Ong Lay Koon, executive director, Lian Beng Group. NextInsight file photo.LIAN BENG GROUP has just announced its FY2015 (ended May) results. It's record revenue ($747.0 million), record profit ($108.0 million) and record dividends (3 cents a share).

Ong Lay Koon, executive director, Lian Beng Group. NextInsight file photo.LIAN BENG GROUP has just announced its FY2015 (ended May) results. It's record revenue ($747.0 million), record profit ($108.0 million) and record dividends (3 cents a share).

The record profit includes fair value gain of $52.4 million on its investment properties while in FY14, the fair value gain was $37.2 million.

Stripping out both fair value gains, Lian Beng's profit would still be higher in FY15 than in FY14.

UOB Kay Hian has just upped its target price for Lian Beng stock from 72 cents to 79 cents.

"Lian Beng is currently trading at 0.6x P/B (one of the lowest among its local peers), 3.2x FY16F PE and a dividend yield of 5.4%," said UOB KH analyst Loke Chunying.

The upgrade came after an analyst briefing chaired by Lian Beng Group executive director Ong Lay Koon on Thursday (July 30). Key takeaways:

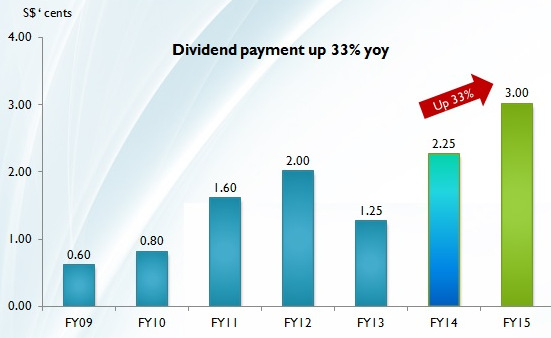

1. Dividends: Lian Beng proposed a 1-cent ordinary final dividend and 1-cent special dividend, bringing the total for FY15 to 3 cents (including an interim 1-cent dividend).

The yield is about 5.4% based on the recent stock price of 56 cents.

Lian Beng has been paying out higher dividends every year (except FY13) as its profit rose. Ms Ong said that, going forward, if Lian Beng achieved higher profitability, the dividends payable can be expected to continue to rise.

2. Cash: Lian Beng had $187.1 million in cash and cash equivalents at end-May 2015 and a debt-to-equity ratio of 0.165.

Its cash pile will swell in the next two years with the completion of several property development projects in which it holds equity stakes. For example, Lian Beng is expected to collect $30 m cash (capital and development profit) with the completion of Eco-tech @ Sunview.

3. Recurring earnings: With its cash pile, Lian Beng continues to seek investments that will yield recurring income.

Its target is S$20 million in pre-tax profit from recurring businesses which now comprises a foreign workers' dormitory, construction-related supplies (ready-mixed concrete and asphalt) and investment properties.

A new contributor of rental income starting from this new FY16 is Space@Tampines, an industrial property which is already fully leased. Lian Beng has a 30% stake in it while Oxley Holdings, 70%.

Similarly, another new contributor this FY will be a 3-storey property in Collins Street in Melbourne which Lian Beng has just bought for A$24.9 million.

In the following FY, the foreign workers' dormitory being built in Jalan Papan (near Jurong Island) will be completed (mid-2016) and start to contribute rental income. This is a 7,900-bed dormitory.

|

4. Order book: Lian Beng's order book for its core business segment -- construction -- stood at $552 million as at end-May this year. It will last till FY17.

This might seem low in comparison with the $628.8 m revenue from construction that Lian Beng recorded in FY15. However, the order book would be boosted if Lian Beng is awarded contracts for projects it is currently tendering for.

5. Property development projects: Lian Beng currently has 10 property development projects in Singapore in which it holds various equity stakes. Notably, a large industrial development -- Eco-tech @ Sunview (97% sold) -- is expected to achieve T.O.P. this year, and the entire revenue and profit attributable to Lian Beng's 19% equity stake will be recognised at one go.  Eco-tech @ Sunview: Light industrial development in Pioneer Road. T.O.P: 2015

Eco-tech @ Sunview: Light industrial development in Pioneer Road. T.O.P: 2015 Hexacube @ Changi Road comprises retail and office units. T.O.P: Dec 2016

Hexacube @ Changi Road comprises retail and office units. T.O.P: Dec 2016

A similar one-time boost to the financial statement will be seen in the following financial year (FY17) when another industrial project (Hexacube, 56% sold) will likely achieve T.O.P.

That's not the end. Another large industrial project -- Mandai Link (98% sold) -- will likely T.O.P. in FY17 or FY18.

Eco-tech has obtained T.O.P in July, so this spike in profit + cash will be reflected in the coming financial results expected to be annouced in Oct.