Excerpts from analyst's report

UOB KH analyst: Brandon Ng, CFA (left)

UOB KH analyst: Brandon Ng, CFA (left)

Receives approval-in-principle (AIP) from SGX; now awaits shareholder’s meeting

UOB KH analyst: Brandon Ng, CFA (left)

UOB KH analyst: Brandon Ng, CFA (left)Receives approval-in-principle (AIP) from SGX; now awaits shareholder’s meeting

WHAT’S NEW

SGX has granted the AIP for the listing and quotation of 86m new shares. To recap, SGF lodged a supplementary offer information statement (SOIS) in Nov 14, for the placement transaction to PM Group. The placement price has been changed to a lower price of S$0.50 or the volume weighted average price (VWAP) on the last market day immediately preceding the date of completion.

If the VWAP price falls below S$0.40, the transaction will take place at a price mutually-agreed on, by SGF and PM Group. After SGX’s AIP, SGF will convene an EGM to seek shareholders’ approval after despatching the circular containing the information.

If the VWAP price falls below S$0.40, the transaction will take place at a price mutually-agreed on, by SGF and PM Group. After SGX’s AIP, SGF will convene an EGM to seek shareholders’ approval after despatching the circular containing the information.

Billionaire Prayudh Mahagitsiri: He and his family were listed as the 15th richest in Thailand by Forbes.com In the SOIS, most conditions remain the same, except the placement price. This includes Mr Prayudh Mahagitsiri, Honorary Chairman of TTA and the Founder and Chairman of the PM Group, to be appointed as Honorary Chairman of SGF and TTA agrees and undertakes that it will not sell or transfer the shares within a 10-year period. SGF will also formulate an official policy of paying 10% of its net profit as dividends.

Billionaire Prayudh Mahagitsiri: He and his family were listed as the 15th richest in Thailand by Forbes.com In the SOIS, most conditions remain the same, except the placement price. This includes Mr Prayudh Mahagitsiri, Honorary Chairman of TTA and the Founder and Chairman of the PM Group, to be appointed as Honorary Chairman of SGF and TTA agrees and undertakes that it will not sell or transfer the shares within a 10-year period. SGF will also formulate an official policy of paying 10% of its net profit as dividends.OUR VIEW

This will clearly be a positive for SGF upon completion of this placement. The new monies will strengthen the balance sheet for expansion, there may be synergies between PM Group and SGF, and investors will be rewarded with annual dividends from next year onwards.

Although the current share price has fallen below S$0.40, we think that the mutually-agreed price would be at least S$0.40 given the amount of time and due diligence conducted for this transaction. According to sources, PM Group has engaged a top-four auditor to check on SGF’s financials prior to pursuing this transaction.

|

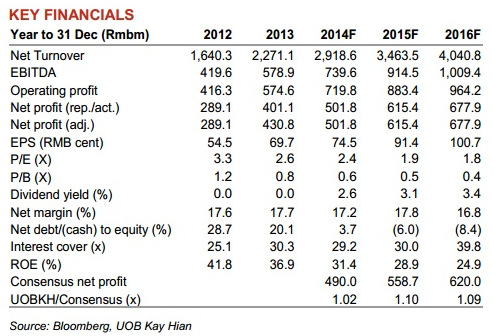

· At the current share price of S$0.37, SGF is trading at a depressed 2014 PE of 2.4x with a dividend yield of 2.6%. |