Excerpts from analyst's report

|

|

INVESTMENT HIGHLIGHTS

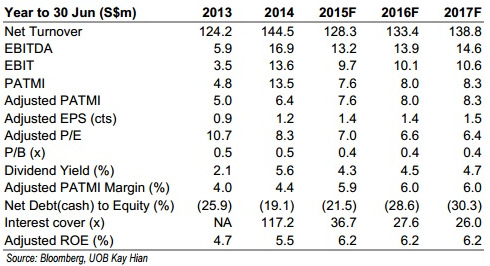

Initiate coverage with a BUY and target price of S$0.171. Ellipsiz has been trading within a tight range of S$0.065-0.12 in the last three years. With earnings likely to continue recovering as 1HFY15 adjusted net profit jumped 63% yoy, coupled with a strong net cash of 4.8 cents/share (50% of its current market cap), we believe Ellipsiz offers good value at current levels.

Start of a cyclical recovery for the global probe card market. VLSI Research forecasts probe card 2013-18 revenue CAGR of 5.2% to reach US$1.5b on the back of steady growth in the semiconductor industry and stabilising exchange rates. According to the World Semiconductor Trade Autumn 2014 Forecast, the global semiconductor market is expected to grow at a 2013-16 CAGR of 5.1% to US$355b, driven by growth from all product segments, assuming a macro economic recovery.

A potential M&A target. As one of the top 10 suppliers with an estimated 4% market share (based on our estimates) of the global probe card market, and the secondhighest ranked probe card supplier among customers (based on VLSI research), we see Ellipsiz as a potential M&A target by larger probe card manufacturers seeking to increase market share. Ellipsiz’s strong net cash of S$26m (4.8 cents/share) could also provide the necessary firepower to grow inorganically through acquisitions.

Road to recovery. Hit by slower customer demand (due to the global financial crisis) and margin erosion, Ellipsiz sank into losses in FY08 and FY09. But earnings have recovered gradually as Ellipsiz restructured, cut cost and moved towards highermargin products (eg from cantilever probe cards to advanced probe cards). Adjusted net profit grew 14% yoy in FY13 and 28% yoy in FY14, driven by both organic and inorganic growth.

50% of market cap backed by net cash. Ellipsiz maintains a very robust balance sheet, backed by a strong net cash position. As at 31 Dec 14, Ellipsiz had net cash of S$26m (4.8 cents/share), which represents 50% of its current market cap. Excluding the hefty net cash, Ellipsiz is trading at a compelling ex-cash FY15F PE of 3.5x with a dividend yield of 4.3%.

Rising earnings and dividend yield. With the recovery in earnings, Ellipsiz has also rewarded shareholders with higher dividends. On the back of a strong performance in 1HFY15, Ellipsiz increased FY15 interim dividend by 10% to 0.2 cent/share (1HFY14: 0.18 cent). For FY15, we expect DPS to rise to 0.41 cent, based on a 30% payout, translating into a yield of 4.3%.