SERIAL SYSTEM, after a scorching 44% jump in full-year 2014 earnings, continued its hard run in 1Q this year with a 45% jump in net profit to US$3.1 million.

Photo by Cheng Siew Hooi.The revenue of the distributor of semiconductors grew 23% to US$261.8 million on strong performance in its core markets of China and Hong Kong.

The figures for 1Q are not typical of the rest of the year as 1Q is traditionally the weakest quarter owing to the cessation of business during the long Chinese New Year holiday period.

The 1Q results and that of FY2014 have validated an enhanced three-pronged strategy which was unveiled at the beginning of 2014 (See: SERIAL SYSTEM: US$1 B Sales Target, Higher Margins With Enhanced Biz Strategy)

The company seeks to expand product portfolio, improve internal efficiencies and deepen penetration in existing markets and widen its geographical reach.

With the better performance becoming more evident, the stock price of Serial has also risen sharply -- from 12.5 cents at the start of 2014 to 18.5 cents last week.

In 1Q2015, gross profit margin dipped to 8.3% from 9.0% due to :

1) Higher sales of lower-margin products,

2) Stiff market competition in South Korea and Taiwan, and

3) Maiden inclusion of the results of Serial I-Tech Group, the renamed distribution business of GSH Corporation. This business currently has relatively low gross profit margins.

Though still thin, net margin rose from 1.0% to 1.2% in 1Q2015.

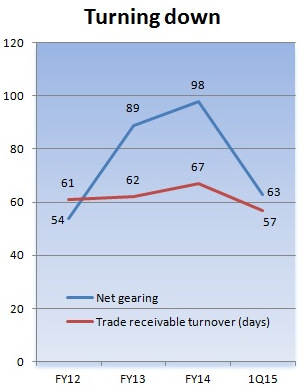

Total expenses as a percentage of revenue declined to 7.4% from 8.1% a year earlier on operational efficiencies and economies of scale..  Notably, Serial's gearing has fallen sharply -- from 98% in FY2014 to 63% in 1Q this year.

Notably, Serial's gearing has fallen sharply -- from 98% in FY2014 to 63% in 1Q this year.

This has resulted in average turnover days for trade receivables in 1Q2015 falling to 57 days from 67 days in FY2014

Asked about this at the 1Q results briefing, CEO Derek Goh said Serial's Hong Kong and Singapore subsidiaries had used non-recourse factoring arrangements with financial institutions -- which did not lead to higher costs.

He added that the gearing would trend towards the 50-60% range.

With that, Serial has addressed one of the concerns and risks that investors and analysts have associated with the company in recent years as it grew sales and made acquisitions of other businesses.

Asked about the risks of impairment of inventory (FY2014: US$841K versus FY2013: US$1.9 million), Derek said that Serial's inventory will rise with revenue growth.

Its policy is prudent and impairs inventory that is above 90 days old. If and when sold after 90 days, there will be a write-back on the sold inventory.

Outlook |