and Keppel Corp.

These are blue chips tracked by Credit Suisse but it is not uncommon for non-blue chips to be shorted too. When reversals come, it will be the turn of shortists to experience agony. Probably, many will end up surrendering their gains and maybe more, we hope. If you are tempted to play the shorting game, bear in mind what Warren Buffett said: "It's ruined a lot of people. You can go broke doing it. "It's a whole lot easier to make money on the long side. You can't make big money shorting because the risk of big losses means you can't make big bets." (Source) |

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Short-sellers whack SUNTEC REIT, SPH, WILMAR, SEMBCORP INDUSTRIES, GOLDEN AGRI -- lots more

- Details

- Leong Chan Teik