Excerpts from analysts' report

Analysts

Analysts: Ng Wee Siang

(left) & Team

Rigbuilders to be affected. A sustained fall in oil prices could force oil companies to scale back their spending. Historically, this has been the case.

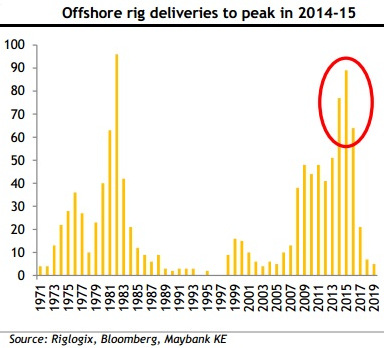

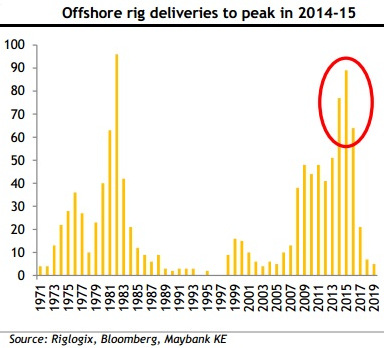

Already, oil majors are under pressure from their shareholders to slash budgets and return cash to shareholders. With peak deliveries of deepwater rigs expected this year and next, deepwater day rates could lose steam, further dampening the demand for floaters.

This could stall the offshore rig-order momentum, affecting rig builders. On this count, we expect

Keppel Corp (HOLD, TP SGD10.95) and

Sembcorp Marine (BUY, TP SGD3.80) to be more affected.

An oversupply of floaters expected to temper near-term rig orders

An oversupply of floaters expected to temper near-term rig orders

Take refuge in OSV operators. Unlike rigbuilders, OSV operators should be better placed in an environment of low oil prices, in our view. An influx of new rigs this year and next should precipitate a return in demand for offshore support vessels (OSVs).

Furthermore, the industry’s increasing migration to the production stage should benefit OSV owners and operators with the right assets.

§ OSV shipbuilders should benefit first, as asset owners start upgrading and rejuvenating their fleets to capture rising sector opportunities. We like Nam Cheong (BUY, TP SGD0.55) and Vard (BUY, TP SGD1.15).

§ OSV operators, Pacific Radiance (BUY, TP SGD1.74) and POSH (BUY, TP SGD1.26), have high-quality assets and sound strategies to lift them above the rising tide, in our view.

§ We continue to favour Ezion (BUY, TP SGD2.38) for its high-growth potential in the region’s liftboat market, underpinned by more oilfield-maintenance work.

§ Mermaid Maritime (BUY, TP SGD0.60) should gain from a growing number of offshore platform bases and offshore installations, requiring more subsea IRM (inspection, repair & maintenance) services.

|

Fuel accounts for almost 40% of SIA's costs. NextInsight file photo. Fuel accounts for almost 40% of SIA's costs. NextInsight file photo.

Main beneficiary: Transport, SIA biggest winner. Oil being a crucial input for transport companies, this sector stands to benefit the most from falling oil prices.

In this case, SIA (BUY, TP SGD12) should gain the most. Fuel accounts for almost 40% of its costs.

About 52% of SIA’s FY3/15E jet-fuel requirement has been hedged at c.USD116/bbl. If jet fuel continues to trade at USD110/bbl, our assumption of USD120/bbl for FY3/15E-17E may need to be trimmed.

This could result in 50% upside for EPS, off a low earnings base, ceteris paribus. And as a major cost item for the global economy, cheaper oil could have positive spillover for general demand and consumption, we reckon.

|

Recent story:

NAM CHEONG: 3Q will be highest quarterly profit ever (+50% y-o-y)

Analysts: Ng Wee Siang (left) & Team

Analysts: Ng Wee Siang (left) & Team An oversupply of floaters expected to temper near-term rig orders

An oversupply of floaters expected to temper near-term rig orders