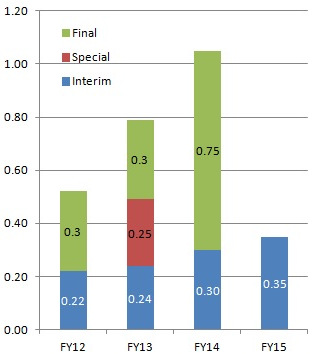

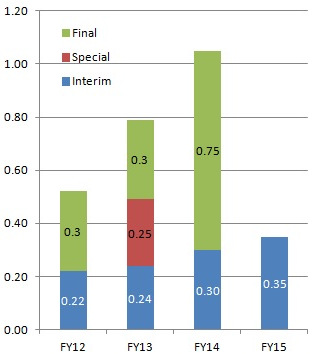

Serial dividends (in Singapore cents/share).SERIAL SYSTEM has declared an interim dividend of 0.35 cent a share, the highest in the last eight years, establishing itself as a high-yield stock.

Serial dividends (in Singapore cents/share).SERIAL SYSTEM has declared an interim dividend of 0.35 cent a share, the highest in the last eight years, establishing itself as a high-yield stock.

If it pays 0.75 cent a share as the final dividend, unchanged from that in FY14, then the yield is about 5.5%.

Serial CEO Derek Goh appears to be satisfied enough with the yield (and, likely, the prospects of the company) that on the first trading day (6 Aug) after the release of the interim results, he bought 920,500 shares of Serial from the open market at 18.84 cents on average.

This raised his stake to about 353 million shares, or 39.41% of the issued share capital of the company.

| Substantial Shareholders of Serial System |

No. of shares |

% of share capital |

1. Derek Goh

|

353,052,570 |

39.41 |

| 2. Sam Goi |

123,603,838 |

13.80 |

|

For those who are familiar with Serial, Derek's buying comes as no surprise as he has been consistently doing so in recent years.

For example in Aug 2013, his holding was 330 million shares, or 36.86% of the share capital. Since then, he has added about 23 million shares, or an average of 1 million a month.

Along with his buying, the share price has also risen -- supported by rising profitability of the company.

Serial share price has gained in the last 4 years. Chart: FT.com

Serial share price has gained in the last 4 years. Chart: FT.com

|

Serial CEO Derek Goh presenting at 2Q results briefing @ Tower Club. Serial CEO Derek Goh presenting at 2Q results briefing @ Tower Club.

Photo by Janine Yong

Highlights of 2Q results:

| |

1H2015

(US$’000) |

1H2014

(US$’000) |

% change |

| Revenue |

571,357 |

475,284 |

20.0 |

| Gross profit margin % |

8.0 |

8.8 |

(0.8) pt |

| Net profit attributable to shareholders |

7,826 |

7,121 |

10.0 |

| NAV/share (US cents) |

13.90 |

12.94 |

7.4 |

» Revenue grew 18% to US$309.6 million, with maiden (2 months) contribution of US$16 million from Swift Value (100%-owned distributor of printer accessories such as ink cartridges) and US$12.9 million (3 months) from Serial I-Tech (100%-owned distributor of lifestyle and consumer electronic products).

» Gross profit margin declined to 7.7% from 8.6% due to increased sales of lower-margin products in South Korea and stiff competition in Taiwan. Serial I-Tech and Swift Value also impacted the group's margin.

» Net profit after tax in 2Q declined 5% to US$4.8 million from US$5.0 million. Net margin declined to 1.5% from 1.9%.

CFO Alex Wui. File photo.» Share of losses in associates was US$0.41 million compared to a share of profit of US$0.11m a year earlier. CFO Alex Wui. File photo.» Share of losses in associates was US$0.41 million compared to a share of profit of US$0.11m a year earlier.

On the positive side, the group's 20% interest in an Australian industrial laundry business, SPL Holdings, brought in profit of US$0.12 million compared to US$0.2 million in 2Q2014, as the business incurred higher expenses as it is rapidly expanding.

On the negative side, the 49%-owned Achieva incurred US$0.37 million losses, in part from buying IT products in USD but selling in Malaysian ringgit. And 28.43%-owned Bull Will contributed US$0.16 million in losses.

![down-arrow[1]](https://lofthousegate.files.wordpress.com/2014/06/down-arrow1.jpg?w=152&h=152) 'Good' declines in 1H2015 'Good' declines in 1H2015

» Total expenses as a % of turnover: In 1H2015, it declined to 7.1% from 7.5% as a result of improved operational efficiency and cost control.

» Average turnover days for accounts receivables: In 1H2015, it fell to 58 days from 67 days, as Serial entered into non-recourse factoring arrangements with financial institutions.

» Gearing ratio: This declined from 0.98 to 0.90, and CEO Derek Goh said it could go down further to 0.7 or 0.6 in 2H2015 if Serial doesn't engage in any M&A activity.

|

|

|

For the Powerpoint materials on the results, click here.

Serial dividends (in Singapore cents/share).SERIAL SYSTEM has declared an interim dividend of 0.35 cent a share, the highest in the last eight years, establishing itself as a high-yield stock.

Serial dividends (in Singapore cents/share).SERIAL SYSTEM has declared an interim dividend of 0.35 cent a share, the highest in the last eight years, establishing itself as a high-yield stock. Serial share price has gained in the last 4 years. Chart: FT.com

Serial share price has gained in the last 4 years. Chart: FT.com

![down-arrow[1]](https://lofthousegate.files.wordpress.com/2014/06/down-arrow1.jpg?w=152&h=152)