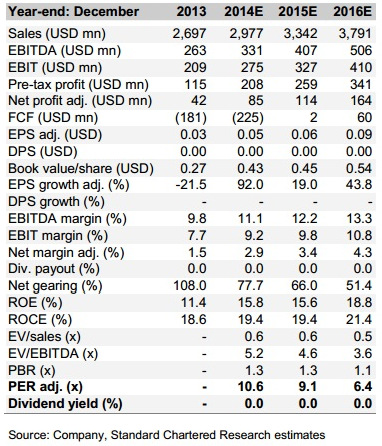

Excerpts from analyst's report

|

|

Integrated and branded protein producer. Japfa operates in Indonesia, China, India, Myanmar and Vietnam. Its animal protein business segments include chicken, pork and beef. It is also a branded producer of fresh milk in China and Indonesia.

Integrated and branded protein producer. Japfa operates in Indonesia, China, India, Myanmar and Vietnam. Its animal protein business segments include chicken, pork and beef. It is also a branded producer of fresh milk in China and Indonesia.The company is headquartered in Singapore and is controlled by Handojo Santosa. In 2013, it derived 67% of its PAT from the animal protein business, operated mainly under its Indonesian subsidiary, Japfa Comfeed (JPFA IJ, OP, PT IDR 1,502).

Japfa is a rare proxy for Asia’s protein boom. Protein consumption is likely to rise with greater prosperity. Our study of protein consumption patterns in 109 countries shows a positive and accelerating correlation between rising income and protein

consumption.

Japfa is a major beneficiary of the rise in refrigerator penetration. The introduction of cheaper fridges in ASEAN is likely to expand the addressable market for meat, fish, dairy and beverages. Refrigeration allows domestic consumers to purchase and store perishable and cold products. They can then store and consume these products at will.

Processed chicken could generate 25% of revenue growth. We believe the meat sector is no longer just a volume story. However, as per capita income rises, we estimate that branded products (as a proportion of sales volume) will rise to 25-35% in 2014-16 from 10-15% in 2010-13.

We initiate with an OP. Our DCF-derived price target implies 30% potential upside. This view is further corroborated by our relative valuation and SOTP analyses. Japfa is trading at a 42% and 55% discount to the sector on a PE and EV/EBITDA basis (2015E).

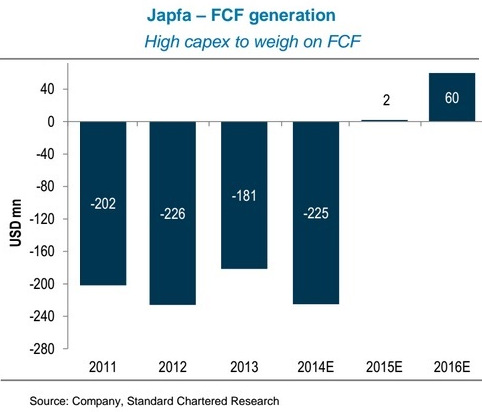

StanChart forecasts Japfa’s free cash flow (FCF) at negative USD 225mn in 2014 and a positive USD 60mn by 2016. FCF could weaken due to high working capital requirements and capex in 2014/15.

StanChart forecasts Japfa’s free cash flow (FCF) at negative USD 225mn in 2014 and a positive USD 60mn by 2016. FCF could weaken due to high working capital requirements and capex in 2014/15.

We initiate with an OP. Our DCF-derived price target implies 30% potential upside. This view is further corroborated by our relative valuation and SOTP analyses. Japfa is trading at a 42% and 55% discount to the sector on a PE and EV/EBITDA basis (2015E).

StanChart forecasts Japfa’s free cash flow (FCF) at negative USD 225mn in 2014 and a positive USD 60mn by 2016. FCF could weaken due to high working capital requirements and capex in 2014/15.

StanChart forecasts Japfa’s free cash flow (FCF) at negative USD 225mn in 2014 and a positive USD 60mn by 2016. FCF could weaken due to high working capital requirements and capex in 2014/15.