Page 1 of 2

Executive chairman & CEO Derek Goh at last week's results presentation.

Executive chairman & CEO Derek Goh at last week's results presentation. Photos by Janine Yong

CEO Derek Goh in a jovial mood. Photo by Leong Chan TeikAFTER trading in a tight range for most of last year, Serial System's share price broke out, climbing from 13.3 cents to 14.3 cents -- or 7.5% -- in two days last week.

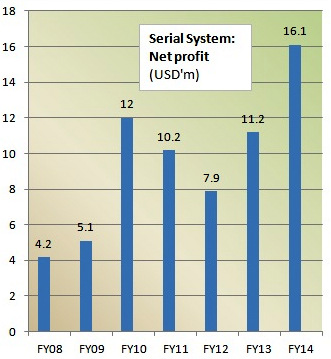

CEO Derek Goh in a jovial mood. Photo by Leong Chan TeikAFTER trading in a tight range for most of last year, Serial System's share price broke out, climbing from 13.3 cents to 14.3 cents -- or 7.5% -- in two days last week.The run-up was triggered by its 4Q results release which showed that the 4Q net profit jumped 52% to US$4.6 million while the full-year's figure was up 44% at US$16.1 million.

As a result of the higher earnings, Serial's share price now trades at a historical PE ratio of just 6X.

Not only is the valuation looking palatable, so is the dividend yield at 7.3%. Serial is proposing a final dividend of 0.75 cents a share, after having paid out an interim FY2014 dividend of 0.30 cent a share.

Furthermore, the stock price is at a discount to the net tangible assets per share of about 18 Singapore cents a share.

In the electronics distribution business of Serial System, economies of scale and tight cost controls matter greatly.

In the electronics distribution business of Serial System, economies of scale and tight cost controls matter greatly. These featured in its FY2014 results. Highlights:

» Surpassed FY2014 revenue target of US$1.0 billion to reach US$1.04 billion (FY2013: US$ 817.0 million).

» Net margin improved to 1.6% from 1.4% in FY2013.

» Total expenses as a percentage of sales declined to 7.4% in FY2014 from 8.0% in FY2013.

» Turnover in North Asia (Hong Kong, China, South Korea, Taiwan and Japan) grew 30% y-o-y, accounting for 84% of the Group’s turnover.

Underpinning the business is its three-pronged strategy announced in Jan 2014 (see: SERIAL SYSTEM: US$1 b sales target, higher margins with enhanced biz strategy).

CFO Alex Wui. Broadly, Serial said the enhanced strategy involves:

CFO Alex Wui. Broadly, Serial said the enhanced strategy involves:a. Expanding Serial's product portfolio and increasing the proportion of higher-value components -- ie, what Serial sells.

b. Improve internal efficiencies with emphasis on financial management, supply chain management and business intelligence -- ie, how Serial will do certain things.

c. Deepen penetration in existing markets and widen geographical expansion -- ie, where Serial will go.