|

|

What is the news?

800Super: Increase in staff costs by percentage revenue was higher than expected.800 Super Holdings Limited ("800 Super") announced its 1HFY15 (Y/E Jun) results on 10 February after trading hours. EPS doubles 100.8% y-o-y from 1.28 Cents to 2.57 Cents.

800Super: Increase in staff costs by percentage revenue was higher than expected.800 Super Holdings Limited ("800 Super") announced its 1HFY15 (Y/E Jun) results on 10 February after trading hours. EPS doubles 100.8% y-o-y from 1.28 Cents to 2.57 Cents. How do we view this

» Revenue lower than our forecast from street cleaning contract – South-West region Integrated Public Cleaning (IPC) operations not fully taken over from incumbent; operations to ramp-up over a period of 6 months (guided by Management). We have adjusted our revenue estimates downwards for FY15e, resulting in back-loaded revenue recognition for the South-West IPC contract, with full year effect from FY16e onwards.

» Increase in staff costs by percentage revenue higher than expected – Staff costs had stabilised in the last three half-years, with not more than 1.5pps increase historically. In 1HFY15 however, staff costs increased by almost 3.0pps. This reflects the manpower issues affecting labour intensive businesses.

» Higher Capex a one-off – We understand from Management that the higher Capex was due to new street cleaning vehicles purchased for the new IPC contracts.

Investment Actions

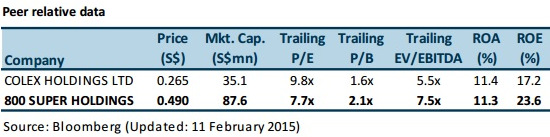

» Our key investment thesis for 800 Super is its defensive business model, resilient earnings and superior ROE that ranges from the high-teens to low-twenties.

» 800 Super enjoys a superior ROE due to its vertically integrated business model and scale, which are better than its closest peer. Consequently, 800 Super deserves a higher P/E multiple than its peer. We assign a P/E multiple of 12x to 800 Super and have a target price of S$0.635. BUY.

Recent story: 800 SUPER: "Uncovering Super-value from trash!" says Phillip Securities Research